US housing market

2022 witnessed the US equity and bond markets enter a bear market. These are indeed long-term trends and while we might witness intermittent rallies as we have had even amidst the start of the bear market during 2022, this bear market will continue for years and years to come. The US Economy, and even more importantly the US Dollar, has entered a state of prolonged decline and these market movements are just a reflection of the underlying fundamentals.

The one asset that has officially not entered a bear market is US housing. The recent declines have been referred to as a correction, much as the case was with the start of declines in equities and bonds. As I will explain here, it’s only a matter of a few weeks or months before the US housing enters a bear market as well.

As I have written earlier, Housing Bubble 2022 is not Housing Bubble 2008[1], this bubble is substantially bigger than the one that triggered the Great Recession in 2008. Let us start with the obvious similarities.

-

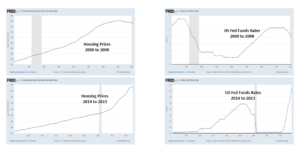

- Abnormal Increase in Housing Prices – Both the periods 2000 to 2008 as well as 2014 to 2023 which led to the Housing Bubbles recorded a CAGR of 7.5% in the house price index. This is substantially higher as compared to the 1980 to 2023 average increase of 4.4%

- Movement in Interest Rates – The formation of the bubbles was indeed a function of the artificially low-interest rates regime of the US Fed and the collapse began with the onset of the rate normalization efforts. There is a lag of about 12 to 24 months between the onset of this rate increase cycle for the markets to feel the results in the form of substantial house price declines.

- The collapse of the housing bubbles – The decline of house prices starts with a trickle and over a few months turns into an avalanche with a massive rise in inventory. All along, the market will deny the existence of a bubble (No nationwide housing bubble – 2007; Subprime is contained – 2008).

What we have seen so far in Q4 of 2022 is the early stages of the unraveling of the current housing bubble. No further rate increases are required and the current 30-year mortgage at 6.6% is more than double what prevailed a year ago. The cost of ownership has consequently increased by about 40% on account of an increase in mortgage rates. This increase and time ought to be enough to launch an avalanche similar to what happened in 2008.

Ironically this trend of increasing cost of ownership is going to continue despite falling housing prices due to the coming increases in mortgage rates increases, taxes, and insurance premiums. If the 2008 crisis resulted in subsequent a 40% decline in house prices, this time around it’s going to be worse with no easy course of reversal.

The above similarities ought to be blindingly obvious for any investor who has a modicum of skepticism about the abilities of the Federal Reserve.

What is far more interesting than the similarities with 2008 are the differences between then and now. These differences will ensure that what “seemed to work” in the aftermath of the 2008 crisis i.e. ZIRP and QE, will prove to be counter-productive this time around.

Why “seemed to work”? – What Bernanke initiated in his tenure as the Federal Reserve Chief merely postponed the liquidation of malinvestments in the housing sector. He managed to replace the 2008 housing bubble with a hyper bubble in stocks, bonds, cryptos, and housing. The unraveling of these bubbles which started a year ago and will continue for the rest of this decade. This will make the after-effects of the 2008 crisis look like the proverbial Sunday school picnic.

In what will eventually be recognized as a great irony in the history of Nobel Prizes, Bernanke was awarded one in 2022 for “his research on banks and financial crises”. Bernanke – by initiating a decade and a half of near ZIRP and QE to counter the 2008 housing bust – has singularly paved the path for the conversion of the United States into a Banana Republic. The Nobel Prize committee couldn’t have picked a worse candidate and a worse time to give the award. Some sense of timing though, this one has turned out to be.

The difference between 2008 and 2023

In one word, “Inflation”. Or more accurately, the manifestation of decades of monetary inflation (i.e. increases in the money supply) in consumer prices.

