SEBI was contacted for a comment and has not replied till now…

Is SEBI going to negate all transactions that were co-location based?

The Securities Exchange Board of India (SEBI) appears to be getting ready to rule on the National Stock Exchange (NSE) co-location scam. From reading this Hindu Business Line article, I understand that penalties are going to be handed to the gang of 14 that formed the core of management in NSE during the time of the scam[1]. A penalty on those involved is a cruel joke on all the investors of India. Does SEBI even understand the magnitude of the crime committed by NSE?

Co-location services started without SEBI approval?

The harm High-Frequency Trading (this comes because of co-location) can inflict on the investor is well documented in Michael Lewis’s Flash Boys[2]. A momentous decision like this, for the SEBI to allow it at the NSE should have been taken after much deliberation, talking to the industry experts including a public hearing period before allowing it. Instead, what happened was that the NSE quietly started tick-by-tick (TBT) High Frequency or Algo trading (HFT) and co-location services in January 2010, putting it out on their website (since modified by NSE) but click here for what was shown[3]. Before they started this, there should have been a notification from SEBI, approving it for all exchanges. But nothing of that sort happened. The Chairman of SEBI at that time was C B Bhave and the NSE Managing Director was Ravi Narain. So strictly speaking, all trades involving co-location are illegal and must be reversed. Will SEBI criticize itself for not stopping NSE? Remember the appointment of Bhave as Chairman was clouded in controversy, over his role in NSDL[4].

A slap on the wrist is counter to the amount of malfeasance that has come out in this gory episode. First, a list of scams alleged:

- Preferential access to a chosen few, who got first come first served basis and as long as they stayed connected, they got first looks at all trades.

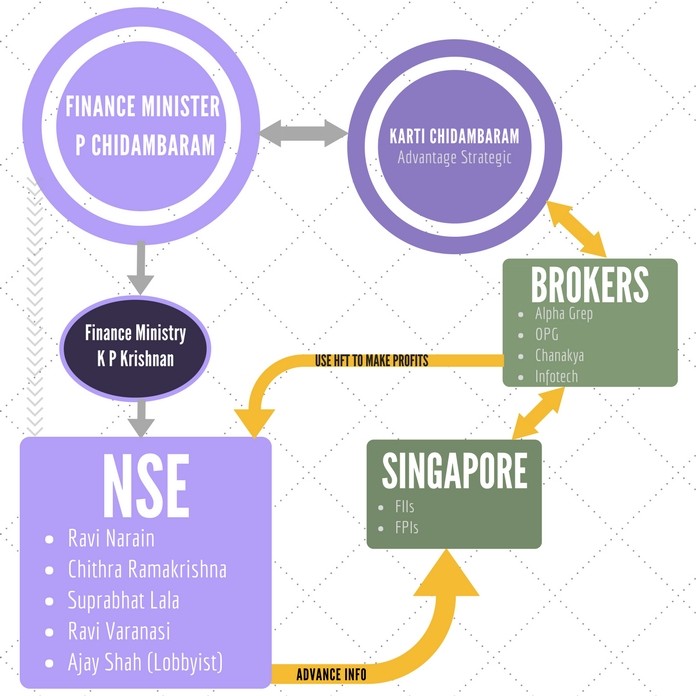

- An ex-employee of Alpha Grep, who had turned whistleblower, had said in his second letter (he had sent 2 letters to the NSE in 2015, which they ignored and when Moneylife asked them as to why they were keeping silent, NSE sued Moneylife), that over a period of more than five years, the full order book, with tick-by-tick, was available for manipulation and to conspire hours earlier, considering that the Singapore market opens at 6.30 AM Indian time, while Indian market begins operations at 9.30 AM. It should be kept in mind that India’s Stock market is influenced by Singapore markets where only Foreign Institutional Investors (FII)s and very few others have access. This is like getting the question paper a day ahead of the examination![5] Was all this data unearthed from the NSE server logs?

