Parts 1 through 9 of this series can be accessed from this page. This is Part 10.

Regime change did not hamper the C-Company

By the end of 2012, it was clear that Jignesh Shah was going to make MCX-SX happen in spite of the hurdles put up by the C-Company. So when MCX-SX opened for business on February 11, 2013, C-Company had a plan of attack in place.

Palaniappan Chidambaram is the mastermind of the C-Company. This is just one of his many teams, who allegedly still swear by him, even today. That his minions are hard at work, trying to keep him out of jail on the several scams that he is accused of, should be proof enough.

First came the introduction of the Commodities Transaction Tax (CTT), despite numerous appeals from the entire commodity futures sector, in the Union Budget announced on February 28, 2013. As a precursor to it, a lobby was created that made numerous arguments for imposition of CTT on commodities. The several appeals put forward by the commodity professionals that CTT will reduce the scope of hedging was not considered.

With the CTT being levied on Gold, Base Metals, Crude Oil and Processed farm items in which the Multi Commodity Exchange of India (MCX) has the leadership, the tax affected its trading volumes drastically. National Commodity & Derivatives Exchange (NCDEX) was not that affected due to its relatively smaller market share in the segments in which CTT was introduced. This was just a trailer. By July the final blow was delivered with the rash action of the Forward Markets Commission (FMC) on the National Spot Exchange Limited (NSEL). Thereafter followed in quick succession measures such as declaring Jignesh Shah and Financial Technologies (India) Ltd (FTIL) ‘not fit and proper’, forced sale of FTIL exchanges in India and abroad without giving sufficient time, arrests and the merger order of amalgamating NSEL with FTIL etc.

All this is without precedent in Indian exchanges, companies, banks and financial institutions. For instance, in the most recent case of NSE’s co-location market abuses too, excepting the resignations of the Vice Chairman and Managing Director[1], no action was taken on either its board or the exchange. With regard to FTIL, severe measures were taken when the investigations are still in process. And the money trail established that there was no money traced either to Jignesh Shah or FTIL or any of the management personnel. Why then was Shah and his group of companies singled out for such harsh punishment?

Did the persecution of Shah and the FTIL group end with a change in the central government in 2014?

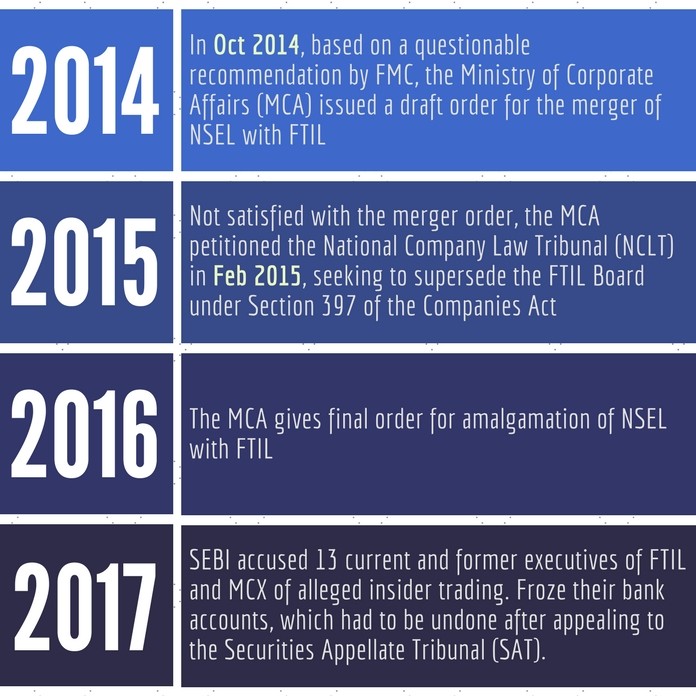

A quick look at Figure 1 will show that a change in the regime at the Center does not appear to have stopped the C-Company from doing whatever it needs to do to further its interests.

On August 18, 2014, FMC Chairman Abhishek recommended to the Ministry of Corporate Affairs, that NSEL should be merged with FTIL alleging that NSEL did not have enough human and financial resources to ensure recovery of the default money. This runs counter to the evidence of FTIL extending all support all these years in terms of financial resources, infrastructure, legal and manpower to NSEL since the problem arose. Sources say that just a day before he was transferred (21st October, 2014) KP Krishnan, the then Joint Secretary in the Finance Ministry, forwarded the draft merger proposal to the Ministry of Corporate Affairs (MCA) which also promptly issued the draft merger order dated 21st October 2014, without any independent investigation of its own.

