In Part 1, we described the four different set of SEBI violations committed by NDTV, on which the SEBI has yet to act. The role of a Venture Capital firm, General Atlantic (GA) that allowed itself to be a conduit to route funds was described in Part 2. This is Part 3.

The name Goldman Sachs is usually uttered in a voice full of reverence and respect in the finance industry. Which other company in the United States could boast of having sourced the last several Secretaries of Treasury? From Hammering Hank who presided over the 2008 Financial crisis to Steve Mnuchin, the current Treasury Secretary, the go-to company for any US President is Goldman Sachs when they have to choose their Secretary of Treasury. This post is the equivalent of that of a Finance Minister in India.

How did Goldman Sachs (Mauritius) end up buying shares of NDTV?

“When morality comes up against profit, it is seldom that profit loses”

– Shirley Chisholm, first African American woman elected to Congress

Sadly, the same got the worse of Prannoy Roy in December 2007. After completing the deal with NBC International / GE Subsidiary (whether it was bogus or genuine, the verdict is still out). In his greed to make a quick buck as he intended to announce this USD 150 million dollar deal, as we pointed out in Part 2 of our series, he did a covert insider trading deal with General Atlantic to acquire close to 48 lakh shares with the objective of making a quick buck by flipping them when he was to announce the deal within days of December 26, 2007 (GA sold shared to Roys). However, “this is where the penny drops”… Sadly he did not have the resources in place and resorted to leveraging and on top of that lying that he had the ability to acquire these and consequent to this, acquire another 20% of NDTV shares in an open offer (mandatory by SEBI). For the 20%, he needed approximately Rs.540 crores and unfortunately did not have this in place and committed a breach of trust (criminal) by making a false statement, which is clearly an act of fraud under FUTP Regulations.

