1. Introduction:

The goal of what follows here is to explain that, contrary to the common perception, the interest rates in India are not high at all. They are actually negative at the present. To understand this, let us first note that much like the US Federal Reserve, any Central Bank in any country worldwide usually has the twin tasks of combating inflation and unemployment rates by tweaking the short-term or the 3-month or 90-day interest rates or yields or the interbank rates. Sometimes, this “nominal” interest rate itself can turn negative and at other times the corresponding “real” interest rate, defined as nominal rate less the inflation rate, can be negative[1]. Thus, when the ECB (European Central Bank) fixes a nominal rate for the entire Euro-region, the resulting “real” rate would naturally not be the same in usually high inflation countries like Greece, Portugal or Italy compared to typically low inflation countries like Germany and France. At other times, a Central Bank can deliberately drop the nominal rate to negative, often to combat the exchange-rate problem. This has been the case with Japan. The fall in Japan’s short-term nominal interest rates into the negative territory helped stabilize the Japanese Yen against the US dollar, for instance, in much the same way as negative short-term rates enabled Denmark to keep the Kroner pegged to the euro.

Perhaps this example by Mankiw best explains what it really means[2]: “If you borrow $100 at a –3% annual interest rate today, then you can well spend $100 today but only owe $97 a year from now.” Even John Maynard Keynes approved of this idea[3], as a means to dissuade hoarding by currency holders, but also wondered if such a measure would not put the economy in a “liquidity trap” or a “zero lower bound” below which lowering interest rates further would not encourage economic growth.

Likewise, even when they are instituted deliberately, the lowering of the interest rates is at best a temporary solution, based on the simple idea that raising the rates combats inflation, so lowering them should combat deflation.

2. Recent declining and negative interest rate regimes in India:

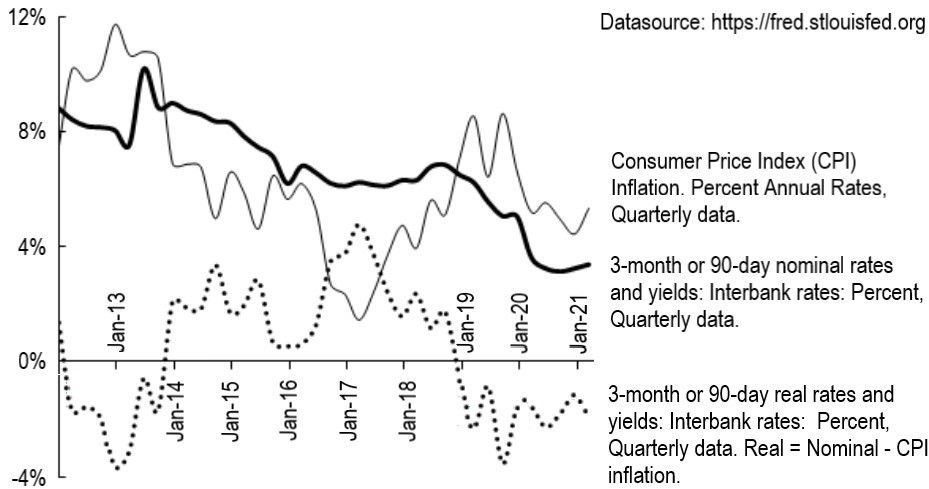

Much like elsewhere worldwide, interest rates have been declining in India through this past decade. The 3-month or 90-day annualized interest rates and yields averaged 8.42% for the 2012-2014 monthly data, for instance, but only 4.47% during January 2019 through July 2021. The reason why we have chosen these two periods is simple and straightforward. The rates quoted here are “nominal” and the corresponding “real” rates are computed by subtracting the corresponding CPI (Consumer Price Index) inflation data from these nominal rates and, as can be seen in the figure below, these real interest rates were negative during these two periods.

3. The tale of the two negative real interest rate periods:

Note that both, the short-term interest rates and the CPI inflation rates, were higher during the 2012-2014 period than during the ongoing 2019-2021 period. The average inflation rate then amounted to 10.11% per year, compared to 6.62% now, whereas the corresponding short-term interest rates ― the principal monetary tool available to the Central Bank ― averaged 8.52% during 2012-2014 vis-à-vis 4.80% during 2019-2021. As for the GDP (Gross Domestic Product), the growth averaged 5.9% per year during 2012-2014 and 1.33% during 2019-2021, a rate that rises to 5.5% if we exclude the two Covid-affected negative numbers for the second and the third quarters of 2020. After all, neither the central nor the state governments in India contributed to this pandemic.

