Raghav Bahl is trying a failed concept all over again – when cornered by government agencies, call it a frame-up[1]. In what will still be fresh in people’s minds, Prannoy Roy thundered at the Press Club of India with Arun Shourie and Fali Nariman in tow, that the Modi government is endangering Press Freedom, Bahl is trying a repeat show and it will also flop.

Bahl the Journo Who Made Good in the Corporate World

It must be remembered that Raghav Bahl started out as a journalist (just like Prannoy Roy) until he founded Network 18 (NW18), a conglomerate that went on to own CNBC India, CNN-IBN, CNBC Awaaz, websites Moneycontrol.com, FirstPost.com and print magazine Forbes India and more… He used to anchor a lot of the television programs in the early days and grew the business quickly. Yes, he has in-depth knowledge of stock markets and equities. Reliance Industries Limited (through IMT) bought a majority stake in NW18 in May 2014, after which Bahl and his co-founder wife Ritu Kapur exited or were forced out[2].

Why did the IT raid Bahl’s premises?

According to a statement issued by Raghav Bahl, Ritu Kapur, and Quintillion Media Group, the Income Tax department conducted raids in connection with a Long Term Capital Gains (LTCG) scam, whereby Raghav Bahl and Ritu Kapur had made “bogus” income of Rs.118 crores. The statement rambles on and on about the propriety of their transactions but what is interesting is a little detail that was intentionally left out…

The Rise and Fall of PMC Fincorp stock

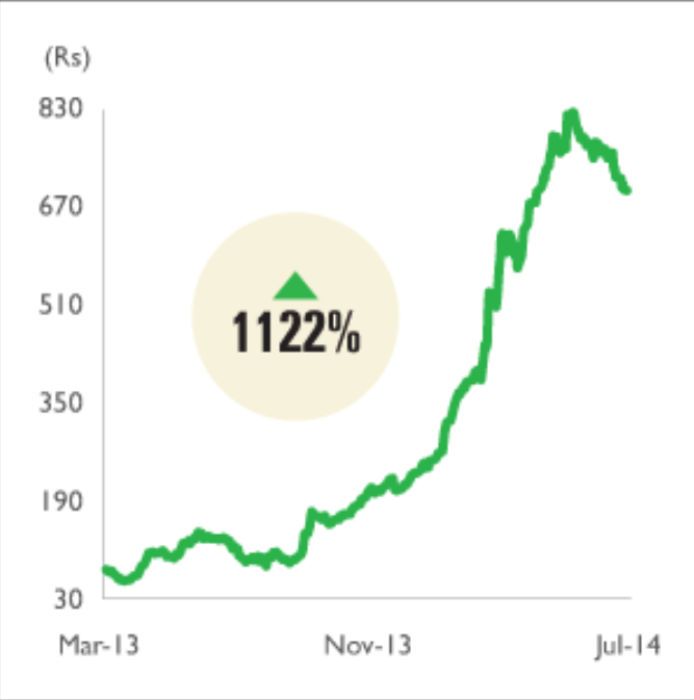

Earlier known as Priti Mercantile Company, this company changed its corporate name to PMC Fincorp, headquartered in Kanpur. During the period Mar 2013 to Mar 2014, the stock price shot up by a whopping 1122% or approximately 12 times[3]. Why did this stock shoot up only to land hard a few weeks later? What was it that it did that merited this meteoric rise followed by a hard crash? The annual report of PMC for FY12-13 states that the company is engaged in trading in shares, and financial services/ investments[4].

How PMC Fincorp and the Bahls are related

This is where the plot thickens… PMC, which went public in 1988, was a penny stock (meaning no products/ sales worth mentioning). However, in 2013, the price of this stock shot by as much as 1122% (or approximately 12 times) before landing hard again (Figure 1).

Below in Figure 2 is the stock price history of PMC Fincorp during the period 2011-2015. Notice how other than a blip for a year or so, the stock never came off the floor. This type of phenomenon is called in market parlance as Pump and Dump. The blip when the stock hit Rs.800 does not show up in this chart, perhaps because there appears to have been a 10:1 split of the stock.

