In a growth scenario, China growing at 5% and 6% and India growing at 7% and 8%

Recently the news that China increased its defence budget by 6.8% set alarm bells ringing. The hue and cry were that our defence allocation was pale in comparison. Even the Global Times took a dig at India’s defence budget allocation, saying it’s an illusion that India can improve military capability with a “small increase” in the budget for defence[1]. Many say that China’s defence budget is approximately 3.5 times, their GDP is 4-5 times and their Comprehensive National Power is ‘X’ times ours. Prima facie, it is a frightening prospect. Such military expansion last took place only with the rise of Nazi Germany. Worrying.

More often than not what you put on the table that matters. It’s what that money can buy. Hence the numbers were analysed and projected into the future. The results were interesting. To put the cart before the horse, India is not under budgeting its defence vis a vis China. As much as there is a worry, there is a huge window of opportunity, financially, to set things right. It is an opportunity for the government, armed forces, defence industry and financial markets to make hay when the sun shines.

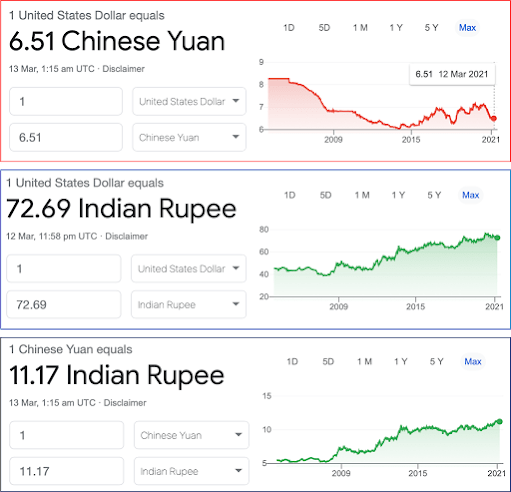

Indian Rupee is unlikely to appreciate relatively if the Yuan strengthens. Hence the real, PPP adjustment values are unlikely to change drastically. Also, Indian aspirations are regional and are unlikely to go global.

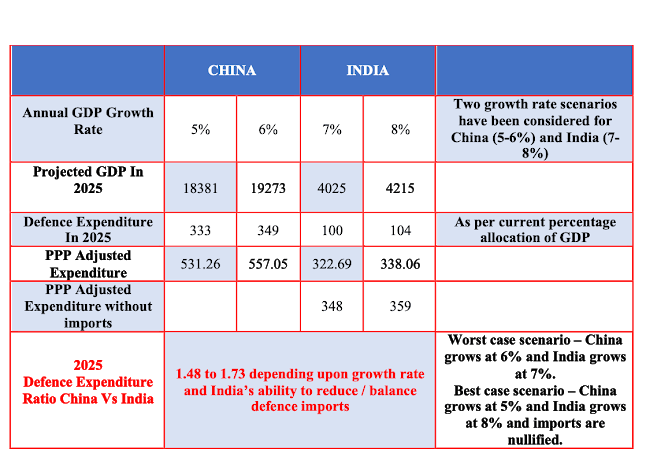

The figure below has been compiled from international sources along with some assumptions. The defence budgets of China and India are based on internationally published GDPs (IMF Data[2]) and Defence Expenditure[3]. It is well understood that the Chinese hide their defence expenditure in other heads. It is assumed that going forward both India and China will maintain their defence expenditure on a percentage basis. The next assumption is that PPP (Purchasing power parities) norms will remain static for the next five years[4]. This will not happen and will be analysed. Two growth scenarios were developed for the future. China growing at 5% and 6% and India growing at 7% and 8%. It is also assumed that India’s arms import bill will continue to be around $10 billion annually since committed liabilities will remain despite “Atmanirbharta.”

In 2020, the Chinese defence expenditure adjusted to real values was approximately 1.87 times ours (Figure 1). The 2025 GDP scenarios for different growth rates have been worked out for both countries in Figure 2. Defence expenditure based on established percentages were then derived for each growth rate. With this, the PPP adjusted expenditure for cases with and without arms import has been further worked out. It emerges that in the worst-case scenario, the defence expenditure of China would be 1.73 times than ours and in the best case scenario it would be 1.43 times than ours. Very clearly, China is not going to heavily outspend India. It is also not that imbalanced, considering that, China is aspiring for global capabilities. Global capabilities imply protection of overseas assets (bases and BRI), power projection, protection of mainland bordering 14 countries, protection of a contested maritime coastline, internal regime protection and competition with the USA. Chinese requirements will only increase in future. In my analysis, what I have outlined is actually the best-case scenario for China. It is also China’s stated ambition to make Yuan the global reserve currency. As China’s GDP rises, so will its debt. All these will make the Yuan stronger. That trend is visible even now over the long term (figure 3). A strong Yuan means less remunerative/ competitive exports. This means the GDP growth will tend to be lower than predictions. Add the debt overhang (of 335% of GDP[5]), loan write-offs that are being forced on them and the ageing factor. Further in a relative sense, if the US economy declines, the effect on China with a strengthening Yuan will compound. The Chinese economy is going to a place with very little headroom left. All these will flush down the hidden defence expenditures. In real adjusted terms their defence expenditure could be far less.

