Parts 1 through 10 of this series can be accessed from this page. This is Part 11.

The Visionary

Vision – A word often associated with entrepreneurs who can look ahead and build what they think the world will need. Steve Jobs was a visionary – he designed the simplest Digital Music Player, the iPod which had the fewest number of controls and moved the User Interface to a computer. And in 2007, he added the Phone functionality into it (The iPhone). Today this device drives the bulk of Apple’s business.

Every step he took, every new segment he addressed, was a logical extension that made perfect sense. Some of the international exchanges were conceived and put into operation in record time, speaking volumes of his capacity to execute.

Elon Musk is another visionary. He figured out the right battery for an electric car and is now building an ecosystem of Green powered energy for the earth which would have run out of fossil fuels.

Jignesh Shah had all the makings of a visionary – he had figured out at a fairly early stage of his career that India can rule the world of finance because that industry needed people who were good at math and could put things together quickly. From making an easy, low-cost trading platform for brokers (ODIN), he had the foresight to solve the problem of commodities such as nationwide price discovery process and providing a platform for hedging risk.

In the course of his discussions with the jewelers, Shah found out that though they were importing gold bars of 99.5% purity, efficient price discovery and hedging opportunities were not available[1]. His Multi-Commodity Exchange (MCX) solved this problem by offering derivatives and quickly expanded it to help farmers get a guaranteed price for a harvest in the future. After his success in the Domestic market, he saw an opportunity to do the same in the International markets and hence the slew of commodity exchanges in Dubai, Bahrain, Botswana, Singapore etc. Similarly, a derivative exchange led to a spot exchange and ultimately to a full-fledged stock exchange (MCX-SX).

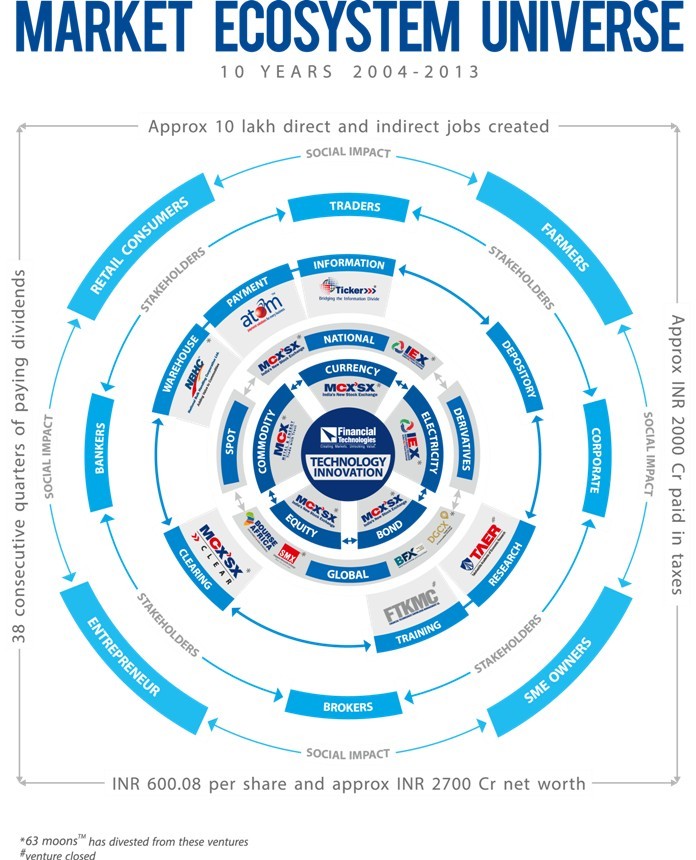

Every step he took, every new segment he addressed, was a logical extension that made perfect sense. Some of the international exchanges were conceived and put into operation in record time, speaking volumes of his capacity to execute. Figure 1 shows the various enterprises that Shah spawned, using his technology engine, the FTIL. His tenacity to create enterprises and build institutional excellence has made some observers to compare him with ‘John Galt’ the fictional character in Ayn Rand’s epic novel ‘Atlas Shrugged’, who showed that grit and determination and sometimes even defiance in creating a masterpiece of work that would be beneficial to the people but could be an eyesore to the enemies.

This eco-system had the capacity to create millions of well-paying jobs throughout the country and yet got nipped in the bud. To preserve the interests of a few.

The whole focus of FTIL’s business strategy revolved around creating and developing an entire extensive 360 degree financial markets infrastructure that encompassed all asset classes and all the ecosystem institutions that were necessary to boost growth, participation and overall welfare. He was not even 10% into fructifying his ambitions before the C-Company stepped in to stop him in his tracks. If just 10% effort resulted in a million jobs, imagine what 100% would have done!