- Most of the algorithms created to milk the market were provided by Ajay Shah (his father founded CMIE, a firm that allegedly keeps under-reporting the number of jobs created in the current regime) and his wife, Susan Thomas and her sister Sunitha Thomas (also the wife of Suprabhat Lala the trading head at NSE). In the garb of research, they got full granular time series data from NSE which no one else could get and created algorithmic programs to game the market through brokers such as OPG, Alpha Grep etc. Such access helped them to stay ahead of others in the market and ensure that they would always win as they were privy to information ahead of the others. Remember that some got their data (the order book) 3 hours ahead of the market opening which gave them the time to find the best algorithm for maximizing the profits[6].

- Installation of Dark fiber between Bombay Stock Exchange (BSE) and NSE by Sampark Communications without relevant permissions. This would have allowed some firms to outrun everyone else and bid for stocks whether they appeared at BSE or NSE. The firms accused of doing this are Way2Wealth Brokers Pvt. Ltd. (W2W) and GKN Securities. Alpha Grep is a subsidiary of W2W and guess who the owner of W2W is?!

The accounting firms appointed by NSE to investigate this have a conflict of interest issue, as mentioned by another whistleblower[7]. This whistleblower claimed that Deloitte, Ernst and Young (EY) and Indian School of Business (ISB), should not be doing the forensic audits as all of them had rock solid conflicts of interests.

A light penalty on the likes of Ravi Narayan or Chitra Ramakrishna would be a gross travesty of justice. That they did this and are now pleading ignorance of what their technical team was up to is shocking. When you are the CEO, the buck stops with you – period. That is why you are getting paid big bucks, in line with Wall Street salaries. And the proceeds of crime in the co-location scam are huge.

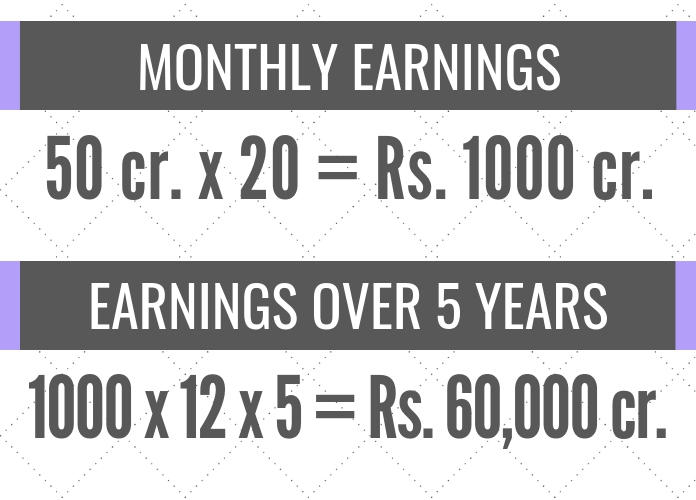

A back of the envelope calculation on how these amounts were arrived – during the period 2010-14, on one hand, the whole market was incurring losses while on the other hand, a handful of HFT operators made illegal gains of at least Rs. 50,000-60,000 crores (cr) ($7.7 B – $11.5 B) in the melee. They were making every day gains of about Rs. 50-100 cr and considering 20 working days in a month, then the minimum monthly gain stands at Rs 1000 cr and it adds up over a five-year period (see Figure 2).

References:

[1] SEBI’s final order in the NSE co-location scam expected soon – Mar 28, 2019, Hindu Business Line

[2] Flash Boys: A Wall Street Revolt – Amazon.com

[3] NSE started Tick-by-Tick Service Illegally in 2010 when SEBI looked the other way – Aug 23, 2018, MoneyLife.in

[4] Meet the SEBI chief C B Bhave – Apr 28, 2009, Rediff Business

[5] Anatomy of a Crime P3 – How did they loot? Oct 2, 2017, PGurus.com

[6] Anatomy of a Crime P4 – Who benefited from the HFT scam? Oct 4, 2017, PGurus.com

[7] Is NSE becoming its own Judge, Jury and Acquitter? Nov 19, 2017, PGurus.com

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

Sir

I appreciate your anxiety in punishing the evil doers in the co-location scam. Do you think that the present government and Sebi are not aware of the misdeeds ? No they are fully aware of it. But any exemplary punishment handed over to culprits by SeBi will lead to huge melt down in the market leading to crash and panic among investors. Hence wiser counsels should always prevail though in the end Dharma is violated.