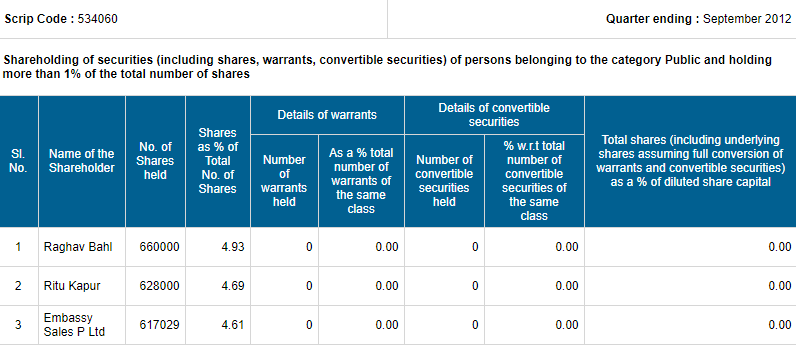

Raghav Bahl and his wife Ritu purchased/owned 4.93% each of this company around September 2012 (see Figure 3). The share price at that time was around Rs.15 per share. Do remember, Mr. Bahl is no naïve or uneducated investor who buys on a tip. He definitely knew and planned this whole purchase of this penny stock with a clear ulterior objective along with some market manipulators and “book entry operators”. Of course, SEBI has been investigating many such cases in the last few years and even the Income Tax Department is working on booking such dubious activities.

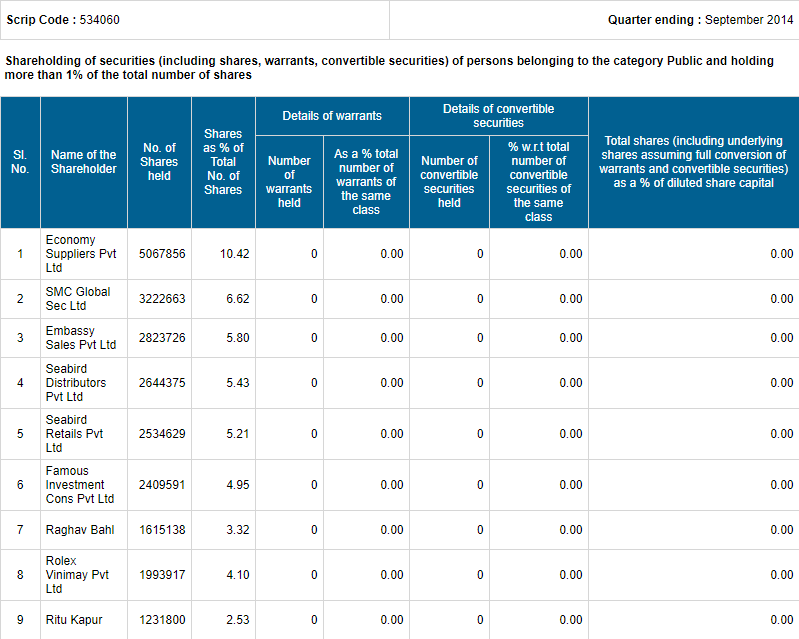

A look at the shareholding pattern in September 2014 shows that Raghav Bahl had unloaded close to 1.6% of his shares and Ritu, close to 2.4% (Figure 4). Note that the shares have split 10:1 or so by this time.

