The word “Weimar Republic” is usually associated with two major events:

- Hyperinflation of the German Papiermark between 1921 and 1923.

- The rise of the totalitarian regime from 1933.

In this article, I am going to focus primarily on the Hyperinflation aspects though the latter phenomenon is an inevitable consequence of the former. Economic chaos tends to favour authoritarian regimes that promise stability, equality, and national pride. Bread and circus cease to be an effective lure under those conditions.

Hyperinflation in Germany

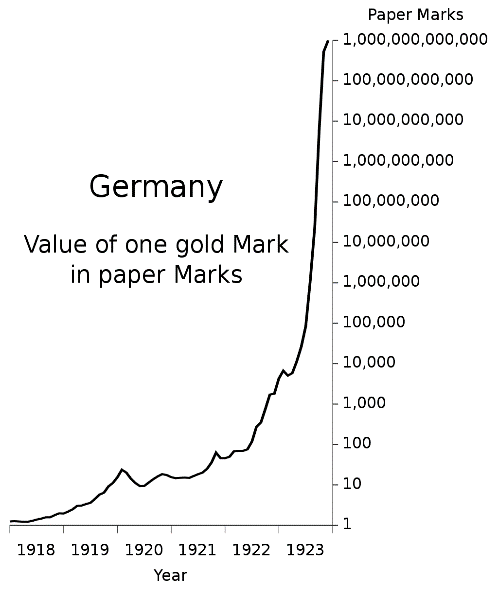

The first graph shows the loss of purchasing power in the German Papiermark from 1918 and the dramatic loss that happened in 1922-23. In 1923 at the peak of the hyperinflationary bust, the exchange rate with the US Dollar was 1 trillion. A loaf of bread that used to cost about 160 by Dec 2022 had increased to 200,000,000,000 marks by the end of 2023.

The signs of the oncoming hyperinflation were obvious for years if one understood monetary economics. The exchange rate of the Papiermark against gold fell by nearly 400% in the two years 1918 & 1919 (1.25 to 9.6 Papiermarks for 1 Gold Mark). It fell nearly another 300% in the next two years 1920 & 1921 (9.6 to 34.8). Of course, 1922 set the previous high devaluation numbers looks tame in comparison when the exchange rate fell from 35 to 1280 within the year. 1923 was of course the year in which the infamous wheelbarrow of currency was required to buy a loaf of bread.

