Note by the author: This is the first of the series of two articles. In this, we are going to focus on the deficits that the United States is confronting

Let us look at four segments of the US Budget

First, we look at the 2020 budget and what is the deficit contribution to the overall US deficit. Second, we will look at the 2021 budget as it stands right now within the context of the deficit. Third, we will look at the drama that is going around, increasing the debt ceiling from the current USD 22 trillion to adding the accumulated debt of USD 6.5 trillion to USD 28.5 trillion. And finally, we look at the infrastructure, which is USD 546 or 566 billion dollars, and the long-term deficit contribution arising from that stimulus. We still have to reconcile this USD 3.5 trillion grand plan in rescue and recovery that is the child recovery plan and the green climate accord etc., – that is still outside the realms.

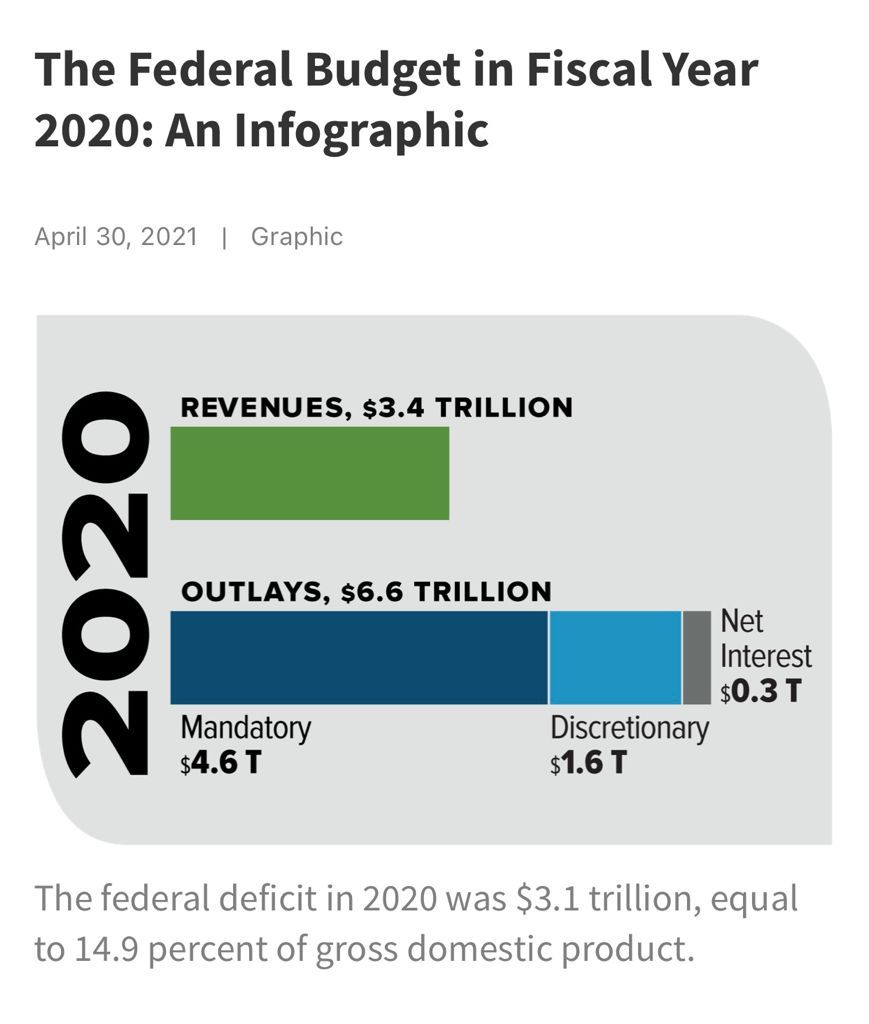

2020 Budget Data Chart

So if you look at 2020 this will all be in the pictures if you take a look at the 2020 US budget that concluded. We had 3.4 trillion dollars in revenue slightly less because of pandemic and the total outlays or expenses was 6.6 trillion dollars and thank God the interest rates were lower, net interest as for the deficit is 0.3 trillion and 4.6 was the mandatory and 1.6 trillion dollars was the discretionary expenses that were included in the 2020 budget. This resulted in a deficit of 3.1 trillion dollars, or roughly, 14.9% of GDP[1].

