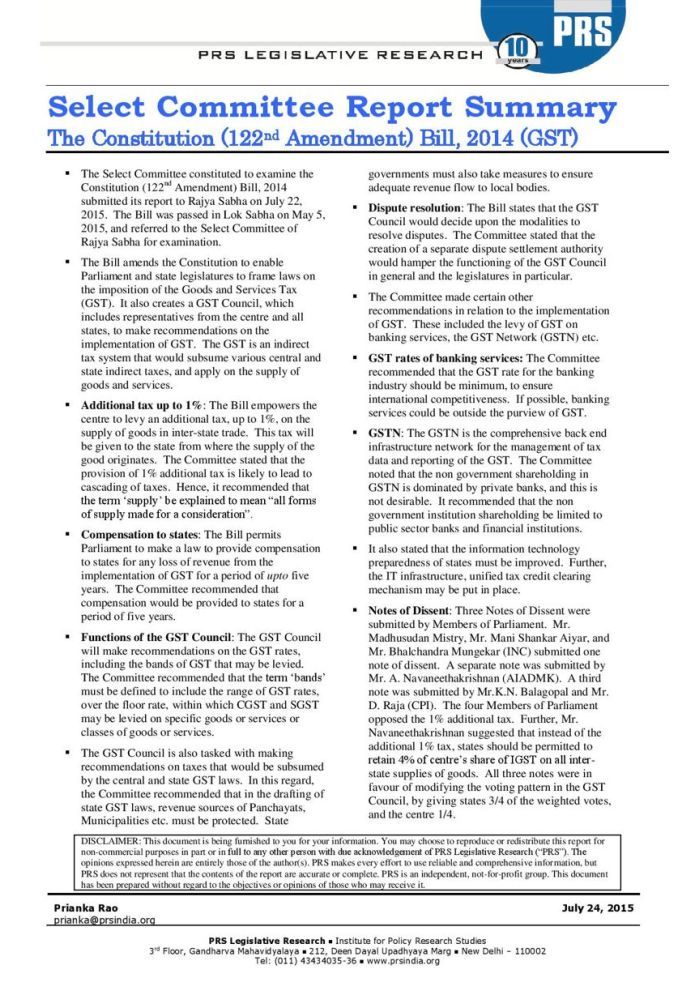

Aug 22, 2016: At the end of this post, we have appended the recommendations of the Rajya Sabha Select Committee on GST. Refer to the section on GSTN for its recommendations.

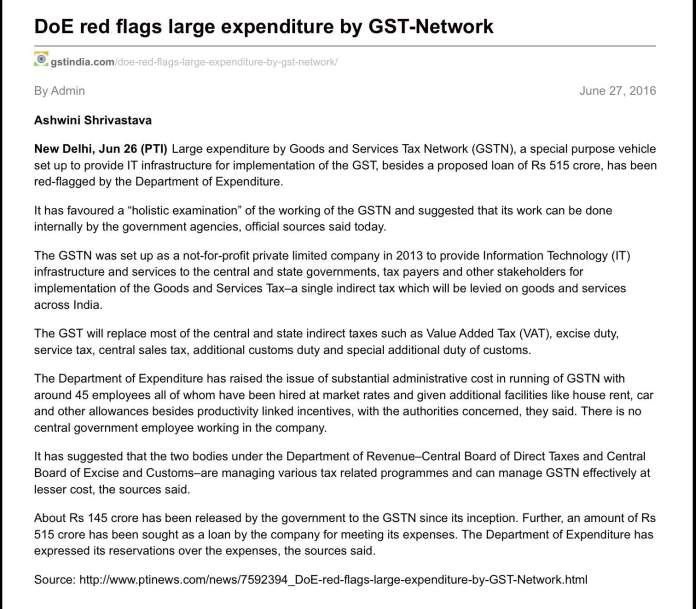

Even as the majority ownership of GSTN is being discussed, the Department of Expenditure (DoE), a government body had red flagged the expenses being incurred. For more, see the picture below:

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]N[/dropcap]ote that this article appeared in June 2016, before the GST Bill was passed! Department of Expenditure comes under the Finance Ministry, so the Finance Minister should have been aware of this. So when he replied in the Lok Sabha that he felt it was best handled by private software companies (the numbers mentioned were that it needs to be able to handle 3-4 billion transactions a month), is one to assume that the DoE suggestion was looked at and rejected?

Don’t get me wrong. I have no objection to a private software company executing the project – what is at stake is the security of the Data. As long as it is always physically stored in the country and there is adequate firewall protection, anyone can write the software. Here is a trail of how this debate on GSTN has evolved. In each of the boxes below, additional information can be accessed by clicking on the text in Blue.

August 7, 2016: PGurus publishes article on GSTN on Private Ownership |

August 8, 2016: Question asked in Lok Sabha on this and replied by the Finance Minister. |

August 8, 2016: Dr. Swamy writes to the PM, expressing concerns on the ownership structure and security of Data. |

August 19, 2016: Prof. R Vaidyanathan advises caution on the role of private players in a non-proft company and on the security of Data. |

What is the way out?

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]S[/dropcap]uch challenges have been addressed elsewhere. Take the United States Internal Revenue Service (IRS) for instance. IRS is the equivalent of Income Tax Department in India. The IRS maintains tax records of individuals and companies. It also has a simple tax filing software Freefile for those whose annual income is below $62,000 per year. There are several other options available for more complex returns such as TurboTax, H & R Block, TaxAct etc. Each has its strengths and weaknesses and will store your personal information on their server until you are ready to submit.

When you click submit, the tax return gets uploaded to the IRS site via a secure Application Programming Interface (API). Think of API as a step-by-step method of sending a tax return in a secure manner. IRS servers are secure – no doubt about it. Otherwise Donald Trump’s returns would be accessible to everyone by now!

A similar structure should be adopted by GSTN. This would allow for several startups to write software on top of the API GSTN will provide. As for ownership, I recommend that entities such as the Banks and Stock Exchanges should be divested of their holdings and be bought back by the Government. All banks of India should be able to manage the GSTN proceeds as long as they can work with the GSTN API.

Opinions expressed are personal.

Rajya Sabha Select Committee report on GST, dated July 22, 2015:

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

Few months back I applied for the SVP(IT) at GSTN Org and got a call from VP(HR) . Surprised to notice his damaging style of the Interview and factually wrong approach to screen me. here let me clarify that I am additional chief Engr at NPCIL (DAE India ) and the VP(HR) was very junior to me in post and age wise from Me.

So that day only I concluded these guys are here to make easy bucks from Govt and god only know what will be their contribution in installation , commissioning and running of GSTN network.