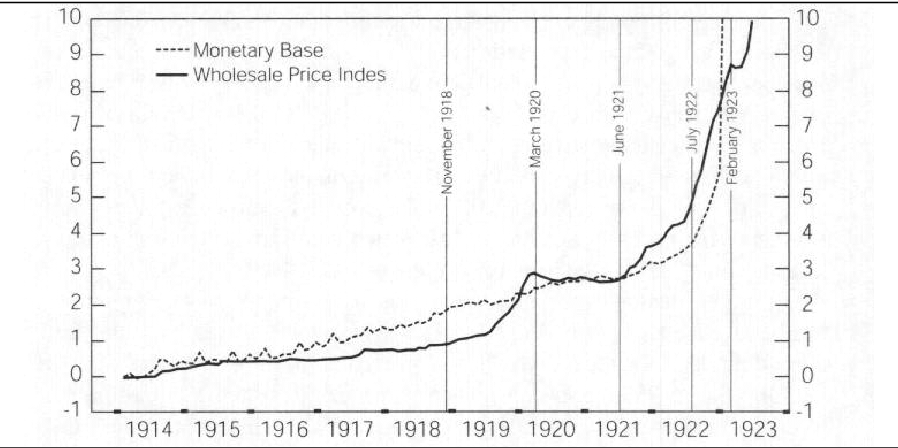

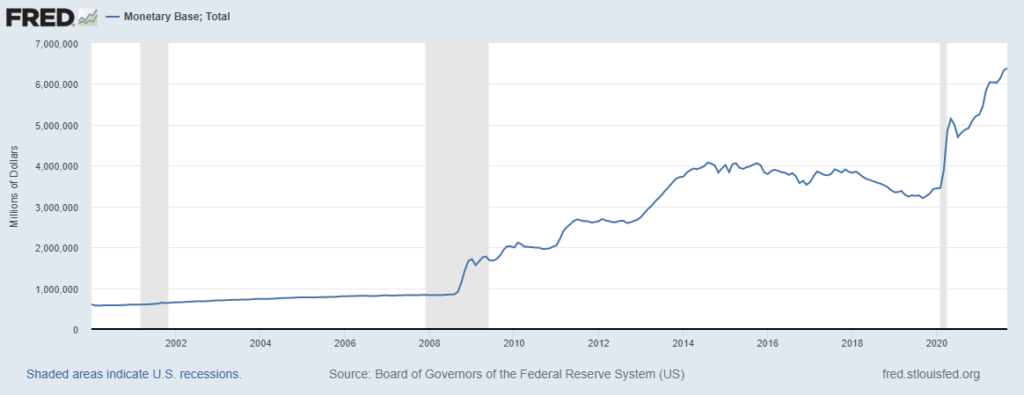

The second graph is more educative for our purpose. As explained in the previous article on a related topic “Are we at the inception of an Inflationary Depression?[1]”, both the lines depict two different aspects both of which are referred to as inflation i.e. the cause and effects. The vital distinction has been completely lost not only on the public but indeed the mainstream economists as well. The dotted lines indicate the monetary inflation (the cause) and the darker line indicates consumer price inflation (the effects). In the early part of an inflation cycle, the consumer price inflation tends to lag the monetary inflation and in the latter part, as expectations of continued monetary debasement set in, the consumer price inflation leads the monetary inflation.

The Inflationary Death-Spiral

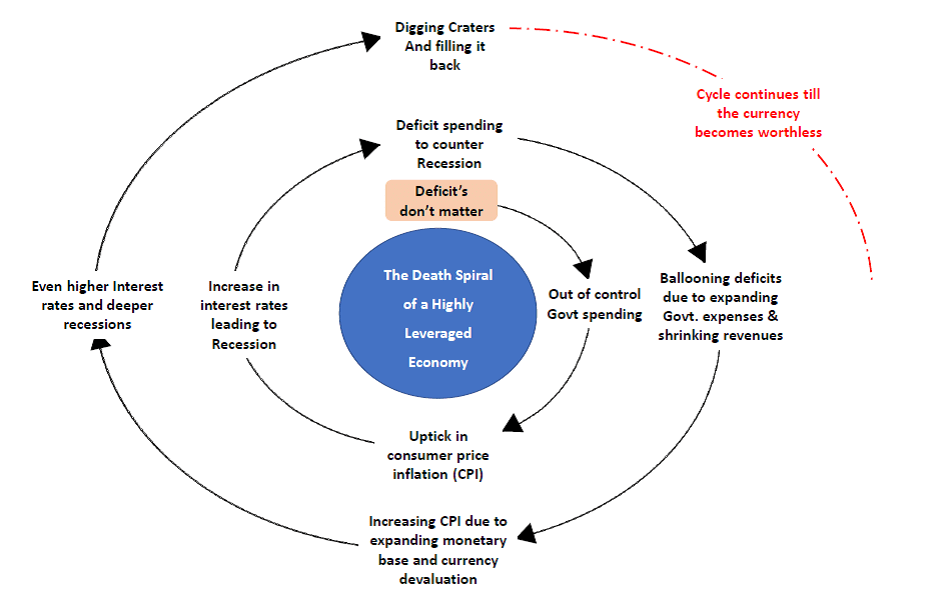

Given above is the typical scenario of how “well-meaning” governments end up causing depressions and high inflations. Starting out in a benign commodity cycle where the monetary inflation does not directly translate into consumer price inflation, governments reach the absurd but very convenient conclusion that “deficits don’t matter”. The Keynesian stimulus appears to work under these conditions and the governments get away scot-free from their monetary sins. Albeit temporarily.

When the payback time arrives, and it always does without exceptions, the monetary stimulus has the effect of pushing on strings from a “growth” perspective. The higher deficits translate into consumer price inflation while the growth seems to falter. The currency weakens, there are greater trade deficits, and the recessions and the consumer price inflation – both worsen. Stagflation, Misery Index (unemployment + inflation) are some of the more commonly used phrases used to describe these economic conditions. & this is where the US, and perhaps the world at large, is headed in the immediate future.