The international prediction is that the Indian economy will grow fastest in the foreseeable future (in excess of 10%). The GDP growth figures considered in this analysis are very conservative. Hence, if our growth rates are higher, defence allocation will also be quantitatively higher even at fixed percentages. Further, the Indian Rupee is unlikely to appreciate relatively if the Yuan strengthens. Hence the real, PPP adjustment values are unlikely to change drastically. Also, Indian aspirations are regional and are unlikely to go global. If all these factors are considered, the allocation for defence is not less. In fact, it will be more than competitive with China. However, does it mean we are doing ok? The answer is No. We need to do more with less! How? That is what this is all about.

The problem is not with the allocation as much as the way we spend on defence. It is universally well known that there are structural problems and huge inefficiencies in our defence firmament. While we might bemoan this fact, it also presents an opportunity due to the headroom available for our planning to improve. Some salient issues which bear upon the defence budget are as under:

- The defence budget will be driven by GDP growth. The mantra should be to let the defence budget grow along with the GDP. Effort should not be made to limit it by value. That would be foolish.

- Atmanirbharta is most important to cap defence imports first and then reduce them. Further, the arms import bill will continue since we will have to pay off committed liabilities and also import some arms for which we do not have the capability. Equally, Atmanirbharta is mandatory for exports. Unless we use an item no one will buy it. Hence arms import and export should be pegged and benchmarks set with a roadmap to make them value-neutral.

- The inefficiencies of our system like delays, poor productivity and quality need special focus. Productivity Linked Incentivisation (PLI) should be the norm, especially for the public defence industry.

- Optimising manpower is inescapable. Shifting to platform centricity from manpower centricity should be the focus. Also, overstaffing of the entire civilian defence establishment needs greater focus. It has escaped attention altogether. Manpower should be productive as per industry efficiency standards or optimised.

- The economy of scale through long term forecasts, aggregation and adopting market principles will pay handsome dividends. Huge scope exists in this arena.

- If the trendline of reducing defence exports, Atmanirbharta, sustaining defence expenditure and privatisation/ corporatisation continues, then the defence industry is in for a sunshine period.

- As much as an additional allocation of the defence budget is required, there is a need to increase the ability to expend it wisely. There is a huge capability mismatch in this area. If this mismatch is not addressed, then we will lag not only in expenditure but in operational preparedness.

- There is a need for India to embark on a Military Civil Fusion (MCF) suiting its requirements. Very important to identify areas where this can happen and take them up as national missions. The scope is huge. Awareness seems to be poor.

- Last but not the least, India should seriously start collectivising security. Entering into strategic partnerships and alliances will offset the requirement of constantly upping our defence expenditure. If this is not possible and all the other points enumerated above are considered impractical and not feasible, then make a humiliating peace with China. We can then compete with Pakistan to be a better Chinese surrogate.

A balanced analysis indicates that the gap, between Chinese and Indian defence budgets, is not as much as it is hyped. This is especially so when the strategic aspirations of China and India are factored in with the way the economies are set to grow. There will be some variations from what is analysed. These variations have to be monitored. Most importantly, it is not as much about the budget allocation for defence, but it is more about how we spend it. We are not getting the bang for the buck. The window of opportunity is there now due to our projected growth rates. The defence industry will enter a sunshine period if we reform as per the way the winds are blowing. Such windows will open very rarely. In our case, it opened once earlier at the turn of the century. We looked the gift horse in its mouth to squander it. It is appearing again now. It should not be a case that a fool and his money are soon parted.

Note:

1. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

References:

[1] ‘Small increase’: Chinese state media takes a dig at India’s defence budget – Feb 4, 2021, Business Today

[2] International Monetary Fund – IMF.org

[3] The 15 countries with the highest military spending worldwide in 2019 – Statista.com

[4] Purchasing power parities (PPP) – OECD.org

[5] Explainer | China debt: how big is it and who owns it? – May 19, 2020, South China Morning Post

- Indian Leadership Vs Chinese Virus - May 4, 2021

- Who will tell the Prime Minister? - April 28, 2021

- A Strategic Marriage of an Arranged Partnership - April 22, 2021