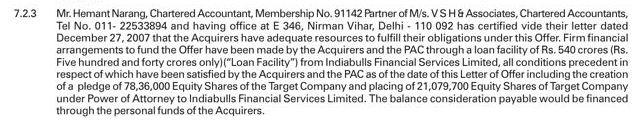

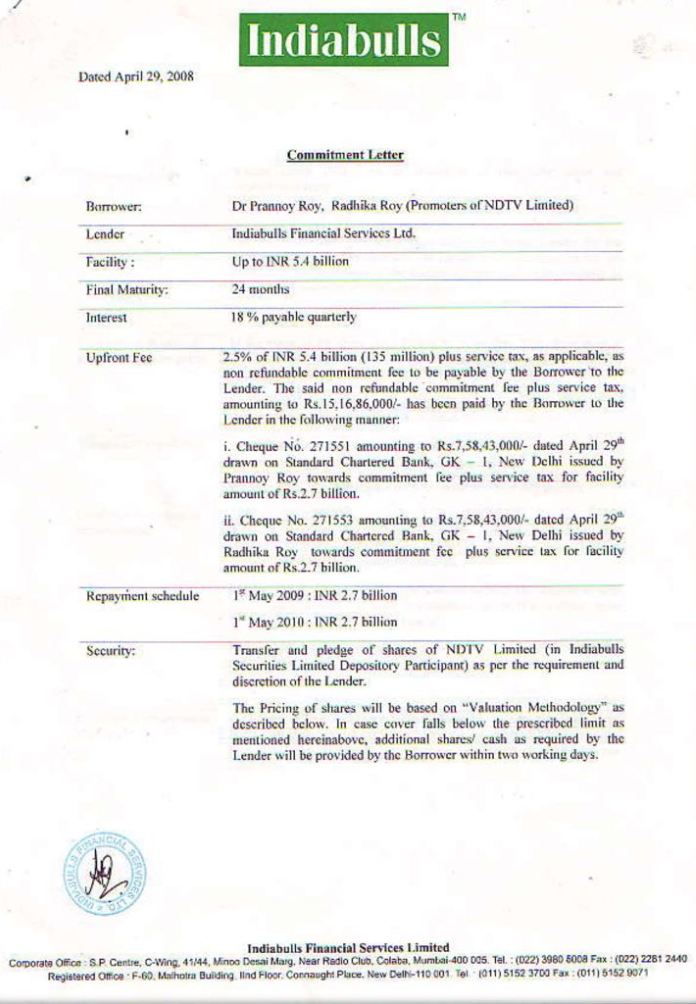

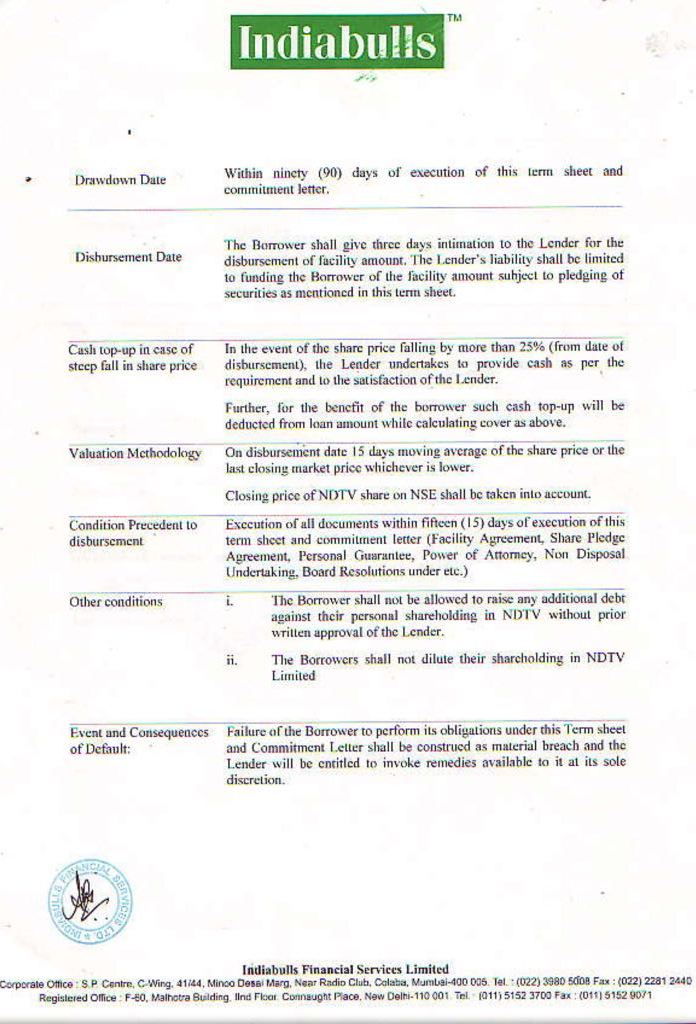

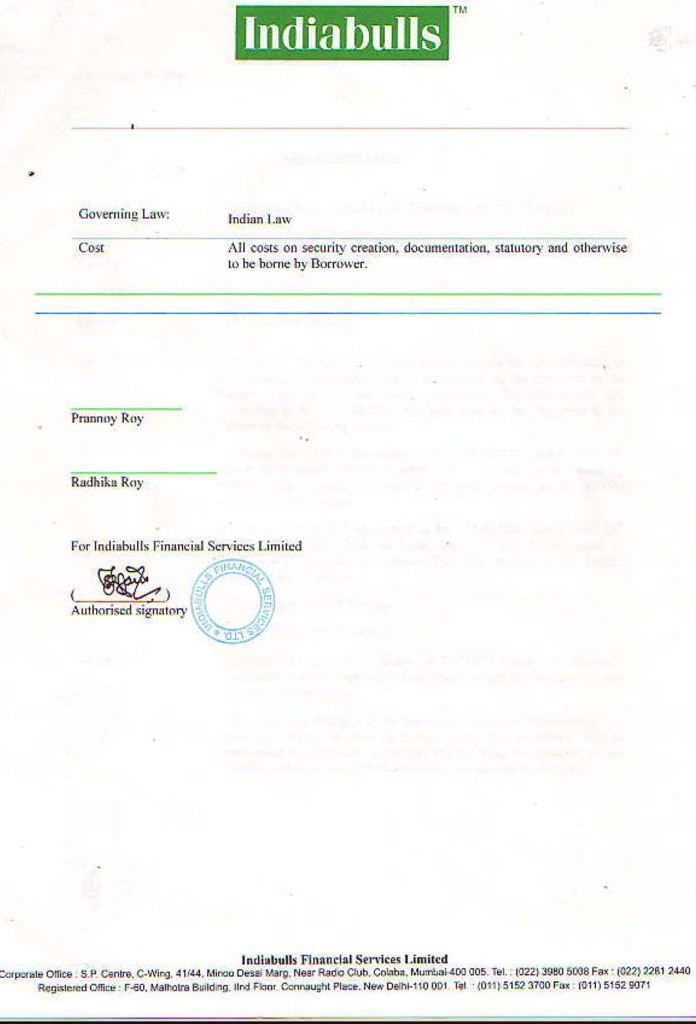

The above lies are clearly evident from documents (Figure 1, taken from NDTV filings) wherein his Chartered Accountant (CA) makes a statement in Para 7.2.3 in the Open Offer announcement on Dec 31, 2007 (CA certificate dated December 27, 2007), that “the Acquirers (Roys) have adequate resources to fulfill their obligations under this Offer. Firm financial arrangements have been made…..”. For more, see Figure 1. However, it is important to note that there were no financial arrangements at all – in fact, it was on April 29th, 2008 that Roys got a firm commitment letter to fund the open offer from IndiaBulls Financial Services (Figure 2). Thus, another point where SEBI needs to invoke the provision of FUTP on Morgan Stanley (managers to the Issue), Roys and of course the CA concerned.

Now we come to the next “actor” in this SEBI and Prannoy Roy cover-up saga. Because Prannoy and Radhika did not have the money in place and they could not flip these shares after the deal announcement with NBCU on Jan 21, 2008, they were saddled with a loan from India Bulls for acquiring the General Atlantic shares and on top of that a Rs.540 crores liability to complete the open offer as mandated by SEBI. These events made them scout