[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]A[/dropcap] normally dovish President of the US Federal Reserve Bank of Boston, Eric Rosengren said that it is time the Fed raises the interest rates, which sent the stock market in the US tumbling. All three indices fell today and the Dow 30 crashed back to the 18000 level after reaching new highs in the last few weeks. With German and Japanese bonds providing negative yields, a contrarian move by the US Fed to raise interests rates spooked the markets. Why did the Stock Market behave the way it did?

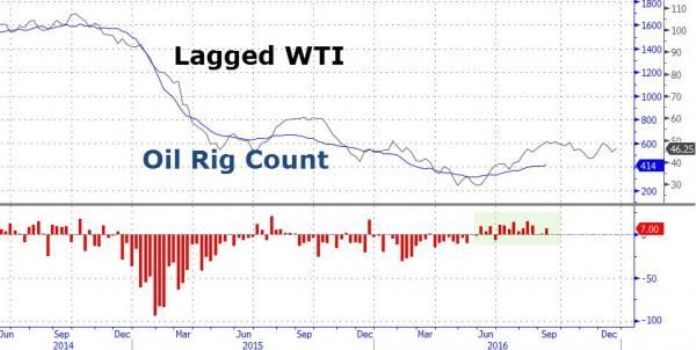

One can offer the usual explanation – the Market hates uncertainty and did not see the rates going up. Especially after the August jobs report said that only 151,000 new jobs were added. The Rig Count in the United States (many were idled when the Oil price crashed down to $33 a barrel) was going up steadily, with a 8 more added last week (see the graphic below) to finish at 414:

What is the correlation between interest rates and US Rig Count? I can think of two:

-

Most shale rigs in the US are not profitable if the Crude price is below $50 (perhaps this explains why OPEC overproduced and drove the price down, in an effort to take out the United States as a competitor). By many estimates the costs of extraction of a barrel of crude in Saudi Arabia (and the Middle East in general) is around $8. So the Saudis may have felt that by keeping the pressure on the production side, they can keep the US out. Russia was a collateral damage in this exercise and tried to wriggle out of it by getting actively involved in Syria. US companies did not close their rigs when the price was tumbling – rather they idled them and went back to improving the efficiencies of shale extraction. In not too distant a future, more rigs may come online as they lower the extraction costs. There were about 1600 rigs operating when the Crude was at $100!

-

Rising interest rates hurts shale manufacturers as they took huge loans at rock bottom rates and now have to pay higher interest rates while the Crude price pressure continues to idle many rigs. A balance has to be struck between profitability and viability.

Conclusion

I expect just one hike this year and another perhaps next. Each will be 25 basis points (0.25%). Remember this is an election year! I do not expect the Fed to raise rates beyond 2% (we are at 0.4% currently). This will give some room to cut them when the next recession hits.

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

Every nation related to the U S A instinctively knows that the king (America) is naked, but don’t say so because of what else; the domino effect.And America goes on regardless with enjoying good life at the world’s expense as no one wants to burn its boat in addition.

The only alternative to have a viable and alternative economy is to go for a new economic federation for south Asia in the lines of the Euro system but separate from it and the dollar.In that case the developing countries of the region will be more secure financially, need no more be black mailed to provide for American avarice and have no fear of sinking or sailing with America.

Outstanding corporate debt is extraordinarly huge – in Jan itself fom Wall Steet mouth – http://www.bloomberg.com/news/articles/2016-01-28/some-29-trillion-later-the-corporate-debt-boom-looks-exhausted . Global economy is in tatters. Virtually all governments are bankrupt. Virtually all banks in the West are bankrupt as their balance sheets do not reflect their exposure to derivatives.

And in this state increase interest rates ?? . Domino effect is well known. Requires only one bank like for instance Deutsche Bank .

The only possibility to increase rates in my opinion is to open up an official QE4 earlier/simultaneously, so that interest dues, if at payable may work to some extent, albeit temporarily

Point is games are being played by the Fed, possibly at the time of an overdue economic collapse