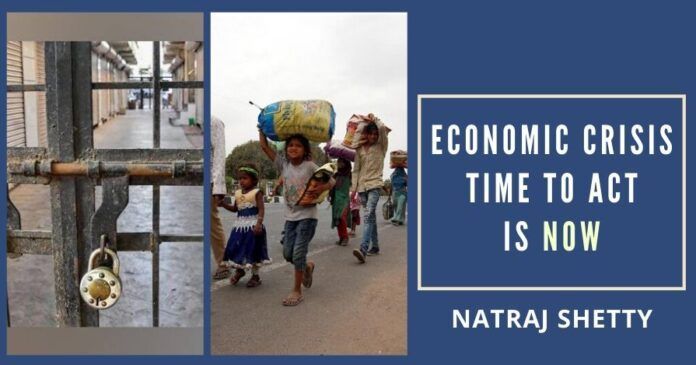

Employee or employer, all business houses, and small or big, all sections of the society are facing catastrophe due to Corona Virus.

Pre Corona Virus (COVID-19), the state of the economy was not in good health, steadily sliding and sinking into a tailspin. Post Coronavirus, the economic woes can become worse and the country’s financial system may collapse soon.

Different sectors, organized and unorganized are likely to be hit hard. Salary cuts, job losses, no new jobs, and high unemployment will be the story unfolding in the coming months ahead. A big chunk of people work in the unorganized sector of the economy in India, and they are at risk of falling deep into poverty due to the Corona crisis.

Many MSME (Micro Small and Medium Enterprises) will be badly hit with inadequately trained workforce after lockdown.

Many International agencies in their analytic reports are describing the post-Corona crisis as something similar to World War III. Uncertainty due to continuity of lockdown and no containment nor any indication of winning the battle against Coronavirus hint of a gloomy period ahead.

Worldwide, in the emerging economy, the unorganized sector plays an important role and especially in the subcontinent and in India, the number of workers in these segments affected by the lockdown is huge. In the coming months, it will start showing its actual adverse ground effects.

Many of the migrant workers, due to lockdown situations have started migrating from big cities/ towns to their rural villages across the country. Even now whenever the lockdown is lifted it will be a humongous task to get the same kind of workforce back to work. Then the long summer vacation period from May to July will add up and thereafter, Monsoon season will hold them from returning to their respective workplace. Many MSME (Micro Small and Medium Enterprises) will be badly hit with inadequately trained workforce after lockdown.

The sectors most at risk include accommodation Hotel industry, Auto, Aviation, Tourism, Food and Services, Manufacturing, Retail, Small business, Service industry, etc. Huge losses are expected across different income groups. The Middle Class will again bear the brunt of the economic crisis. This is the big segment of Indian society, law-abiding contributing positively to GDP through Income Tax, govt revenue, churning out entrepreneurs, job creation, employment abroad earning foreign exchange, etc.

PM Modi should immediately constitute a high power team to work on the recovery and return of illegal Indian Black Money from Tax havens, within a stipulated time frame.

Drastic and devastating increases in layoffs and reductions in wages and no employment opportunities. Many are in low-paid, low-skilled jobs, where a sudden loss of income is devastating. Will further reduce the demand in the market. The pandemic and subsequent lockdown will definitely change and influence the buying pattern in the future to be visually noticed priority for saving cash in hand, and stock adequate food-stuff for the emergency. We will see the drop in demand for non-essential luxury products. This will again add to the low sales less demand and stock-piling up. Further hurting the economy.

Large scale integrated strong policy measures are needed immediately by supporting enterprises, employment and incomes, stimulating the economy and jobs, protecting workers in the workplace, using social bonding between the government, workers, and employers to find solutions out of this crisis.

Employee or employer, all business houses, and small or big all sections of the society are facing catastrophe due to Coronavirus. We have to move fast decisively and govt should find some comprehensive solution. The right and urgent measures could make the difference between survival and collapse.