for a person who could buy off the acquired shares and also help them in further acting as a “shadow Person Acting in Concert (PAC)” who would covertly use them as a front and keep acquiring the shares they get in the open offer. The “actor” by design, turned out to be Goldman Sachs (GS) & Co., who agreed to work as a “shadow PAC” with Roys and negotiated a deal after going back and forth for a few weeks. On March 7, 2008, Goldman entered into a binding term sheet (undisclosed and illegal as per SEBI regulations) to acquire around 1 crore shares at about Rs.430-450 a share. This is where the second round of FUTP, Insider Trading and of course a criminal breach of trust under Section 405 of Indian Penal Code (IPC) kicks in.

Sec 405 of IPC (Criminal Breach of Trust) that is also a Predicated offence under PMLA and CBI / EOW should have registered an FIR besides obviously SEBI acting under FUTP and Insider Trading.

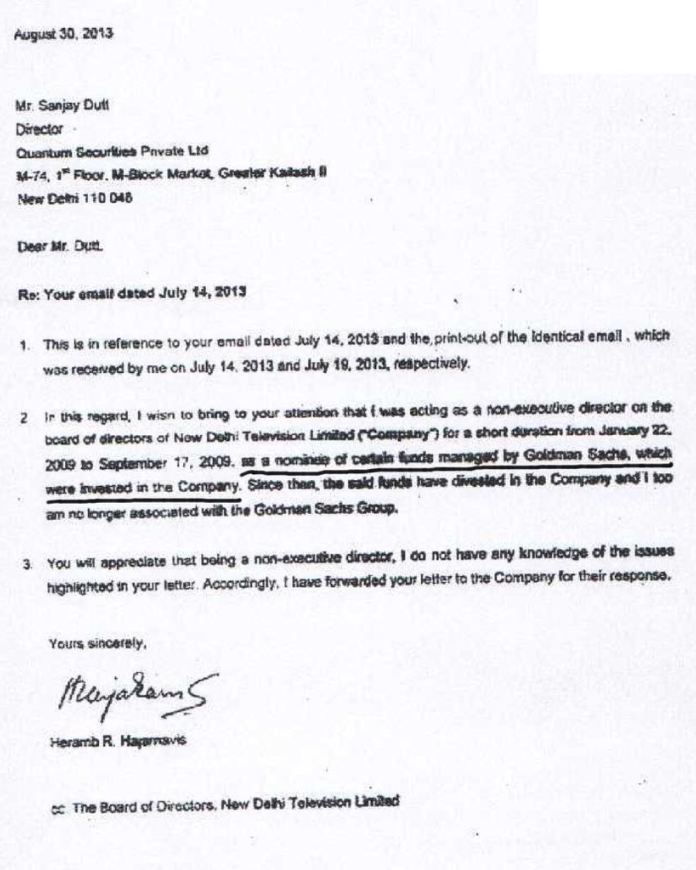

Further, this gets more intriguing that it turns out that Goldman itself was not the real beneficiary of these shares being acquired but in reality they were fronting for some unknown person (see Figure 3). This has been filed by Goldman Sachs Director (who was on NDTV Board) in the Bombay HC on August 30, 2013. Thus, as it turns out that 15% of NDTV from 2008 to around 2012 was and maybe even today is held by an unknown party!!