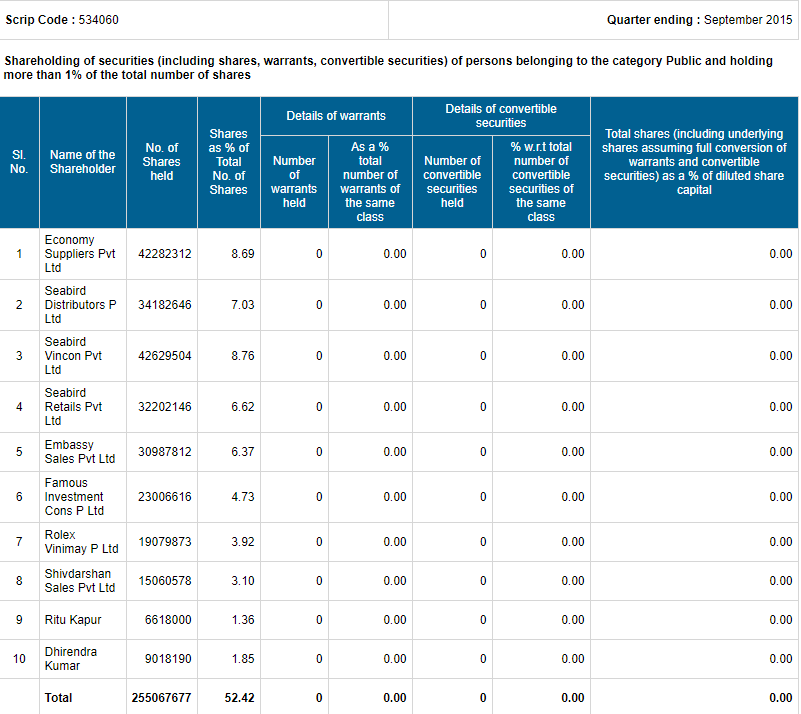

Bahl had completely sold his stake by Sep 2015

Now if we take a look at the shareholding pattern, in September of 2015, we see that Raghav Bahl was no longer a shareholder and Ritu too had divested more (Figure 5)!

Questions

- In your long-winded statement, Mr. Bahl, there is no mention of your “multi-bagger” investment in PMC Fincorp. A back of the envelope calculation shows that you profited close to 660000 * 830 = Rs.54.8 crores and a Ritu Kapur, a similar amount. Perhaps this is what the Income Tax (IT) department wants to know. We are sure, you can expect to see the Enforcement Directorate coming to check whether money was laundered, that is if there was a conversion of black to white or some other bogus fund routing.

- On the face of it, it looks like a payoff. So who pumped up the stock? And for what purpose? Market manipulators and book entry operators will surely provide answers along with the Promoters of PMC Fincorp.

Stay tuned, this may just be the beginning of a bigger tax scam…

References:

[1]Raghav Bahl alleges frame-up, accuses I-T of trying to ‘colour’ returns – Oct 13, 2018, Times of India

[2]Exits galore as RIL takes over Network18 – May 30, 2014, LiveMint.com

[3]Stock Manipulation: PMC Fincorp – Aug 7, 2014, MoneyLife.in

[4]PMC Finance – pmcfinance.in

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

Right now I see a very similar pattern with the stock : Electrosteel steels

https://www.moneycontrol.com/india/stockpricequote/steel-medium-small/electrosteelsteels/EI13

Can we please get a view if that is also Pump and Dump.

when you are writing about anyone and everyone why not write about Rafale deal also Iyer!!!!

India is being fleeced dry by a few who have been very well “cultured” by the corrupt system that had prevailed for far too long especially during the Congress rule. If nothing gets done India will never get back to being a nation worth its past glory.

Such articles need more publicity so that common man is able to understand how owners of MSM are engaged in corruption and mega frauds. Should the govt try to question or investigate their malpractices, these presstitutes start blaming the govt and call it vendetta, killing FOE, trampling of the 4th corner of democracy and what not.

Raghav Bhal like many business journos and big media barons engaged in stock exchange manipulations to get easy money. When caught they try to hide behind the garb of journalism. None is above law and crooks must be fixed

Kudos to Sree Iyer for countering the charges by the anti-Modi brigade. Our mainstream media demonstrate their solidarity with the suspects by not investigating such suspected frauds.

Unless our legal system puts the onus of proof of innocence on the accused where prima facie case is established, such cases will drag on and make India a fertile ground for financial fraud.