Questionable politics: Induction of non financial matters into the finance bill

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]T[/dropcap]he Rajya Sabha returned to the Lok Sabha, five of the amendments moved by the Government, in an unprecedented move after the upper house discussed the finance bill amendments for over five hours taking exception to several provisions of the Finance Bill, stating that the government had sought to amend 40 laws in one go, without following the procedure in an unusual manner.

The Finance Bill 2017 had been tabled in Parliament on 1st February 2017. However, when the same was tabled for scrutiny, just before that the Union Finance Minister added 30 pages of amendments to the government’s own bill text. The amendments were brought without any discussion by suspending normal rules of Lok Sabha for passing these amendments.

During a discussion on the Bill, the Opposition accused the government of “smuggling in” provisions to bypass the Rajya Sabha as the upper house has limited powers on money bills.

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]C[/dropcap]oncerns were raised by opposition members on the substance and the process followed by walkout on Lok Sabha. Later the Finance Bill was cleared by Lok Sabha. Then it was presented before the Rajya Sabha, legislation is a money bill and the Government does not need the assent of the Rajya Sabha, where it is in Minority.

The main changes proposed under the amendments are given below:

The ‘Aadhaar’ number will be mandatory for every person after July 1, 2017, while applying for a Permanent Account Number (PAN), or filing their Income Tax returns.

In the absence of Aadhaar number, he/she will have to provide the acknowledgement that Aadhaar has been applied. All existing assesses of Income Tax will have to provide to the Income Tax Department in a manner to be notified by the central government at a later date. This has been done despite a Supreme Court order declaring that the Aadhaar number can only be voluntary.

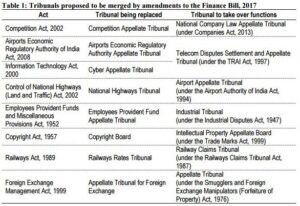

Tribunals, Appellate Tribunals and other authorities:

Certain Tribunals are proposed to be replaced, and their functions are proposed to be taken over by existing Tribunals under other Acts and the details can be found in a Table below:

The purpose and the detailed back ground was not provided. Amazingly the National Highways Appellate Tribunal is replaced by Airport Appellate Tribunal because both are different legislation.

The chairpersons, Vice-Chairpersons, Chairmen or other members who are currently occupying posts with Tribunals to be merged, and will be entitled to receive up to three months’ pay and allowances for premature termination of their office term.

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]A[/dropcap]s present terms of service of Chairpersons and other members of Tribunals and Appellate Tribunals are specified in their respective Acts. The amendments to the Finance Bill, 2017 propose that the Central government may make rules to provide for the (i) qualifications, (ii) appointments, (iii) term of office, (iv) salaries and allowances, (v) resignation, (vi) removal, and (vii) other conditions of service for these members.

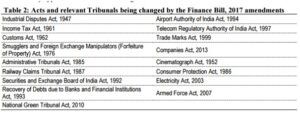

The amended provisions will apply to Tribunals, Appellate Tribunals, Boards and Authorities under the various Acts given below. The Central government will have the power to amend this list of Tribunals, through a notification that means that prior Parliamentary approval is not needed to bring other Tribunals into this scheme.

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]T[/dropcap]he amendments to the Finance Bill, 2017 propose to remove the limit of 7.5% of net profit of the last three financial years, for contributions that a company may make to political parties. In addition, contributions to political parties will have to be made only through a cheque, bank draft, electronic means, or any other scheme notified by the government to make contributions to political parties.

Lowering limit on cash transactions:

Under Finance Bill, 2017, cash transactions above three lakhs rupees will not be permitted: (i) to a single person in one day, (ii) for a single transaction (irrespective of a number of payments), and (iii) for any transactions relating to a single event. Amendments to the Finance Bill, 2017 propose to lower this limit from three lakhs rupees to two lakhs rupees.

Power to impose the penalty by officers:

The Securities Contracts (Regulation) Act, 1956 and the Depositories Act, 1996 were amended in 2004 to empower the adjudicating officer to impose penalties on offenders for various offences including their failure to furnish information, documents or returns. Amendments to the Finance Bill, 2017 propose to clarify that the adjudicating officer will always be deemed to have had this power.

The list of Acts moved to be amended by way of amendments is also given below

1. INCOME TAX ACT, 1961

2. CUSTOMS ACT, 1862

3. CUSTOMS TARIFF ACT, 1975

4. CENTRAL EXCISE ACT, 1944

5. CENTRAL EXCISE TARIFF ACT, 1985

6. FINANCE ACT, 1994

7. INDIAN TRUSTS ACT, 1882

8. THE INDIAN POST OFFICE ACT, 1898

9. RESERVE BANK OF INDIA ACT, 1934

10. REPRESENTATION OF THE PEOPLE ACT, 1951

11. SECURITIES CONTRACTS (REGULATION) ACT, 1956

12. OIL INDUSTRY (DEVELOPMENT) ACT, 1974

13. RESEARCH AND DEVELOPMENT CESS ACT, 1986.

14. SECURITIES AND EXCHANGE BOARD OF INDIA ACT, 1992

15. DEPOSITORIES ACT, 1996

16. FINANCE ACT, 2005

17. PAYMENT AND SETTLEMENT SYSTEMS ACT, 2007

18. COMPANIES ACT, 2013

19. FINANCE ACT, 2016

20. INDUSTRIAL DISPUTES ACT, 1947

21. EMPLOYEES’ PROVIDENT FUNDS AND MISCELLANEOUS PROVISIONS ACT, 1952

22. THE COPYRIGHT ACT, 1957

23. TRADE MARKS ACT, 1999

24. RAILWAY CLAIMS TRIBUNAL ACT, 1987

25. THE RAILWAYS ACT, 1989

26. SMUGGLERS AND FOREIGN EXCHANGE MANIPULATORS (FORFEITURE OF PROPERTY) ACT, 1976

27. FOREIGN EXCHANGE MANAGEMENT ACT, 1999.

28. AIRPORTS AUTHORITY OF INDIA ACT, 1994

29. CONTROL OF NATIONAL HIGHWAYS (LAND AND TRAFFIC) ACT, 2002

30. TELECOM REGULATORY AUTHORITY OF INDIA ACT

31. INFORMATION TECHNOLOGY ACT, 2000

32. AIRPORTS ECONOMIC REGULATORY AUTHORITY OF INDIA ACT, 2008.

33. COMPETITION ACT, 2002

34. CINEMATOGRAPH ACT, 1952

35. ADMINISTRATIVE TRIBUNALS ACT, 1985

36. CONSUMER PROTECTION ACT, 1986

37. RECOVERY OF DEBTS DUE TO BANKS AND FINANCIAL INSTITUTIONS ACT, 1993

38. ELECTRICITY ACT, 2003

39. ARMED FORCES TRIBUNAL ACT, 2007

40. NATIONAL GREEN TRIBUNAL ACT, 2010

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

- Mounting NPAs and keeping fuel outside GST is a bad financial strategy - September 4, 2018

- Flood relief for Kerala through GST - August 23, 2018

- Trafficking cultural property of India - June 8, 2018