The FTIL Group challenged the constitutional validity of merger under Section 396 of the Companies Act in the Bombay High Court. Despite, the MCA receiving near complete opposition by FTIL (99.55%) by shareholders and 100 percent by creditors, employees and Board of Directors, both in the form of physical papers as well as emails opposing the merger, the MCA passed the final merger order on February 12, 2016, which is pending adjudication in the Bombay High Court. It may appear strange that Section 396 is applicable for merger of two government companies by consent, which was never applied in the past in Independent India in regard to the private sector companies, which is now being applied for forced merger of two private companies despite the board, creditors, employees and above all, shareholders opposing it with near unanimity.

MCA did not stop there. It petitioned the Company Law Board/ National Company Law Tribunal (NCLT) (from June 1, 2016, The National Company Law Tribunal has been constituted and Company Law Board stands dissolved) seeking to supersede the FTIL Board under Section 397 of the Companies Act for alleged “mismanagement” even as the merger order was still pending adjudication. This issue is also under adjudication.

SEBI accused FTIL and MCX officials of ‘Insider Trading’

The FTIL Group was once again targeted when SEBI accused 13 current and former executives of FTIL and MCX of alleged insider trading. SEBI alleged that they had traded in FTIL and MCX shares with Unpublished Price Sensitive Information (UPSI), and averted losses of Rs.4.1 crores in FTIL and Rs.81 crores in MCX. It may be noted that what SEBI called as UPSI was in fact available in the public domain since long. SEBI had also immediately frozen their bank accounts making it impossible for them to withdraw money for day-to-day expenses. However, the Securities Appellate Tribunal (SAT) ordered the de-freezing of these accounts. In view of SEBI’s action, the ED also revived its action against the Group summoning these officials. Strangely, this order too appeared to be issued by a whole time member who happened to be on the verge of completion of his tenure.

What is distressing about this SEBI action is that it froze the bank accounts of an employee, who was not even working at FTIL at the time of the crisis, had his Bank account and Demat account frozen[2]. Was it sloppiness or brazenness or total apathy on part of SEBI? And this happened on Aug 3, 2017! The same SEBI is in total stupor, refusing to act on gross violators such as Tata[3] and NDTV[4]!

The Mastermind

As shown in Figure 2, Palaniappan Chidambaram is the mastermind of the C-Company. This is just one of his many teams, who allegedly still swear by him, even today. That his minions are hard at work, trying to keep him out of jail on the several scams that he is accused of, should be proof enough. The real Machiavelli of the UPA, he was prepared to kill a job-generating engine to preserve the National Stock Exchange (NSE).

The Manipulator

KP Krishnan, is an amazingly quick-to-respond bureaucrat, putting even some of the ambitious management types in Private Sector to shame. He could orchestrate Ramesh Abhishek, still at the FMC on Aug 18, 2014, to recommend that NSEL be merged with its parent company FTIL to the Ministry of Corporate Affairs (MCA), and then on the day before he was transferred out of the Finance Ministry, push the MCA order without any independent investigation. Currently, he is a Secretary in the Ministry of Skill Development and Entrepreneurship. He helped kill a million-job creating entity and is now in charge of creating jobs for the whole country! Irony died a thousand deaths.

The Executor

Brought in as a Chidambaram man into the FMC in 2010 and becoming Acting Chairman in 2011, his only notable contribution to the Commission was to declare FTIL (and by linkage the rest of the exchanges founded by Jignesh Shah) not fit and proper. He failed to bring even a single development to the commodities market in India and in the last presided over the merger of FMC with SEBI. After getting all the parties to agree to pay on August 4th, 2013, Abhishek let off the defaulters by not executing the plan of action! Was this pre-planned and done this way just to finish off Shah? FMC is now merged into SEBI and Abhishek is currently the Secretary of Department of Industrial Policy & Promotion Ministry of Commerce & Industry.

To be continued…

[1] Anatomy of a crime – Conclusion – Oct 9, 2017, PGurus.com

[2] Jignesh Shah challenges P Chidambaram to a Public Debate on NSEL – Aug 5, 2017, 63 Moons web site

[3] Swamy slams SEBI Chairman for inaction against Tata companies for Insider trading – Oct 11, 2017, PGurus.com

[4] Gurumurthy writes to SEBI Chairman about NDTV – Oct 5, 2017, PGurus.com

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] [1]C-Company machinations – Part 10. How Chidambaram continues to rule over Fin Min – Dec 1, 2017, PGurus.com […]

[…] C-Company machinations – Part 10. How Chidambaram continues to rule over Fin Min – Dec 1, 2017, […]

[…] [1]C-Company machinations – Part 10. How Chidambaram continues to rule over Fin Min – Dec 1, 2017, PGurus.com […]

sick retarded arun jaitly is a liability for bjp

[…] C Company machinations – Part 10. How Chidambaram continues to rule over Fin Min – Dec 1, 2017, […]