Estimate $200 Billion required to tide the present economic crises, Pre & Post Corona Virus. The approx break up according is as follows:

- ₹ 10 Lakh Crores for Pre Coronavirus.

- ₹ 5 Lakh Crores for Post Coronavirus.

- Total ₹ 15 Lakh Crores bailout economic package.

We have already deployed the World Bank funds and we are in discussion with others for funds to fight the pandemic.

Ideally, this is the time to fulfill the huge Election promise made prior to 2014, Election by the BJP, Shri Narendra Modi, to fight against Corruption and get back illegal Indian Black Money from foreign Tax Havens. Which is estimated to be around $1 Trillion stashed in Tax havens, worth to approx ₹ 77 Lakh Crores.

In simple language the Black Money estimate is;

- All India’s GST collection of 7-8 yrs approx.

- Income Tax collection of 17-18 yrs approx.

Dr. Subramanian Swamy suggested 6 options available for recovery and return of Black Money and can be easily put into action[1]. A detailed letter of Dr. Swamy listing the 6 possible options has been sent to PM Modi a long back, which can be put into effect.

PM Modi should immediately constitute a high power team to work on the recovery and return of illegal Indian Black Money from Tax havens, within a stipulated time frame.

In the process, the election promise can be fulfilled and the recovered money can be utilized to overcome the present economic crises.

It’s Now or Never

Perform or Perish

Fulfill Promise

Hope, we reach out and hit the right chord.

Reboot and Reset our Economy!!!

Note:

1. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

References:

[1] Dr Subramanian Swamy On How To Bring Back Black Money Stashed Abroad – Dec 22, 2016, Youtube

- Trouble brewing in the new alliance partnership in Maharashtra Government? - August 1, 2022

- Dr. Subramanian Swamy to file case against 2 production companies for ‘false portrayal’ of ‘Ram Setu’ issue in its forthcoming movies titled Ram Setu and Setu - July 31, 2022

- All is not well with Karnataka BJP… - July 30, 2022

I have my doubts over black money even existing in tax havens now. It is impossible to hide a trillion dollars just as cash in some foreign bank account. I feel the black money has already been converted to either untraceable virtual currency or in assets that have been acquired and sold and resold upto a point where the original owner cannot be pinpointed to have acquired it in the black. The other big issue is laundering. This makes it even harder to figure out if the money is black or white. The only way to tackle this is to put all the IT staff on overdrive to scrutinize tax returns of high net worth individuals, politicians, movie personalities and celebrities and figure out how much of a difference exists between what they have declared and what they actually possess. That would give us a nearly accurate estimate of actual black market controlled by Indians. To expect that you’ll find some treasure trove of a trillion dollars of black money stashed in some Swiss bank account is folly. We could have found such a trove if we had acted in the 90s or early 2000s. We are multiple decades too late. The thief is smarter and always 20 steps ahead of the cop. He will get caught eventually but after a lot of resources poured into it. So let us not go with the assumption that we will find some trillion dollars in the Swiss banks and put undue pressure on the Modi Government. Let’s be realistic too. Because putting false hope in people and then making the Government do the circus at this critical juncture is going to further risk our fragile economy. The only way forward is huge stimulus package. Even if it means temporary inflation. People need cash. What is the point of low inflation if people don’t even have cash to buy anything? The economy should be hard rebooted and that would mean introducing liquidity. Print more notes and implement some form of basic income for all. It can be reversed later once the economy picks up. Instead focus on building infrastructure, a manufacturing base and plants and machinary. Companies will move out of China but they have no place to setup their factories and start production immediately. India should help them. That is the only way forward. Boost our manufacturing by giving complete thrust to Make in India. Now is the right time!

The author needs to tell as to how black money can be brought back from tax havens. Is it so simple like making an election jumla? Forget black money from tax havens because there is no viable method except rhetoric with Modi. Instead make life easy for people to invest and do business by following free market policies instead of poor socialist policies embraced by Modi.