Why this housing downturn is nothing like the last one

With the caveat that the Housing bubble (HB) 2022 is not yet officially categorized as a bubble, let us start with the obvious similarities. Incidentally, bubbles are never classified as one before they burst. That said, it is indeed an incredible feat that back-to-back bubbles have been created in the same asset class within a short span of time.

- In both cases, the growth in housing prices during the preceding few years had been in excess of the long-term trend.

- Even after accounting for the growth in median incomes, HB 2022 is far bigger than HB 2008.

- Both bubbles are the direct outcomes of an easy money policy of the US Fed i.e. artificially low-interest rates.

- The 2008 bubble was caused by Greenspan’s low-interest rate regime after the Nasdaq bubble burst where he lowered the Fed funds rate to a then-unprecedented 1%.

- The 2022 bubble was caused by nearly 15 years of near ZIRP and QE. The bubble is so big now that what would have been considered a stimulative interest rate environment just the last time around is now enough to prick the bubble.

- Both the bubbles met their pin in an increasing interest rate environment. In 2008, a rate of 5.25% triggered the housing burst. In 2022 it is a 3 to 3.25% rate that caused it.

- Technically, Housing bubble 2022 is not acknowledged as one. But it’s only a question of time – maybe another few weeks for what is but obvious to be accepted as a fact by the mainstream media.

- HB 2022 does not even require a 3% Fed funds rate for its burst. Even a 2.0% interest rate and a reasonable time i.e. 6 to 12 months, would have resulted in much the same outcomes.

There are other similarities in terms of the speculative behaviour of investors, banks/ lending institutions, Fannie Mae/ Freddie Mac, and other regulatory agencies, but since the focus is on the principal role of the Federal Reserve in engineering bubbles, let me end here. Suffice it to say, if investors were drunk, the ONLY bartender in town was the Federal Reserve. All other entities mentioned are sideshows.

Thinking slightly ahead, when a post-mortem of HB 2022 is done, all the other entities mentioned above would be criticized for causing the bubble, except the Federal Reserve. This was the case with the Nasdaq bubble of 2000, HB 2008 and so too will it be with the HB 2022. The Federal Reserve will always be Caesar’s wife.

What then is the difference between HB 2008 and HB 2022?

If I were to summarize it in two words, it would be “Price Inflation”.

- What provided a floor to the 2008 housing price crash was the monetary policy of ZIRP and QE. While, in my opinion, QE is a certainty going forward, the chances of a meaningful reduction in interest rates are next to zero. In fact, the chances are that interest rates are further increased in order to supposedly curtail the raging price inflation.

- The interest on a 30-year fixed mortgage is now upwards of 7% compared to 3% at the start of the year. One can even expect this rate to go into double digits within the next 12 to 18 months for the following reasons:

-

-

- Increase in the Fed funds rate – While acknowledging the possibility that this may not necessarily happen, the correct thing to do would be for the US Fed to increase rates to a level that offers a real positive yield. That is the ONLY way to curtail monetary inflation and thus price inflation. That’s what Paul Volcker demonstrated in his tenure as well.

- Increase in the spread between the Fed funds rate and the 30-year treasury rate. We should witness a substantial increase on this count as investors begin to understand the nature of the price inflation that lies ahead for the decade ahead.

- Increase in the spread between the 30-year treasury rate and the mortgage rates: Given economic uncertainties and rising defaults/ foreclosures, the lending institutions would charge a higher risk premium to the 30-year treasury rates.

-

- QE, by definition, is monetary inflation. Given where we are in the commodity price cycles, price inflation will surely follow monetary inflation with very little lag. This is quite unlike the 2008 cycle where the massive monetary inflation (increase in the money supply) did not immediately result in price inflation.

- Another big difference is the bear market in all other Asset classes (DJIA down > 20%, Nasdaq down > 30%, Bonds have had their worst period in the last 40 years, Bitcoin down > 70%). In some sense, real estate was the only “good asset” that hitherto had not entered a bear market. So while in 2008, real estate lead the downturn for stocks, this time around it’s the last to enter the bear market. What does this mean?

- In the downturn, not being isolated to one asset, the pressure to pivot will be immense on the Fed. So QEs that will dwarf the size of the previous ones would be the norm and this would add to the price inflation.

- The economy with back-to-back quarters of negative GDP is already in a recession before the burst of the housing bubble. This burst will plunge the US into a much deeper recession than the one we witnessed in 2008 without any of the tools readily available.

The 2008 Lehman moment equivalent

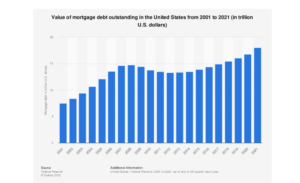

It is all but guaranteed that the mortgages will go into a massive default when the bubble bursts and so the 2008 Lehman moment equivalent is just around the corner. Given that the housing mortgage market size is bigger by about 20% compared to 2008, the ripple effect on the banks will be much bigger than in 2008.

So what we have is indeed a very toxic combination of factors – a much bigger bubble than 2008, little backstopping tools available as was the case in 2008, price inflation already very high, and more importantly on a secular uptrend, substantially higher levels of government and private debt, and general economic conditions worse. So what will happen with the bursting of HB 2022 will make 2008 look like the proverbial Sunday school picnic.

What should the US Fed do?

This is indeed a much easier question to answer than “What will the US Fed do?”. There are only two choices in front of the Fed.

- Allow the US Economy to sink today by continuing the monetary tightening & QT to save the US Dollar. This is precisely what Paul Volcker did with his 20% interest rate.

- Support the US Economy with monetary easing & QE today. This will collapse the US Dollar and with that the economy as well tomorrow.

Economically speaking, it seems to be a straightforward choice. Throw in the mid-term elections, 25 years of easy money policies by the US Fed starting with Greenspan, and the near lack of awareness let alone a detailed understanding of Austrian Economics amongst the decision makers and investors alike – the choices are not so obvious anymore.

In fact, I have little doubt in my mind that the US Fed will opt for the latter with the near-unanimous support of the markets.

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- 2008 Redux? YES and NO - October 23, 2023

- Is there a conundrum in the US Housing Market? - September 21, 2023

- Why the Fitch downgrade doesn’t make sense - August 14, 2023