This above Death Spiral has played out on dozens of occasions in the smaller Latin American countries and is very characteristic of many African countries as well. But the economic fundamentals and phenomena guiding these outcomes do not distinguish between rich and poor countries. Just that the cycle is longer in the developed economies due to the misplaced confidence of the unsuspecting public on the motives of their government and the non-existent intrinsic value of their currencies.

Since the USD is at the center of this epic bubble, it is perhaps best to start by identifying where in the above cycle in the US Economy is. After years of denying CPI and months of hallucinations on the transitory nature of the CPI, the US Fed has now finally acknowledged that inflation is here to stay. So when the CPI is running at well north of 5% against their targeted goal of 2%, and the economy is apparently in the pink of health (according to Fed officials), why are the interest rates still at zero? How long can it stay at zero using excuses that even the mainstream media has now begun to question?

Of course, the US Fed neither believes in the transitory nature of the CPI nor in the “strong economy” opinion that the voice in the public domain. The ONLY reason why the US Fed has not raised the interest rates is that they understand the Inflationary Death Spiral that the US Economy/ Dollar is about to enter. Let’s say that the Fed manages to hike the rates to a very nominal 1%. That would still leave the real interest rates negative by a massive 4%+. But this 1% interest rate would deliver a devastating blow to both the housing and bond hyper-bubble markets that the US economy cannot possibly hope to recover from.

That would indeed set off a chain reaction of a recession forcing the Govt. (does not matter whether it is Republican or Democrat) to step in with a big stimulus which would lead to even higher CPI. In fact, this is exactly the same phenomenon we have witnessed in many Banana Republics, but perhaps for the first time, we will witness this happening to the World’s reserve currency in the years ahead.

What is the difference with the 2008 Great Recession?

That is indeed a very good question. Apart from the much worse US debt (government, corporate and public) situation today, comparisons to the 2008 situation are indeed understandable. A very leveraged economy entered the Great Recession and yet, the subsequent massive reflation did not lead to the above Death Spiral cycle playing itself out. Why should it be any different this time around?

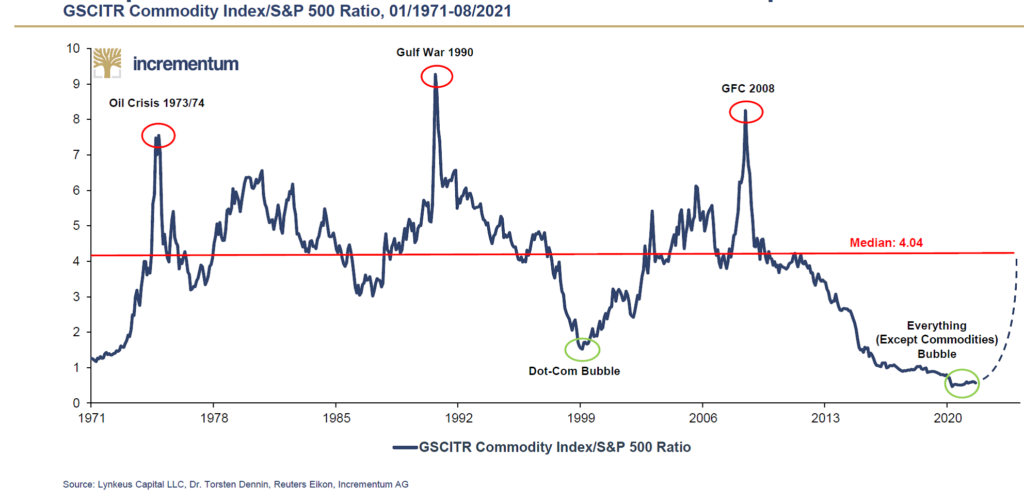

The difference was explained in the previous article linked above through a phenomenon referred to as the Cantillon Effects. When the crisis of 2008 hit, the relative valuation of commodities (vis-à-vis S&P 500) was at nearly all-time high levels. So the reflation trade post-2008, saw the new funny money created to flow into stocks, bonds, and real estate and more importantly, away from commodities. The US Dollar Index was at an all-time low in 2008 and has substantially strengthened despite all of the monetary inflation created by the US Fed in the interim period.

