How Maxis ended up owning 99% of Aircel

That much of real estate in India is owned by a few and on paper shown as Benami properties is well known. Only in the recent past is the information that companies also have used Shell corporations and a web of corporate entities to flout rules and own outright Indian companies is coming to light. This post shows how Maxis Communications Berhad of Malaysia ended up owning 99% of Aircel India. At the end of the post is a copy of the filings of Maxis to the Malaysian Stock Exchange and to its shareholders.

According to the filings of Maxis in Malaysia’s Stock Exchange on March 21, 2006 (and approved by PriceWaterhouseCoopers, a Big 4 accounting firm):

-

A wholly owned subsidiary of Maxis, Global Communication Services Holdings Ltd. (GCSH) and Deccan Digital Networks Private Limited (JVC) a Maxis Joint Venture company, acquired respectively 39% and 35% of Aircel worth $422 million and $378 million respectively for a total sum of $800 million.

-

Proposed venture between GCSH and Sindya Securities and Investments Pvt. Limited in relation to their participation in the JVC.

-

For an additional $280 million, GCSH bought all Put and Call options of approx. 63 million shares of Aircel, representing about 26% of the stock.

Let us do some quick math. Adding the stakes of GCSH in Aircel, we arrive at Maxis holding 65% of Aircel stock and Deccan Digital owning about 35%. The purchase price for Aircel was $1.08 billion. See the Pie chart below for more:

Who owns Deccan Digital Networks? Maxis has 26% and Sindya Securities and Investments Pvt. Limited, 74%. Then who owns Sindya Securities and Investments Pvt. Limited?.

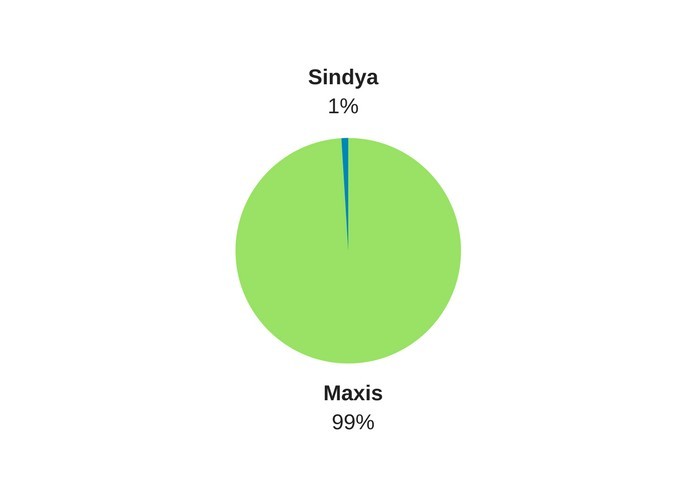

Here comes the interesting part… While Sindhya paid Rs.34.17 crores for its 74% equity stake in Deccan, Maxis paid Rs.11.82 crore for the equity. In short, the total investment of the Maxis Group in Aircel is a whopping Rs.3514.15 crores ($800 million) against just Rs.34.17 crores by Sindya. The pie chart below shows the same as percentages:

According to CBI sources, this investment break-up suggests that Sindya is just a front for Maxis. That Maxis owns nearly all of Aircel is also reported in Malaysian Wireless, an independent news portal.

Below is a copy of filings by Maxis in the Malaysian Stock Exchange

Maxis Filings With Malaysian Stock Exchange in March 2006 by PGurus on Scribd

Note:

1. The conversion rate used in this article is 1 USD = 44.41 Rupees.

2. Text in Blue points to additional data on the topic.

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

If true, is Modi govt corrupt for letitng them go free?