Parts 1 through 7 of this series can be accessed from this page. This is Part 8.

The Last Straw

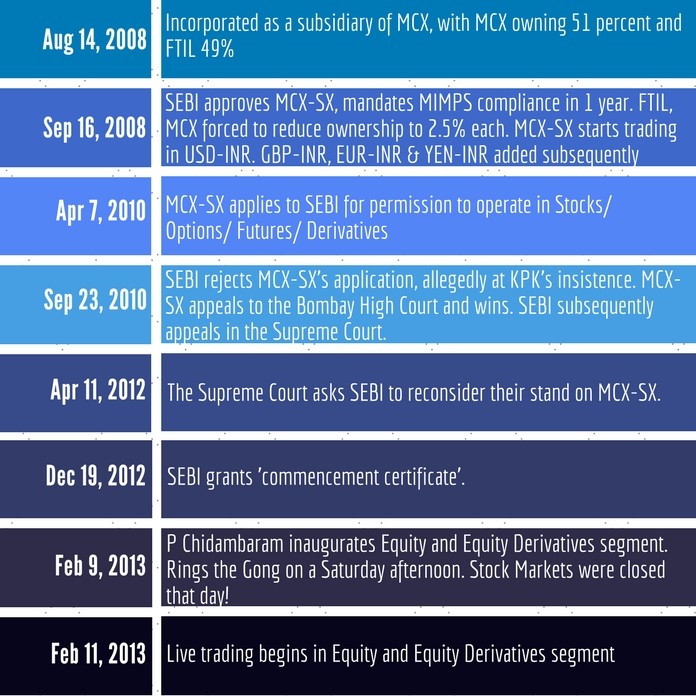

The year was 2007/ 08. The SEBI and the RBI had opened up the currency derivatives trading in India and stock exchanges were allowed to seek a license for trading in this market segment. Flush with the success of MCX, DGCX and other ventures Jignesh Shah had applied for getting a license for a Stock Exchange. Promoted by FTIL and MCX, the exchange was to be named MCX-SX.

MCX-SX had applied to be a full-fledged Stock Exchange but permission was granted only for the currency derivatives segment – they could not trade stocks and other capital segments.

But even as the door opened ever so slightly for Shah, the Finance Ministry tried to protect the NSE (or so many in Mumbai thought) by capping the percentage of ownership to 5%. Note that such restrictions did not exist for BSE or NSE when they became exchanges. Even such restrictions were not there for banks and insurance companies set up in the private sector. At the time of incorporating MCX-SX, FTIL and MCX owned 51% and 49% respectively. Because of the changing of rules, FTIL and MCX together could only invest up to 5% in their new venture, the MCX-SX. The excess shares were converted and warrants issued to the shareholders, causing enormous losses to FTIL and MCX. This would have gutted any investor who was looking for better valuation for investments (hoping to make a killing out of the stock), which they were most likely to do, having been so successful in all their previous ventures.

But banks were exempted from this 5% limit. So one can deduce from this the fact that most banks in India are Public Sector Owned and indirectly come under the Finance Ministry, and therefore could be controlled through them. What a devious plan!

If this sounds hard to believe, the Income Tax (IT) department raided MCX which was used as leverage by vested interests to malign the image of FTIL Group and create roadblocks for the equity market license application of the Group’s stock exchange, MCX-SX. It was a calculated move to protect NSE’s monopoly. The department had allegedly acted on a fabricated report that Shah had stacked Rs. 300 crores but nothing was found. Why was this done? Because MCX-SX had to raise 51% of its money from the public (another rule change) and any rumor of malfeasance by one of the promoters would have spooked the investing public. This action was unprecedented in any exchange’s history – it was taken without informing either the ministry or the concerned regulator.

MCX-SX had applied to be a full-fledged Stock Exchange but permission was granted only for the currency derivatives segment – they could not trade stocks and other capital segments. It took three years and protracted legal battles in the Bombay High Court and then the Supreme Court before MCX-SX was given permission to trade in equity stocks. SEBI would find new, specious reasons to keep rejecting their application. Figure 1 Illustrates the various hurdles put in the way of the application process of MCX-SX.

Writing on the wall for NSE

Using one pretext or the other, the C-Company had kept needling FTIL and through it the spirit of Jignesh Shah. He kept growing, undaunted by the pinpricks. SEBI (with the covert or overt connivance of some C-Company team mates) kept throwing mud at MCX-SX and that did not deter them one bit. The timelines of MCX-SX from inception to going live is shown in Figure 19.

Therefore, after many a battle, when the SEBI finally granted MCX-SX permission to trade in Currency Options, Equities and Equity futures, the vice-like grip that NSE held over India as the only real Stock Exchange game in town, was broken. If allowed to flourish, it was just a matter of time before NSE, the Stock Exchange would go the way of all its feeble subsidiaries who tried to take FTIL on[1]. The writing was on the wall. Something had to be done to stop Shah. Something diabolical, ingenious, something from the left field (as Americans would say) or bowling a googly, as the cricket lovers like to say, had to be done. If allowed to survive, Shah and the FTIL group would do to NSE what they did to the other exchanges of India. The smiling assassin was getting ready to administer the coup de grace.

To be continued…

[1] How Chidambaram and C-Company placed hurdles in the way of FTIL – Nov 24, 2017, PGurus.com

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] C-Company Part-8 – The tipping point – MCX-SX becoming a full-fledged Stock Exchange – Nov 26, 2017, […]