The situation today is anything but comparable to 2008 – as different as “night” and “day” as it possibly could be. The relative valuation of commodities is lower than what it was in 1971 when the US Dollar was still on the gold standard. The monetary inflation is directly going to flow into commodities and hence reflects in consumer price inflation. Given the excessive debt on the books of the US Govt, corporates and the consumer, even a minimal increase in interest rate will be devastating. Damned if it raises interest rates and damned if it doesn’t raise interest rates. What else can the US Fed do other than to maintain the status quo on interest rates, talk about marginal tweaking on the taper in the context of rising CPI, and hope for a miracle?

What Should the US Fed/ US Govt do?

So is there no way out? Well, for sure there is no easy way out given the extent of malinvestments in the system. Much similar to the situation of a drug addict who has had an extended period of ever-increasing doses. Now it’s either withdrawal time or certain death due to additional overdoses. The economic recession/ depression (the equivalent of the withdrawal) is thus a painful but necessary cure to the problem of excessive addiction to cheap money.

For starters, the misadventures in the traditional Keynesian stimulus ideas stem from the wrong diagnosis of a “demand deficit”. This, of course, defies basic common sense as demand is infinite i.e. all of us want all the things all the time and it is always supply which is the constraint. Economics is all about how we utilize our limited resources to satisfy our unlimited wants.

So the best that the US Govt and indeed all Govts around the world could do is to allow free market forces to let interest rates rise which will serve the purpose of redirecting resources from the bubble sectors (stocks, bonds, real estate, Nasdaq 2.0, etc.) into commodities. This will anyway happen with or without the Central Banks allowing the markets to do so. Just that the interference of governments & Central banks makes the bubbles bigger which postpones the day of reckoning. The crash in the bubble sectors is going to be that much bigger and more catastrophic due to the continued interference.

Allowing interest rates to increase is just one part of the solution. The second step that would ease the burden on the economy is to dramatically reduce the size and scope (deregulate) of government interference in market activity. This would free up resources for the productive sector of the economy while removing the shackles imposed on the companies. The best of regulations always happens by the markets and allowing governments to do the job of regulation only creates an environment where the government plays a significant role in deciding the winners and losers in the markets.

Now the interest rates, especially at the long end, would increase anyway – with or without the consent of the Central Banks. There is only a temporary phase in which these rates can be doctored and we are pretty much near the end of that epoch. So a crash in the equities, bonds, and real estate is not only inevitable but imminent as well at this point. The more interesting question is – Would the governments reduce their size or would they continue to indulge in their reckless stimulus ideas? If history is any indication, it is going to be the latter that would lead to the end result of hyperinflation as explained above.

The Timelines… When?

On a side note, I think Heisenberg’s uncertainty principle in Physics should have an economics equivalent as well. Predicting the event and the timelines are almost impossible given that the effects are a consequence of billions of human actions at work.

Purely from a technical standpoint, the US Fed has created sufficient monetary inflation and the US Govt has made pension promises that are unfunded to the tune of several hundreds of trillions of dollars, that Hyperinflation in the US Dollar is pretty much guaranteed. It’s just a question of when the world wakes up to realize that the US Dollar is just a piece of paper, intrinsically no different from the Papiermark of the Weimar Republic.

If one were to draw a parallel with what happened with the Weimar Republic, the monetary inflation from 2008 and perhaps even more so from 2020 is eerily similar to what happened in 1918. That said, the translation of the monetary inflation into consumer price inflation is still is in the nascent stages, and probably over the next 12-18 months, the Death spiral will start playing itself out in the form of stagflation.

The hyperinflation itself looks a few years away, but it is now increasingly looking like a probable event than just a possibility. If anything, I would only conclude by saying don’t bet on “a few years away”.

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

References:

[1] Are we at the Inception of an Inflationary Depression? – Jun 17, 2021, PGurus.com

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- 2008 Redux? YES and NO - October 23, 2023

- Is there a conundrum in the US Housing Market? - September 21, 2023

- Why the Fitch downgrade doesn’t make sense - August 14, 2023

[…] Assuming I am correct, today’s discussion of the anatomy of inflation could especially relevant. In the article, “Is the World About to Be Weimared?”, the author describes the progression of inflation or hyperinflation. (Source: https://www.pgurus.com/is-the-world-about-to-be-weimared/#) […]

Good analysis. People nearing retirement need to give a serious thought on their investment strategy?