Parts 1 through 6 of this series can be accessed from this page. This is Part 7.

The Motive

The National Stock Exchange (NSE) was Chidambaram’s playground. This is where he amassed riches. Anything that threatened the supremacy/ viability of NSE was dealt with severely. There were several skirmishes between the Bombay Stock Exchange (BSE) and NSE and in most of them it was NSE that came out on top. The message was clear – C-Company was backing NSE. The BSE brokers, quick to sense which way the wind was blowing, started to gravitate towards NSE and many of them ended up getting a broker license there too. Slowly but surely NSE became the dominant stock exchange in India. All regional exchanges became less and less relevant and many closed because NSE was electronic and could reach all parts of India.

At the time the NSEL was asked to shut down, it was regulated by the FMC. As part of the compliance process, NSEL provided fortnightly information to FMC as prescribed including details of commodity stocks.

Here was an upstart, Jignesh Shah, fresh from the success of his software product ODIN, who was threatening to turn NSE’s turf upside down with a string of exchanges. And the C-Company fought back – by putting hurdles, impediments, strictures etc. C-Company was trying to slow down every venture of Shah but only two entities are discussed here for brevity, the NSEL (National Spot Exchange Limited) and MCX-SX (MCX Stock Exchange Ltd.).

Commodity Exchanges – A Primer

Chicago Mercantile Exchange (CME) was perhaps the first commodity exchange in the world when it started operations in 1898. Why was an exchange needed for Commodities? To provide a centralized marketplace where commodity producers can sell their commodities to those who want to use them for manufacturing or consumption[1]. The beauty of a commodity futures exchange is that a wheat farmer can lock in a price for his crops months before they’re even harvested. This process increases business survival among farmers, and the exchanges always make sure there’s a buyer for every seller, provided their prices meet.

Commodity exchanges make the economy much more efficient. There are two types of Commodity Exchanges – Commodity Futures and Commodity Spot Market.

Commodity Futures vs Commodity Spot Market

What is the difference between Futures and Spot as far as commodities go[2]? It is similar to what they mean in Stocks. Spot is the equivalent of selling/ buying stocks today whereas, in the futures market, you can specify conditionally to buy or not buy, sometime in the future. You would go to the spot market if you wanted to buy or sell something today. On the other hand, you would go to the futures market if you want to buy or sell something at a future date but you want to fix the price today[3].

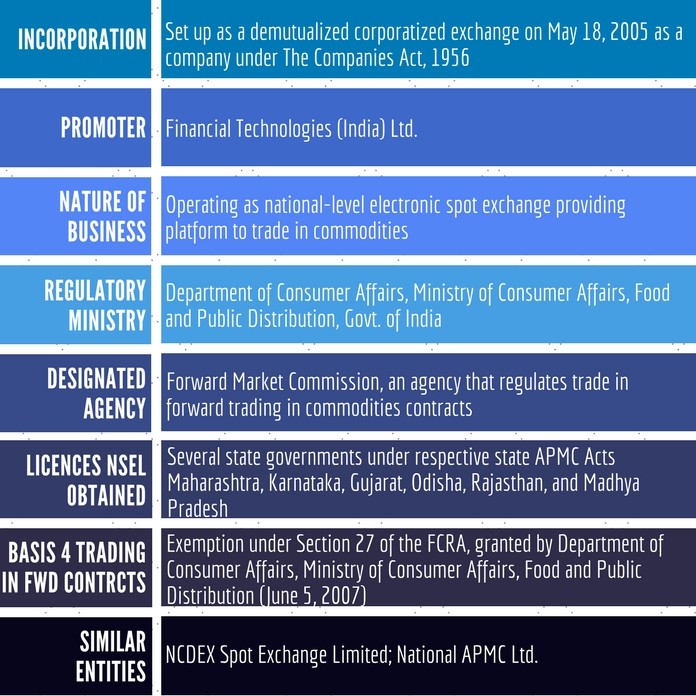

MCX allowed investors to hedge and manage risks in commodity futures. But Shah was not going to have an exchange just for futures. He came up with one for the Commodity Spot Market too. And that was the National Spot Exchange Limited (NSEL). MCX started operations in 2003 while NSEL started in 2008. For more see Figure 1.

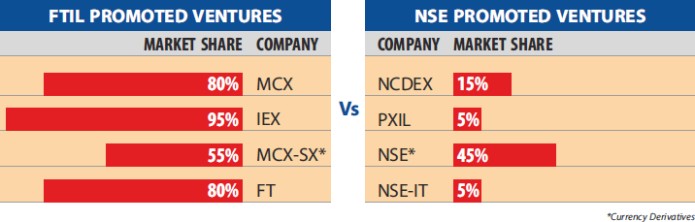

NSE’s response to MCX was NCDEX (the National Commodities and Derivatives Exchange Limited). By 2004, MCX was beginning to steer business away from NCDEX to itself. This was not something the C-Company expected. All FTIL ventures were beginning to dominate every sector in which they were playing (Figure 2). Something had to be done to stall the juggernaut. So in 2007, the C-Company swung into action. K P Krishnan (KPK), the then Joint Secretary, Department of Economic Affairs, Ministry of Finance, and a trusted lieutenant of Chidambaram, issued a missive to weaken the foundations of MCX. In an unprecedented diktat to two leading financial institutions, namely, the Life Insurance Corporation of India (LIC) and National Bank for Agriculture and Rural Development (NABARD), Krishnan directed these two behemoths to sell their equity stake in NCDEX to NSE so that NSE could ‘provide credible competition’ to FTIL’s MCX! This unwarranted move by Chidambaram and KPK clearly indicates their vendetta against the FTIL Group and their ulterior motive to kill competition. How can the Government side with one Private entity (NSE) over the other (FTIL)?