Though the growth in money supply has been pronounced in the last 3 years, it has indeed been quite elevated right since the late 1990s. The hammer the Federal Reserve has used to confront every nail (LTCM 1998, Nasdaq bubble 2000, Housing bubble 2008) has been to inflate. The lag of this money supply increase to show up in consumer prices has indeed allowed the US government to print its way out of trouble. Till now that is.

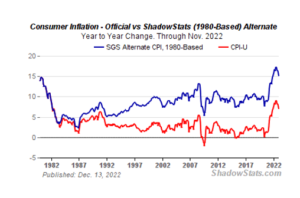

A more important reason than the transmission lag of monetary policy has been the active intervention of the US government in continuously redefining the way Consumer Price Inflation is calculated. As John Williams of Shadow Government Statistics explains, if we use the same metrics as was used in the early eighties, inflation for nearly the last 3 decades has been running at about twice the official rates. Talk about allowing a fox to guard and report on a hen house.

The US Fed Pivot

The housing bubble bust of 2023 is but a few weeks away and this eventuality guarantees a pivot of the current rate tightening and QT cycle. But then it really is not as straightforward as the one in the aftermath of the 2008 crisis during which the Fed could claim that “inflation was too low”.

So what will the Fed do? Continue tightening to counter inflation or ease to prevent a complete housing collapse? It is my supposition that they will attempt both at the same time, and end up achieving neither of the intended outcomes.

The tightening will come in the form of maintaining interest rates or even moderately raising rates to counter consumer price inflation. The easing will come in the form of a massive QE – perhaps targeted at the housing sector. The US Money Supply (M2) which is a shade under $22T should be near $30T towards the end of 2024. The size of QEs this time would dwarf the earlier rounds.

The effect on CPI – By definition, QE is inflation. Given where we are in the commodity cycles, this is going to result in a substantial increase in consumer prices that even the doctored CPI numbers will get into double-digits.

The effect on housing prices – While the US Fed may not move the rates up a whole lot, we will witness a significant increase in the spread between the US fed rates and the 30-year mortgage rates. This spread is typically at its lowest just before the bursting of the bubble as was the case during 2008.

This spread between the US Fed funds rate and the 30-year mortgage will widen over the months and years ahead and even if the Fed keeps the rates unchanged, the 30-year mortgage will cross 10% over the next 2-3 years deepening the housing crisis.

So this move of the US Fed will worsen the recession while at the same time increasing inflation.

The End Game

We are indeed at the end game for the US Dollar as it has existed in its unbacked form since 1971. It is indeed a miracle that a currency whose intrinsic worth is a pure fantasy has survived this long as the world’s reserve currency – and this despite running massive trade deficits for decades.

In the normal course, the US Dollar will have a prolonged deep decline vis-à-vis other currencies over the next decade. But there are a number of factors that can hasten the decline – Oil for Gold by Russia/ Saudi could be one such move; China dumping its treasury holdings could be another; yet another move could be a Gold backed Yuan with a Gold window open for other Central Banks as existed between 1945 and 1971 with the US Fed.

With so many factors that could decimate the US Dollar, it’s hard to predict the trajectory of the decline. But it’s indeed certain that by the time this decade ends, the US Dollar will no longer be the reserve currency and the world would have reverted to some form of a gold standard.

The classical gold standard would of course be the ideal system wherein we abolish the institution of Central Banking. But almost any form of the gold standard would be infinitely superior to the pure fiat currency system we have today. For the sheer magnitude of the havoc it is going to cause to the world at large in the years ahead, it is hard to have come out with a more innocuous-sounding plan than what hatched at Jekyll Island more than a hundred years ago. Hopefully, good riddance soon.

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

Reference:

[1] Housing bubble 2022 is NOT Housing bubble 2008 – Sep 30, 2022, PGurus.com

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- 2008 Redux? YES and NO - October 23, 2023

- Is there a conundrum in the US Housing Market? - September 21, 2023

- Why the Fitch downgrade doesn’t make sense - August 14, 2023

[…] Why 2023 has to be worse than 2008 – Jan 05, 2023, […]