Questions that SEBI, ED, MIB and CBI need to get answers for…

- Who did Goldman Sachs front for, why has SEBI been quiet on the FUTP and Insider Trading violations,

- Why haven’t CBI, ED and EOW looked at this angle as this squarely attract Sec 405 (Criminal breach of trust under IPC) and of course, most important,

- What has Ministry of Information and Broadcasting done about this illegal and benami ownership in a news broadcasting entity??

| Sr. No. | Date | Event/ SEBI Violations |

| 1 | 26 Dec, 2007 | As the open offer got triggered post the GA trade of 26.12.2007, the promoter was compelled to (as per law) make an announcement to acquire (as per SAST) 1.25 crores shares valued at Rs. 550 crores. It is pertinent to note here that the Promoters had no financial arrangements for this amount and made a false statutory declaration in the mandatory notice on 31.12.2007 |

| 2 | 1 Jan 2008 | They began discussions with GS to offload as many shares as possible while at the same time they had made an offer to buy (commitment as per law) to acquire shares from public shareholders. Thus, they took a completely contradictory position to the open offer announcement. |

| 3 | 12 Jan, 2007 – 7 Mar, 2008 | Many meetings, email exchanges and sharing of unpublished price sensitive information took place between Promoters, NDTV officials and GS etc. to negotiate a binding term sheet/ agreement to offload 14.99% shares. (about Rs. 420 crores worth). This illegal deal was closed by Luthra & Luthra (law firm) and once again never disclosed to SEBI, NSE and BSE etc… |

| 4 | 7 Mar, 2008 | Binding agreement was signed and not disclosed (as is legally required) to SEBI, BSE & NSE or the public at large. Thus, a clear case of PIT, FUTP & even SAST (as GS becomes a PAC) as open offer was ongoing and Promoter was on the one hand buying shares and on the other, selling to Goldman Sachs i.e. a benami transaction running concurrent to Open Offer. |

| 5 | 17 Apr, 2008 | By virtue of the above agreement, GS purchased from PR and RR (Roys) 49.13 lac shares for a consideration of Rs. 213 crores thus pocketing an insider trading gains of Rs. 17 crores ($5 million). Do note, that as on 26.12.2007 they had bought 48.36 lac shares for Rs. 194 crores from GA. This is clearly a case of plain and simple insider trading and fraud on all minority shareholder since all information was kept undisclosed while promoters made an illicit gain of Rs. 17 crores (i.e. in PMLA parlance “proceeds of insider trading crime”). It is important to note, the agreement of 7.3.2008 had very interesting/ illegal covenants that are clearly in violation of all SEBI and Listing Agreement (LODR) regulations. For example – appointment of a nominee director of GS, tag along rights, drag along rights, information rights, restrictive rights as to who NDTV can deal with, GS permission specifically needed to amend articles and memorandum of association etc. This is a classic case of fraud, misrepresentation and personal gain (PIT) to promoters at the cost of Company and without doing any disclosures to not only public at large but also Ministry of Information & Broadcasting as the licensing authority for news broadcasting companies. In addition Home Ministry Security clearance as close to 15% share of a news broadcaster sold to a foreign entity and Director appointment. |

| 6 | 14 Jul 2008 | Within 4 days of closure of the Open Offer, another Rs.170 crores worth of shares by virtue of the 7.3.2008 agreement was sold to GS by Roys. This again is covered as a PIT and FUTP violation. Do note, as they had not funds, promoter Open offer was funded by IndiaBulls after much delay and SEBI strictures/ threats… |

| 7 | Sep, 2008 | Heramb Hajarnavis was appointed on the Board of NDTV as an independent director and at no stage he or NDTV stated in his appointment that he is a nominee of GS. |

| 8 | 30 Aug, 2008 | In a filing with Bombay HC, Hajarnavis (see Figure 3), goes on to state in a letter that he was a nominee of certain funds that were managed by GS. This is truly a shocking revelation as it shows that the funds invested by Goldman were not theirs but they were acting as a benami/ front for some third party. This makes this suspect political or some other vested interest money in acquiring stake/ control in NDTV. |

Continued…

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] act. That Silicon Valley based firms were allowed to act as a conduit was described in Part 2. Even Goldman Sachs was not spared as it held some stock as part of a fund for a yet-to-be-named owner in Part 3. This is the […]

Why is SEBI going so slow in this matter ?

Sun under Sea even going to set soon…