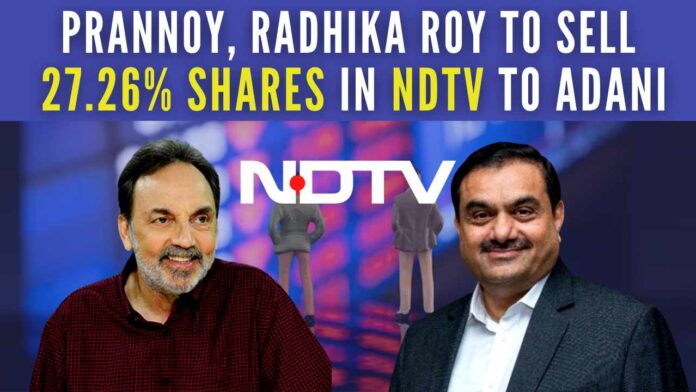

Adani Group becomes the single-largest shareholder in NDTV as founders sell stake

At last NDTV founder, Prannoy Roy cut a good deal with Gautam Adani. NDTV founders Prannoy Roy and his wife Radhika Roy on Friday said they will sell 27.26 percent out of their remaining 32.26 percent shareholding in the news broadcaster to Adani Group. With this deal, Adani who is already having more than 37% percent shares in NDTV will get more than 64% shares in the TV channel company.

Safe exit?

The larger question is this deal with Adani will provide a safe escape route for Prannoy Roy and his wife, facing two CBI cases and a huge Income Tax fine of more than Rs.800 crore, and ED waiting to jump on CBI cases.

“Since the Open Offer was launched, our discussions with Mr. Gautam Adani have been constructive, all suggestions we made were accepted by him positively with openness,” said Prannoy Roy and his wife in a statement.[1]

Adani’s offer to Roy

Adani who had got 29% shares of NDTV from Mukesh Ambani’s linked firm floated an Open Offer to acquire more than 26% shares of NDTV from November 22 to December 5. But he got only 8% shares in Open Offer. After selling their 27.26% shares, Roys will have only 5% shares in NDTV. This is the first time Prannoy Roy speaks about the NDTV acquisition by Adani and was keeping mum after Adani in an interview revealed talks with him and offered Roy to continue as Chairman.[2]

Two CBI cases on Roy

Roys and his wife’s 32% shares in NDTV are currently valued at around Rs.900 crore. But as per the Income Tax notices, he owes more than Rs.800 crore as a penalty. He faces two CBI cases. The first case (FIR) was registered in June 2017 after raiding his home for ICICI Bank loan fraud. From the loan taken of around Rs.400 crore, CBI has all details of siphoning off more than Rs.40 crore to acquire a palatial bungalow in Cape Town, South Africa by Roys.

The second CBI case (FIR) was registered in August 2019 for floating 38 shell companies in tax havens across the Globe to launder money. In both of these cases, CBI under Prime Minister Narendra Modi has not yet registered Charge-sheet, except for summoning few times Roy and his wife to the CBI office. Why Charge-sheet is not filed to date – five years after the first FIR and three years after the second FIR?

Why ED did not jump in?

Both CBI cases involve money laundering. Why ED did not jump in? The answer is simple – Adani’s offer is needed for Prannoy Roy to buy peace and get away with the sale of his shares in NDTV – around Rs.700 crore or with some premium as a full final settlement and to walk to sunset in life.

PGurus Managing Editor Sree Iyer has published a book – NDTV Fraud exposing the multilayered frauds and scams in the garb of a media company. The book is available here.[3]

Reference:

[1] Statement Of Radhika And Prannoy Roy, NDTV Founders – Dec 23, 2022, NDTV

[2] Asia’s richest man Gautam Adani reveals global media ambitions – Nov 25, 2022, FT

[3] NDTV Frauds: A classic example of breaking of Law by Indian Media Houses Kindle Edition – Amazon.in

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

Every rupee of ill-gotten money has to be laundered for use. Nobody steels money to keep in safe. There is an argument making the rounds that unless the money is laundered there is no need for ED to be involved. Good for lawyers to argue but far from truth and hope the courts do not buy it. Just because the shares are sold to Mr. Adani, will the Roys get away from facing the law and IT dues.? If we start putting behind bars all the economic offenders, the jails will run short of room and there will be vacuum at the top everywhere. So the best thing to do is to take away all the stolen wealth with heavy fins just leaving enough for survival.