Parts 1, 2 and 3 of this series can be accessed from this page. This is Part 4.

A World Class Commodity Exchange

Jignesh Shah was not satisfied merely with a robust software product. Confident that India has the wherewithal to build high-performance technology companies, Shah set out to apply for a Commodity Exchange license when the opportunity arose in 2002. At first, he was not taken seriously – he was neither a trader nor a banker. And he was going up against an established player such as the Bombay Commodity Exchange (BCX).

A superior technology, under a man who was on a mission to prove to the world that India can lead from the front in the world of Finance, led to several spectacular successes.

He had to work hard the power corridors of Delhi to get noticed. But Shah persevered and finally won approval for a Commodity Exchange. And he surprised everyone by going live in just nine months, on November 10, 2003. NSE had a competing exchange called the National Commodities and Derivatives Exchange (NCDEX) and was forced to wake up to the reality that now there is a new player in town, who is quick on the draw. The next step was market domination. How did MCX achieve this?

In Gold we trust: MCX

Zaveri Bazar in Mumbai is perhaps one of the oldest gold markets in India. Located in South Mumbai, some shops go back 300 years. There are no less than 7000 shops[1] that sell Gold, Silver and Platinum-based jewelry in shops, some of which are as small as 150 square feet!

One of the lessons told over and over again to startup entrepreneurs is to identify the right problem and solve it. Then work on capturing the market as quickly as possible. Shah used to roam the streets of Zaveri Bazar, talking to some of the bigger consumers of Gold bars to find out their issues. The first thing he noticed was that the merchants did not have the accurate price of Gold as it was being traded in various exchanges across the world. The jewelers were calling banks/ brokers/ each other to get the latest price.

In order to stay connected, many of these bigger jewelers had a private exchange (PBX) with extensions so they could call amongst themselves to know the price movements. Shah noticed that in this PBX box, there was an unused Data Card socket, while all Analog card sockets were used up. A light bulb went off! Using the Data card, Shah developed a simple Electronic display that could show the price of Gold in real time in every shop that was using the PBX. Sales from these may not have made a lot of money for Shah but more importantly, he had earned the trust of the jewelers by solving a vexing problem.

Gold purity

In the course of his discussions with the jewelers, Shah found out that though they were importing gold bars of 99.5% purity, efficient price discovery and hedging opportunities were not available. MCX filled this gap and that led to huge volumes and MCX was on a tear. By making this simple but ingenious move, MCX stole a march over the others.

MCX was FTIL’s crown jewel, while ODIN was its cash cow. NSE and BSE, because they used V-SAT had a one-hour downtime in the afternoon because of interference from the Sun. MCX worked a way around this and provided continuous operation from start to end of the trading day. This riled the other exchanges no end.

MCX captures market share

A superior technology, under a man who was on a mission to prove to the world that India can lead from the front in the world of Finance, led to several spectacular successes. The average daily turnover at MCX touched a high of Rs. 503 billion ($8 million approx.) in 2011-12. The ecosystem generated by MCX created a million jobs and a million more opportunities[2]. More on this later.

Signs of trouble from Chidambaram

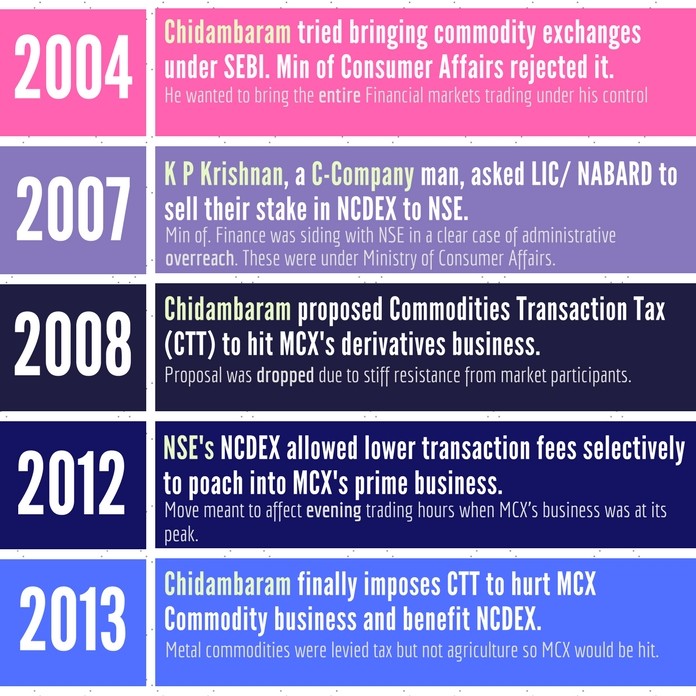

MCX’s meteoric rise nettled Ravi Narain, the head honcho at NSE no end. Jignesh Shah was beating him at every turn. Their rivalry was approaching that of Ambani-Wadia of the 1980s[3] as each battled to control the stock markets. The C-Company moved into action (see Figure 3) to tilt the scales in favor of the NSE and its subsidiaries:

MCX brushed away these roadblocks and continued to grow. Here is a short list of its achievements:

- No. 1 Commodity Derivatives Exchange in India; No. 3 in the world

- No. 1 in Gold and Silver in the world

- MCX had record turnover for any exchange in India

- First exchange from India to get listed in public capital markets (it was oversubscribed)

- First ever evaluation by any exchange in regard to contribution of jobs14, incomes and sustainable livelihoods.

Why were Chidambaram and C-Company going to such great lengths to cut down Jignesh Shah’s companies? You will need to read the previous parts in this series as well as the series on #HFTScam[4] and #ForexDerivativeScam[5]. A gullible country finding its feet in the world of High Finance got shortchanged by a cunning operator who built an army of sepoys who enriched their boss and themselves.

To be continued…

[1] Zaveri Bazar, a treasure trove of precious jewels – May 18, 2015, Rediff.com

[2] A Million Jobs and a Million Opportunities – A study by Tata Institute of Social Sciences

[3] NSE vs FT: The fireworks have just begun – Aug 10, 2010, Business Standard

[4] High Frequency Trading Scam at NSE – Sep-Oct 2017, PGurus.com

[5] Forex Derivative Scam – Jul 2016, PGurus.com

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] [2]C-Company Part 4 – How Chidambaram tried to control all Financial markets in India – Nov 11, 2017, PGurus.com […]

[…] C-Company P4 – How Chidambaram tried to control all Financial Markets in India – Nov 11, 2017, […]

Its pleasure to see the peeling of Powerful people….