What does the C-Company want?

What does the C-Company want desperately? Why go through all this maneuvering? To understand this look at the following table:

| FTIL vs NSE | |

| FTIL | NSE |

| Born in the background of reforms as a private enterprise and the vision of an indigenous entrepreneur | Born in the background of reforms as a Government initiative promoted by public financial institutions |

| Started as a technology company providing software solutions in stock market trading | Started as a stock exchange with primary responsibility of developing debt markets in India |

| Pioneered multi-asset-class trading solutions that enabled equity market trading to spread across the country and capture market leadership | Introduced electronic trading in stock markets and established as a demutualized stock exchange and established a nationwide presence |

| From providing exchange solutions progressed to set up one of India’s national commodities derivatives exchange, the MCX. | Having failed to create a vibrant debt market for which it was set up with government support, began competing in equity market segment with BSE, then the only national stock exchange in India |

| MCX became India’s no.1 commodity derivatives exchange and quickly scaled to become one of the top global commodities derivatives exchanges | Shortcomings at BSE, special favors bestowed on NSE by the Government and public financial institutions, enabled it to overtake BSE in equity market turnover and gain market leadership |

| FTIL began to set up exchanges of various asset classes in India and build exchanges in leading international financial centers that have particular relevance to the real economy | NSE began to gain clout and focused more on developing futures and options products for the equity markets on the exchange which are all cash settled and have no bearing with the real economy |

In order to succeed, NSE needed the government to give a helping hand. That alone was not enough. NSE also needed others to not rise and challenge its pole position. Now why did the C-Company and more specifically P Chidambaram, need to help NSE? The Government should not be interfering in the affairs of private companies – period. Then why this approach of favoring one exchange over the other? If Shah and the FTIL ecosystem was creating jobs by the thousands, wouldn’t it have been easier for the Government to whisper sweet nothings in the ears of Shah and claim credit for job creation? They were after all, self-sustaining, not needing any handouts or rule fixing… There has to a bigger reason.

Could this be it?

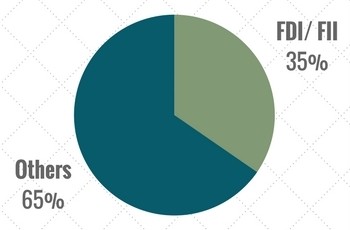

The National Stock Exchange has been trying to go public for some time now. Just when it looked like the decks were cleared, the High Frequency Trading Scam blew up in its face[2]. What is the reason for this eagerness? Why are the investors eager to cash out? Let us look at who owns NSE – As of September 30, 2017, the Shareholder pattern[3] looks as shown in Figure 2.

The foreign investment, in the form of Foreign Institutional Investor (FII) and Foreign Direct Investment (FDI) needs to be probed. If any of these investments are through Participatory Notes, that raises a red flag. Who exactly owns the country’s premier (some may say the only viable) stock exchange needs to be public knowledge before they can do their Initial Public Offering. Some estimate that NSE may be worth close to Rs. 80,000 crores ($12 billion at Rs.65 to a USD). About $4 billion of this money is going to be the in the hands of the secret investors whose identity has to be established. If it is proved that any of it belongs to a politician or a bureaucrat of India, then that is really people’s money unless they can prove it otherwise.

What is the solution?

People connected with this are going to great lengths to protect, preserve and perpetuate the NSE. Figure 3 shows a suggested to-do list for various entities that are probing the operations of the NSE.

SEBI is the main regulator/ player in this co-location scam. The forensic audit entities chosen to audit NSE’s operations have raised a lot of questions of the conflict-of-interest category[4]. The least it can do is now place in the public domain all the forensic audit reports and let the real stakeholders (shareholders and others associated with the markets) determine if the process has been above board. There has been a rush by the NSE to sweep all the scams under the carpet, which suggests that there may be more going on than meets the eye. This is not an easy investigation and therefore it needs to be done step-by-step, methodically and deliberately. There are implications for several C-Company men in this investigation and no one who is guilty should escape.

Continued…

[1] C-Company P4 – How Chidambaram tried to control all Financial Markets in India – Nov 11, 2017, PGurus.com

[2] SFIO may be roped in co-location case as probe gathers steam – Dec 3, 2017, MoneyControl.com

[3] NSE Shareholding pattern – Sep 30, 2017, NSEIndia.com

[4] Is NSE becoming its own Judge, Jury and Acquitter? Nov 19, 2017, PGurus.com

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] C-Company – Part 11 – The Way Forward – Dec 05, 2017, […]

[…] C-Company – Part 11 – The Way Forward – Dec 5, 2017, […]