The Securities Exchange Board of India (SEBI) Circular was issued in April. Why the reaction now? Who or what could be behind this?

A mild circular to try and restrict round tripping stays dormant for months and suddenly it flares up. Asset Managers Roundtable of India (AMRI), an association of Foreign Portfolio Investors (FPI) takes issue with the circular which restricts Non-Resident Indians (NRIs), Persons of Indian Origin (PIO) and overseas Special Purpose Vehicles set up by Indian financial services groups from being ‘beneficial owners’ of FPIs. So what does this mean, in plain English?

What is the problem?

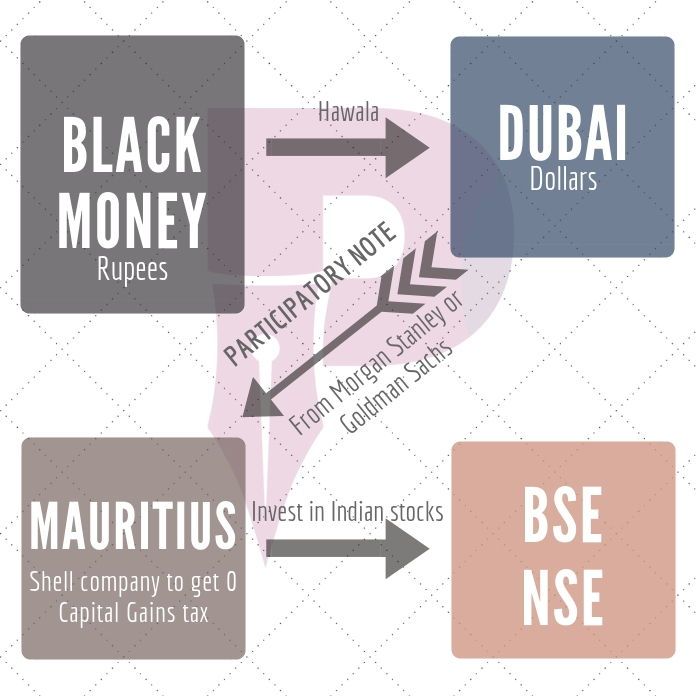

Readers of PGurus by now know how Participatory Notes (PN) is generated. One way is the following – Black money is given to hawala operators in India and the individual can collect equivalent dollars (less commission) in Dubai. Said individual then goes to financial companies such as Morgan Stanley or Goldman Sachs and deposit the dollars to get a Participatory Note with the value (no name). The PN is then routed into India through a company located in Mauritius and invested in the Stock Market of India. A sudden buy of a company’s shares drives up the market and draws innocent buyers along and the individual then sells out at a high and makes handsome profits (on which no capital gains tax is paid). This process can be repeated over and over (hence the word round-tripping) and is completely legal. The new regulation puts a dampener due to the fact that PNs are issued only to citizens of India. The issue is that such category of investors must provide their beneficial owners (BO) in a prescribed format and this starts soon[1]. The anonymity of the PN owner is lost.

The threat of withdrawal of funds

Is this an empty threat or does it have legs? According to the Economic Times article1, FPIs hold about 24% stake in Bombay Stock Exchange (BSE) stocks amounting to close to $400 billion. A withdrawal of $75 billion means withdrawing about 20% of their stake. But who would buy these shares, when they arrive at the market all at once? Especially now that the members of AMRI have shown their hand, the shrewd Indian investor might decide to wait it out for the prices to fall before making a killing! Would the FPIs then take a huge loss? Unlikely. Shares have to be sold gradually, at the “right time” or the seller will have to eat huge losses. But the threat of the tide going out and being caught without their pants may force the hand of some to sell and maintain their anonymity. Or there could be a more diabolical plan, to have buyers lined up to buy these without the public getting a whiff. Can the government do anything about it? Yes. Ban the Participatory Note. And settle the open trades after 6 months.

Pick value stocks on the cheap

Here is an opportunity for the discerning investor to pick up value stocks on the cheap. One of the fundamental rules of investing is to always have about 15-20% of your portfolio in cash – because you never know when the stock you covet comes at a price you can afford.

References:

[1] Decoding the SEBI-FPI standoff: Will it hurt Indian fund managers overseas? Sep 4, 2018, Economic Times

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

There is another angle to this type of round tripping – the dollars that are obtained by making the Indian black money white are many times invested back into the companies of the same people who had that black money to begin with. So selling the shares of that company will result in a stock crash and may even deplete the company’s cash. The other angle is that of tax evasion – if the treaty shopping is eliminated then there will be no incentive for someone in India to move money out of India and then bring it back through a tax haven such as Mauritius – it will be better to invest directly in India. But the livelihood of several powerful is completely dependent on this offshore drama, and they will do whatever to protect this sham. So every now and then whenever the govt tries to do something to curb this menace of tax evasion through offshore, the whole of this industry comprising of vultures from banking, accounting and legal background are up in arms and make so much noise (and orchestrate a temporary crash) to force the govt to backtrack. A while back this industry shamelessly called their effort as Azaadi Bachao Andolan and sadly our judiciary also supported it.