Figure 2 shows the domination of FTIL-promoted ventures over those of the NSE.

Back to NSEL. NSEL had come into being as a follow up of numerous recommendations from institutions in India and abroad for a vibrant spot market to ensure efficient and uniform pricing for agricultural commodities in the spot market in the country which received the endorsement and support of the then government including the Prime Minister Manmohan Singh. Similar sentiments were echoed by the then Finance Minister P Chidambaram in his Union Budget 2004 address.

How NSEL was established

The Forward Markets Commission (FMC) asked MCX to submit a concept paper for the creation of spot exchanges. Once it was approved, NSEL was formed as a subsidiary of MCX. Similarly, others such as NCDEX promoted NCDEX Spot Exchange Ltd. (It has since been renamed as NeML). A new space and a new war between the two famed competitors, FTIL and NSE.

After a while, a view emerged that since MCX was in the business of trading in commodity futures segment, MCX’s shareholding in NSEL should be transferred to FTIL. And that is how FTIL ended up owning NSEL.

Did FTIL make big profits from NSEL?

FTIL received no dividends or bonus from NSEL. On the contrary, money was always pumped in by FTIL. Neither FTIL nor its promoters or directors have benefitted to even a single paisa from NSEL. Dividends declared by FTIL are from its standalone profits.

Who are NSEL’s major players and partners?

NSEL had a network of alliances with clearing banks (such as SBI, Axis, HDFC, ICICI, Kotak etc.); national depositories (NSDL, CDSL); public sector undertakings, (NAFED, FCI, MMTC etc.) and other market participants. All leading brokers on BSE, NSE, and MCX were also members of NSEL. Several states passed APMC act, under which NSEL obtained licenses to trade in those states.

What was the APMC Act?

An excellent explanation for why The APMC (Agricultural Produce Market Committees) Act was passed by states is given by Balaji Viswanathan[4]. APMC forces the farmers to sell their produce only to middlemen approved by the government in authorized Mandis (markets).

Who regulated NSEL?

At the time the NSEL was asked to shut down, it was regulated by the FMC. As part of the compliance process, NSEL provided fortnightly information to FMC as prescribed including details of commodity stocks. The rash action of FMC in closing NSEL could be looked from the following points which prove quite in contrast to the decisions taken by the regulator.

- Spot Contracts for more than 180 days in some cases are offered by banks. Exemption was given to NSEL for 1 day forward contracts and extended to all. NSEL used to settle contracts in 25-36 days, rival exchanges in 70-75 days and banks in 180 days

- Every aspect of trading was reported to the FMC every fortnight. Warehouse visits were made by brokers on behalf of the clients and the Comptroller and Auditor General (CAG) auditor of Public Sector Undertakings (PSU) have verified the existence of stocks

- Such contracts traded at NCDEX too but were given a year’s time to wind up

- NSEL replied to a show cause notice for validity of contracts beyond 11 days and short selling. NSEL responded and presented legal aspects of the Contracts to the government and the FMC for which no response was received for 15 months

- FMC action was not because of any default by NSEL. The payment default happened after FMC’s abrupt action

Is it fair to close an exchange all of a sudden even if some deviance is found only in certain contracts (as the exchange was offering various types of contracts) which could have been addressed by an orderly winding up of positions over a specific time period?

The details of the decision to close NSEL and through it attack the parent FTIL will be discussed in the coming posts. But was NSEL the real cause for C-Company to shut down FTIL? To get the answer to this question, we need to look at the other brainchild of Shah, the MCX-SX (MCX Stock Exchange Limited).

To be continued…

[1] The importance of the Commodities Market – Sep 13, 2017, TheBalance.com

[2] Commodity Spot market versus Commodity Futures market – Aug 23, 2017, MotilalOswal.com

[3] Five key differences between Spot Market and Futures Market – Tradingsim.com

[4] What is the APMC Act? Jun 21, 2014, Quora

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] How Chidambaram and C-Company placed hurdles in the way of FTIL – Part 7 – Nov 24, 2017, […]

Dear Sir,

It seems you have incorrect information about NSEL

1. NSEL has only 13-15 deafutler owning 5,600 cr. So if it is a exchange then how come it has only so small number of buyer. It was basically a money laundering machines for these buyers

2. NSEL in collaboration with FMC and agriculture ministry carved out an exception.

3. There was no verified stock of goods. If there was stock then why on Jul 31s 2013 all of it vanished.

4. 13,000 investors were duped. The invetors weren’t promised exorbitant gain but very conservative game.

5. FTIL is beneficiary from NSEL and the case that is currently undergoing also proves that.

I am one of the victim of NSEL hence I know more truth in this now. It was a Ponzi scheme from Jignesh Shah.

This series is NOT about NSEL. Rather it is about C-Company.

[…] How Chidambaram and C-Company placed hurdles in the way of FTIL – Nov 24, 2017, […]