Team PGurus came across this tweet and post by @PankajSharma that gives deep insights into NSE’s continuing shenanigans!

Deloitte, E & Y, ISB…..Juries acted as NSE’s shadow

—- https://t.co/eiJpIscJOX —-@dreamgirlhema @ppchaudharyMoS @PonnaarrBJP @saravanakr_n @MrsGandhi @M_Lekhi @suhelseth @pbhushan1 @MD_Nalapat @IncomeTaxIndia— Pankaj Sharma (@Pankajsharma978) November 18, 2017

The content of the link in the tweet is reproduced below (Click on the Source button for the original post). It has been formatted to fit your display and corrects some simple grammatical errors.

| Deloitte, E & Y, ISB… Juries acted as NSE’s shadow |

| November 17, 2017 |

| This can be a capital market potboiler, where the accused is selecting the jury and ensuring that the juries are paid sufficiently so that the verdict can be controlled by the accused. In the NSE colocation scam case, all recent investigators were so chosen so that NSE can extract their pound of flesh in terms of what goes in the fact-finding report, due to past or ongoing associations between the exchange and investigator(s).

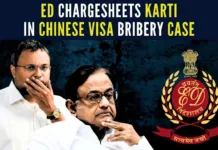

After Deloitte, Ernst and Young (EY) etc. the latest addition include Indian School of Business (ISB). All have rock solid conflict of interests. Let me unravel from the beginning. India’s largest stock exchange seems to be in a rush to sweep everything under the carpet vis-à-vis the market wide colocation fraud that cost investors Rs.50000 crores over a period of 5 years. The exchange is cherry picking auditors, investigators etc. to tailor the possible findings so that the main perpetrators of the crime continue to enjoy the good life. And surprisingly the Indian regulator SEBI is a sitting duck and allowing such blatant conflict of interests to take place (right under their supervision). What started with a whistleblower complaint, was first investigated by SEBI itself. The preliminary report by IIT experts showed clear marks of fraud, the involvement of insiders etc. Then a second investigation team was formed. It is very interesting that the NSE was asked to select an investigator, Mr. Ravi Narain who was one of the main accused and a beneficiary of the scam and was given direct responsibility to select the investigators! He himself is the key accused and has subsequently been showcased by SEBI. He picked Deloitte. Very significantly, Deloitte was having business dealing with NSE. This fact again was never disclosed neither by Deloitte nor by NSE. Only when media raised the issue, the same came in the limelight. Quite obviously Deloitte report lost its credence instantly when the same was made public by a whistleblower. Quite obviously, the report did not have anything worthwhile as findings as it was a big compromise. As the noise began to increase in the market with more facts tumbling from a series of whistleblower letters, the regulator was forced to redo the entire investigation. For the third time in a row, as the regulator was left with no choice, SEBI and NSE had to ensure another round of investigation. This time Ernst and Young (EY) was chosen along with ISB. Let me now tell you the real motives for selecting them. As before, NSE wanted to select someone who will not write some unpleasant truth in the report. So again, same logic was applied to find few, whose findings can be controlled. Like Deloitte, EY also has huge financial interest from NSE in the form of large projects, audits etc. with NSE. Among the few projects that they had with NSE include a review of their system, checking disaster management plan etc., so on and so forth. Now you will be surprised to note that even ISB is a big conflict of interest. As recent as in 2004, NSE paid a huge amount of money (in cr) to ISB to set up a trading innovation lab. The timing is very significant. The scam operation was in full swing during that period and was about to come to an end as the regime of one of the masterminds and beneficiary of the scam Karti Chidambaram (son of P Chidambaram) came to an end as political scenario in India flipped (Congress lost the general election). Around the same time Ravi Narain (ISB project was commissioned during his tenure as MD & CEO NSE) also resigned from NSE. They created a buffer in the form of these partnerships, knowing that the same will pay a rich dividend later. Among other things, ISB received crores of rupees, etc. as funding and aid. The involvement of Deloitte, EY and ISB, all were kept under wraps initially. Unimaginable truly. Considering the fact that the fraud had affected the entire market, SEBI should have NSE to be transparent. Moreover, NSE being a public institution needed to disclose such developments on its own, as a corporate governance practice. NSE for long used similar services from people like Ajay Shah, Susan Thomas etc. to voice opinions in their favor. They could not do it this time, as all these names are out in public domain as loyal NSE servants. Both have served NSE in multiple capacities, including board and important committee positions. Last, I have every reason to believe that SEBI was not careful in handling such cases. NSE and ISB association was known to SEBI as S Raman, SEBI ED was involved when the technology lab went live. Moreover, what is the credential of such firms including ISB in investigating such fraud? For example, ISB is a management institute. ISB, itself neither advertises itself as a capital market expert not it claims to be a big data expert. Meanwhile in between NSE formed another committee of its own people which included, Yatrik Vin (CFO), J Ravichandran, Ravi Varanasi (CBO & a direct accused), Vasudev Rao (legal head) and Dr. V R Narashimhan (CRO). Obviously, nothing bad and exceptional were reported as all were NSE insiders. NSE board was presented with the report. Finally, so many efforts and thinking are going into cover-up activities, there must be something even bigger than Rs.50000 cr which as many believe is the size of the scam. We need an answer and SEBI must now hand over the investigation to central agency and true experts (without an iota of conflicts). |

The Anatomy of a Crime series gives a detailed account of #HFTScam.

- Subramanian Swamy approaches Supreme Court on Govt’s modification of 2G Scam Judgment to avoid auction of Satellite Spectrum - April 23, 2024

- Defence Minister Rajnath Singh visits Siachen. Reviews military preparedness - April 22, 2024

- Amit Shah’s shares in the Stock Market almost doubled in the past five years - April 21, 2024

[…] Is NSE becoming its own Judge, Jury and Acquitter? Nov 19, 2017, […]

[…] Is NSE becoming its own Judge, Jury and Acquitter? Nov 19, 2017, […]