“Deep pockets and empty hearts rule the world. We unleash them at our peril.” ― Stefan Molyneux

SEBI’s consultation papers

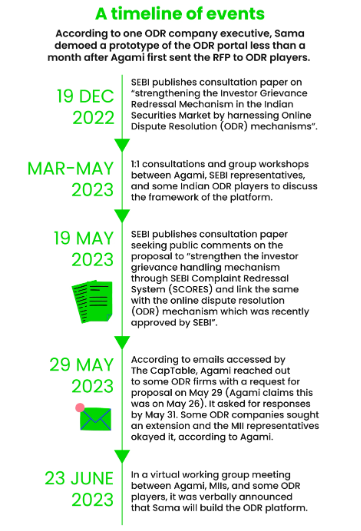

On December 19, 2022, the Securities and Exchange Board of India (SEBI) floated a consultation paper. In it, the markets regulator explored the possibility of implementing online dispute resolution (ODR) tools to bolster existing investor grievance redressal mechanisms in India’s securities market.

The Indian securities market comprises two kinds of players — exchanges (NSE, BSE, NCDEX, MCX, and MSEI) and depositories (CSDL and NSDL). Collectively, SEBI refers to these entities as MIIs or market infrastructure institutions. And while SEBI’s consultation paper stressed that MIIs’ existing grievance redressal mechanisms were “efficacious”, it still proposed that a significant chunk of these processes move online.

This wouldn’t be the first time MIIs employed ODR tools. Indeed, ODR solutions, especially video conferencing, surged in popularity during the pandemic and have since become mainstays for both private companies and public institutions. SEBI, though, wanted MIIs to truly embrace ODR in order to give investors another avenue where they can have their grievances resolved.

Exactly five months after floating the first consultation paper, SEBI floated a

second one. This time, it wasn’t just proposing that an ODR mechanism be put in place for MIIs. Instead, it sought to link the SEBI Complaint Redressal System (SCORES) — an online platform that allows investors to file complaints related to the securities market — with the mooted ODR mechanism.

A little over a month later, on June 23, it was announced that SAMA, a mediation services platform founded in 2015, would be the one to build this platform. And as per the terms of the request for proposal (RFP) floated for the platform, SAMA would build it by July 1.

A chronology of events mentioned will clearly determine the following takeaways :

- SEBI launched this initiative way back in December 2022 and it is a publicly admitted position that SEBI has come up with this concept to solve all disputes through the ODR portal within the securities market.

- Between March and May 2023, public consultations were conducted by SEBI – AGAMI – MII and some ODR players.

- However, in February 2023, SEBI had discussed with the awardee SAMA at the SEBI Bhawan on forming a working group and ensuring that they get a head start over others. There are emails to prove that Pramod Rao, the current executive director of SEBI set up the first meeting along with his colleague Rohan Singh Meena and led the discussion on behalf of SEBI with select few ODR players in a closed-door meeting in February of 2023. Emails are there to prove this.

- AGAMI as a consultant comes on board to advise once SAMA got an advantage by 1 month to speak with other ODR players and appear to facilitate a dialogue. This 1 month is critical.

- 19th May SEBI publishes a further paper to seek public comments on ODR.

- Subsequently, AGAMI who is a consultant, releases a paper called RFP where as a bidder you have to provide technical bids and financial bids without any EMD – Technical qualification – Eligibility criteria to build the country’s ODR Common Protocol (OCP like UPI). There are no financial criteria, nor anything here. AGAMI releases this on behalf of BSE and 7 other MIIs on May 29th, 2023.

- It is informed to other ODR players that a response needs to be provided by May 31st as the project has to be live on July 1st, 2023.

- 23rd June 2023 via a verbal communication in a Zoom communication that SAMA gets the right to develop the platform that will be showcased to across the securities market.

- July 1st week the deadline had come and no launch.

- July 24th was the next launch, but even this didn’t take off due to various reasons including the product not being ready.

- Subsequently, SEBI releases a gazette notification operationalizing dispute resolution by amending all of SEBI’s regulations and then a circular making ODR operational without a proper product.

- They have further gone ahead to comment that they don’t know who owns the data.

More questions than answers

- How was AGAMI nominated by SEBI to be the consultant on this project? When the very engagement goes against the Procurement Manual of the Ministry that has overriding control over SEBI? This engagement itself is ridden with conflict of interest and will fail the test of propriety mentioned in these guidelines. Why was this given a go-by?

- SEBI after taking the initial lead in February 2023, decided to overnight bring in AGAMI as a consultant who will then work with MII to release the product. SEBI takes a stand that it is the private business of MII and SEBI has nothing to do with that. Then on what basis did May 29th letter allegedly known as the RFP get BSE to launch this on behalf of all 7 MIIs?

- Why did the consultant spill the beans that it is going to SEBI’s platform officially in an email?

- How can AGAMI be a consultant when the 50% shareholder of AGAMI – Sachin Malhan happens to own 8% of the winning entity SAMA? How could SEBI get this consultant on board with so much ex-facie conflict of interest?

- The same pattern followed in 2019 when Pramod Rao was in a position to influence and ensured the team backed by Sachin Malhan and Bayside Tech won the ICICI ADR Challenge in 2019. At this time Pramod Rao was the General Counsel of ICICI Bank. The relationship of Sachin Malhan and Pramod goes back to a company called Keep Learning, where both were minority shareholders and have since practised divide and rule. This entity even has a stake in a distillery company – Gemini Distillery.

- How can the security of millions of citizens be bartered for the whims and fancies of Pramod Rao who is the ED of SEBI? Is he not accountable to the citizens?

- SAMA does not have the capacity nor capability to roll out large-scale systems. They have admitted on record that the product is not ready after 23rd June and as late as 24th July too.

- Does SEBI think that it can play with the hard-earned share monies of millions of people to benefit Sachin Malhan and Pramod Rao? Pramod Rao used his position of influence to benefit Sachin Malhan. This is the 2nd time that this has been proved.

- SEBI claims MIIs are private entities, but they are private entities performing public functions under Article 12 of other authorities. Shouldn’t there have been a tender? A toilet tender in SEBI has 114 pages but not a platform that is rolled out to all across the country?

- Who is going to regulate the regulator?

- Aren’t MIIs performing acts of other authorities and therefore instrumentality of state? Where is the tender? Where is RFP? Where is the EMD? Where are the eligibility criteria?

- Pramod Rao is the same director who has now been nominated by Ministry of Finance to the IFSCA last month against this background of conflicts, malafide intention, and a desire to benefit Sachin Malhan.

Therefore how is the Government of India allowing this to go on? This will erode the confidence of the people and the public in the securities market. This move could potentially even cause a market crash as well if people know that their data isn’t safe at all.

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- SEBI and its Waterloo – Part 2 - August 9, 2023

- SEBI and it’s Waterloo - August 5, 2023