Likewise, the general government final consumption expenditure averaged 10.9% of GDP for the entire 2010-2020 period, and 10.6% during 2011-2014, compared to 11.5% during 2019-2021. The domestic investments in India averaged 32.8% of the GDP during 2012-2014 and fell to 27.9% of the GDP during 2019-2021. But Foreign Direct Investments (FDI) rose from a quarterly average of $400 billion in 2012-2014 to $648 billion in 2019-2021. As P. Chidambaram was finance minister during 2012-2014, whereas 2019-2021 is when the current Prime Minister Narendra Modi’s government is in charge, this exposes the pointlessness of the former finance minister’s disingenuous tirade against the Modi Government’s economic performance and applies particularly to these FDI data because they have nothing to do with the interest rates here but amply signify international investors’ confidence in India’s economic future[4].

Barro found from his empirical analysis that inflation affects growth and investment negatively[5]. Likewise, even when they are instituted deliberately, the lowering of the interest rates is at best a temporary solution, based on the simple idea that raising the rates combats inflation, so lowering them should combat deflation. The United States and other developed economies did hit “liquidity trap” in the process though, and Japan has been trying to extricate itself from that trap through Abenomics ― the former Prime Minister Shinzo Abe‘s three-pronged strategy that combines fiscal expansion, monetary easing, and structural reforms to help the Japanese economy. The futility of rate cuts to stimulate the economy is also what Ben Bernanke, the former US Fed Chairman points out[6]. “Reducing the nominal federal funds rate to –0.5% in September 2011 would have lowered the real federal funds rate to –4.3% instead of the then existing –3.8%”, he argues and doubts if a paltry stimulus such as this would have made any difference to the economy.

4. The winners and the losers:

Note that advanced industrial economies have resorted to rate cuts largely in response to the 2008 “Great Recession” whereas, in our immediate context here, the negative real short-term were not the doings of the Reserve Bank of India (RBI). Nor for that matter is RBI responsible for the conspicuously declining trend in interest rates seen worldwide that is perhaps pushed by demographics in the aging West but affects the interest rates worldwide[7]. What immediately matters to the Indian economy though is that negative interest rates affect most particularly the retirees who have spent their working years saving for retirement assuming that interest rates would always be positive in nominal and real terms, giving them additional income in their retirement. Negative interest rates effectively constitute a hidden tax on the savers[8], therefore.

Indeed, most of the developed economies since the Great Recession of 2008 have been effectively mired in the liquidity trap, like Bernanke, Geithner, and Paulson[9] ― the three Americans who were most intimately involved in helping the world through that crisis ― opine. But as for the governments, negative interests rates have the effect of raising taxation and allow government spending to continue or even expand, simply because they allow the government to issue what amounts to a self-liquidating debt without any transfer payment to the savers or the bond-buyers. This allows adding to the debt nominally while indeed subtracting from the debt as negative interest rates reduce its value by the annual interest as it travels toward maturity. Not surprisingly, therefore, while neither the Government of India nor the Reserve Bank of India instituted these two negative rate regimes in India, government spending certainly increased substantially during 2012-2014 as well as the 2019-2021 periods, as the following graph clearly shows.

This responds favorably, albeit partially, to Dr. Subramanian Swamy‘s call at the January 3-4, 2020 Annual India Conference of Harvard US-India Initiative for the Modi government to reduce the interests on bank loans, giving impetus to small industries, and totally eliminating the income tax[10]. Surprisingly, though, the graph here also shows a rise, not a drop, in Business Confidence Index and perhaps reflects the realization that these negative real interest rate events are only transient in nature.

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

References:

[1] Negative Interest Rates – by Sarkis Khoury and Poorna Pal – May 07, 2020, MDPI

[2] It May Be Time for the Fed to Go Negative – Apr 18, 2009, NY Times

[3] The General Theory of Employment, Interest and Money – Palgrave Macmillan

[4] Government is clueless about the economy: P Chidambaram – Dec 05, 2019, ToI

[5] Inflation and Economic Growth – AECONF

[6] What tools does the Fed have left? Part 1: Negative interest rates – Mar 18, 2016, Brookings

[7] Demographics and real interest rates: Inspecting the mechanism – Science Direct

[8] Negative Interest Rates: A Tax in Sheep’s Clothing – May 02, 2016, Federal Reserve Bank of St. Louis

[9] Firefighting: The Financial Crisis and Its Lessons – Apr 16, 2019, Amazon.com

[10] Income Tax Is Total Harassment: Subramanian Swamy At HUII 2020 – Mumbai Live

- India’s inflation and interest rates through these past 10 years - October 3, 2021

- India and the new Afghanistan - September 26, 2021