Déjà vu! This is exactly what happened in 2010 when RRPR sold to Roys NDTV shares at Rs.4 per share when the market price was Rs.140!

Which fool or genius sells shares at below market price?

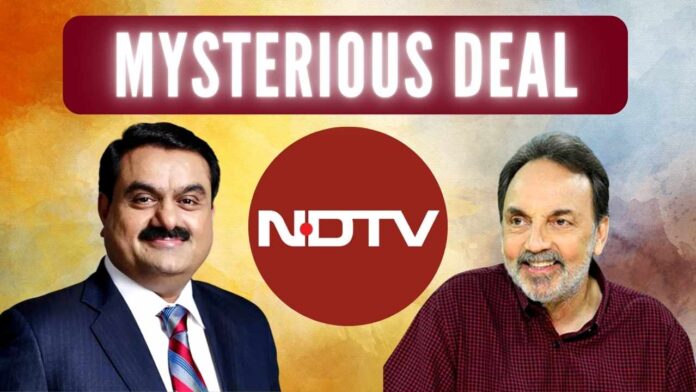

Industrialist Gautam Adani’s NDTV acquisition is a curious one. Adani Group gave an open offer approved by the Securities and Exchange Board of India (SEBI) at Rs.294 to acquire up to 26% shares in NDTV after acquiring more than 29% from the Mukesh Ambani-linked firm Vishvapradhan Commercial Private Ltd (VCCPL). The open offer is open from November 22 to December 5. Now the market rate of NDTV shares is Rs.386 and what is mysterious is that in the first four days, Adani Group acquired six percent of NDTV shares at Rs.294!

Why sell at a lower price?

As per Bombay Stock Exchange (BSE) data in the public domain, the market price of an NDTV share is Rs.386. But Adani Group acquired six percent of NDTV shares in four days at Rs.294 per share! Why would anyone sell for less than the going price, which is too close to Rs.100 per share?

Indian Mainstream Media is completely silent on this curious deal. If Prannoy Roy, the Bishop of pro-Left-Congress Media had any problem, the entire cabal would have jumped on this mysterious deal published on Friday evening (Nov 25) at the Bombay Stock Exchange’s website. No watchdog has barked on this deal. Not even a peep or a whimper. Why?

The deal stinks

One thing is sure. Including NDTV founder Prannoy Roy, all cut a deal with Gautam Adani, who is considered to be close to Prime Minister Narendra Modi. Here is why:

- 1 crore, 67 lakh, 62 thousand and 530 shares have been bid and are open for tender by Dec 5, 2022.

- Of these, 39 lakh, 35 thousand, and 78 shares have been tendered by shareholders at Rs. 294 a share and is 23.48% of the total that is bid by Adani.

The shares continue to rise and at 4 PM on Friday the 25th, the per share price was Rs.386.80[1]. Why is someone walking away, leaving money on the table?[2]

What is going on? Where is the market regulator SEBI? Sleeping as usual? SEBI needs to be frequently reminded that it represents the common shareholder’s interests. Prannoy Roy and his cohorts put up a pretense of a protest when Adani acquired Mukesh Ambani linked firms’ 29% shares in NDTV. But later we saw many in the upper management of NDTV selling their shares and making a quick buck.

PGurus already reported that Prannoy Roy has cut a deal with Adani. Modi government’s most favored industrialist gave an interview to Financial Times, published on Friday revealing that he had offered the Chair to Prannoy Roy[3].

Adani has asked Roy to continue as Chairman

He (Adani) said, “the cost of creating an international media group would be ‘negligible’ for the conglomerate and he had invited NDTV owner-founder Prannoy Roy to remain as chair. Adani’s AMG Media Network also bought a stake this year in business news platform BQ Prime, formerly BloombergQuint,” reports Financial Times[4]. Neither Prannoy Roy nor his minions have uttered a word on Adani’s revelations.

This shows that the posturing of Prannoy Roy was a sham. It is unlikely that Prannoy Roy will continue on the Board of NDTV after Adani gets 56% shares by mid-December and going to accept Adani’s offer to “remain as chair”. It is certain that Roy will prefer a safe escape from the cases he is facing from the Central Bureau of Investigation (CBI) and expected Enforcement Directorate’s (ED) cases – apart from the huge tax evasion penalties from the Income Tax Department.

Roy and his wife’s 32% shares in NDTV are currently valued at around Rs.900 crore. But as per the Income Tax notices, he owes more than Rs.800 crore as a penalty. At present, he faces two CBI cases. In the first case, a First Information Report (FIR) was registered in June 2017 after raiding his home for ICICI Bank loan fraud. From the loan taken of around Rs.400 crore, CBI has all details of siphoning off more than Rs.40 crore to acquire a palatial bungalow in Cape Town, South Africa by the Roys.

A second CBI case (FIR) was registered in August 2019 for floating 38 shell companies in tax havens across the Globe to launder money. In both of these cases, the CBI under Prime Minister Narendra Modi has not yet registered a charge sheet, except for summoning Roy and his wife Radhika a few times to the CBI office. Why were the charge sheets not filed to date?

PGurus Managing Editor Sree Iyer has published a book – NDTV Frauds exposing the multilayered frauds and scams in the garb of a media company. The book is available on Amazon.[5]

References:

[1] NDTV shares continue to pour in on Day 4 of Adani open offer – Nov 25, 2022, Business Today

[2] Offer to buy – Live – Nov 25, 2022, BSEIndia.com

[3] NDTV take over: Adani and Prannoy Roy enter into a deal. Safe exit from CBI, ED, Income Tax cases? – Nov 26, 2022, PGurus.com

[4] Asia’s richest man Gautam Adani reveals global media ambitions – Nov 25, 2022, Financial Times

[5] NDTV Frauds: A classic example of breaking of Law by Indian Media Houses Kindle Edition – Amazon.in

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

Even God is surprised at Indian corruption

Internal mind corruption (vibrations) is what leads to external ambient atmosphere pollution. Corrupt thoughts corrupt atmosphere / environment. Both are interlinked. This is what Upanishads state.