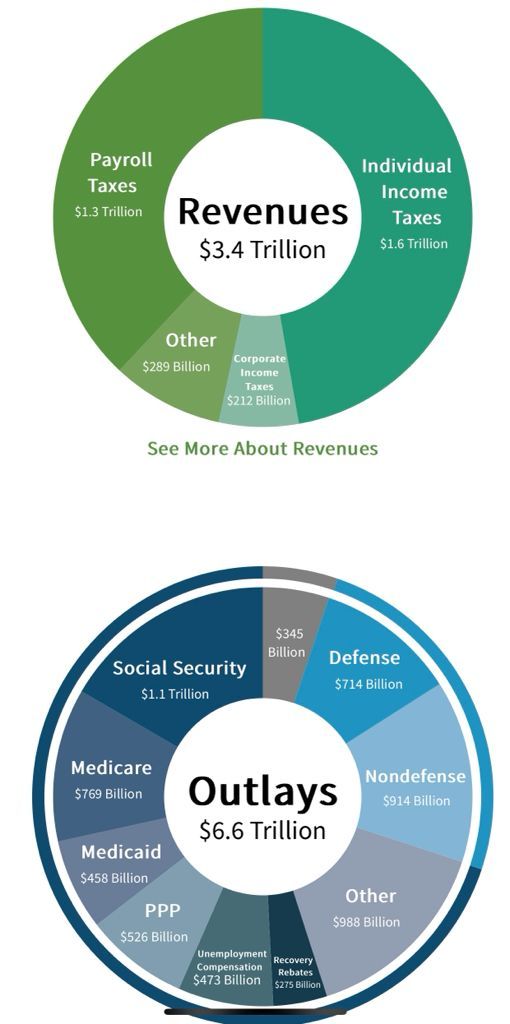

Revenue shortfalls

I won’t touch on the revenues, revenues makeup. We have already discussed in Daily Global insights, payroll taxes, individual income taxes, corporate taxes, which is very small, and then the other forms of duties section. But when you look at the outlays of USD 6.6 trillion as of the discretionary expenses that were included in dollars and look at the Wagon Wheel, it should be clear to everybody where this USD 6.6 trillion is coming from; this would again be very similar when it is completed for 2021. Social Security is the biggest line item making up to USD 1.1 trillion. Medicare is 769, Medicaid is 458; these are mandatory.

The net interest which is the interest that we pay on the US debt is 345 billion dollars. Then we get into defense is 714 billion dollars that has been pulled back by about 5% much to the dismay of the department. The discretionary spending, which is non-defense is 914 billion. There’s a whole set of attributions to it. Then you have the 988 billion which was the stimulus that got added then we had a PPP program of 526 billion. Then you have unemployment compensation of 473 billion, recovery rebates of 275. This is the makeup of the 6.6 trillion so you can see how 3.1 trillion dollars in the deficit sprang up as a result.

The 2021 budget

When we look at the 2021 budget right now, the way the 2021 budget is looking like, the outlays have increased from USD 6.6 to 6.8 trillion, as of 1st July. Revenues have gone up marginally, from USD 3.4-3.6 trillion to USD 3.8 trillion. The deficit is already at USD 3 trillion[2]. The debt ceiling has not increased, as it now stands; by the end of this fiscal year i. e. 2021, without increasing the debt ceiling, is around 23 trillion dollars. This one is held by the public.

So, we could be looking at USD 5 to 6 trillion is at least USD 4 trillion without the other outlays coming in as we look at 2021. This just gives you the dimension of the picture. Historically, we have toggled the outlays and revenues with a net gap of no more than a trillion dollars in some instances 1.3 or 1.4. But we have blown the budget apart and we are now very comfortable dealing with a 3 or 3.5 trillion dollars deficit. This is a very worrying sign.

The debt ceiling drama

The debt ceiling is the ceiling that the United States government that the House and the Senate grant to the treasury so that the treasury can print or borrow money in the markets and meet the obligations as set out by the Congress and the Senate through the budget process or the extraordinary process such as reconciliation and stimulus programs. The budget ceiling expired on August 1st at USD 22 trillion. Through budget expansion and stimulus programs, we have built up USD 6.5 trillion. This is even before the 2021 budget kicks in[3].

So, we’re now looking at USD 28.5 trillion if the Senate and Congress grant an extension. In the absence of an extension, the treasury will again adopt extraordinary measures by pulling back some of the program’s, non-payments which is a mess but take it for granted that this going to be done one way or another. Right now, Mitch McConnell has taken a position that he is not going to support this debt ceiling because Democrats have developed a habit of their pet programs to be accommodated and they want Republicans to be part of it and Republicans will have no holes[4]. If we assume that everything gets done sometime between now and the close of the session and the debt ceiling gets lifted, we will have one way or the other way approved or unapproved say USD 28.5 trillion.

The Infra promise

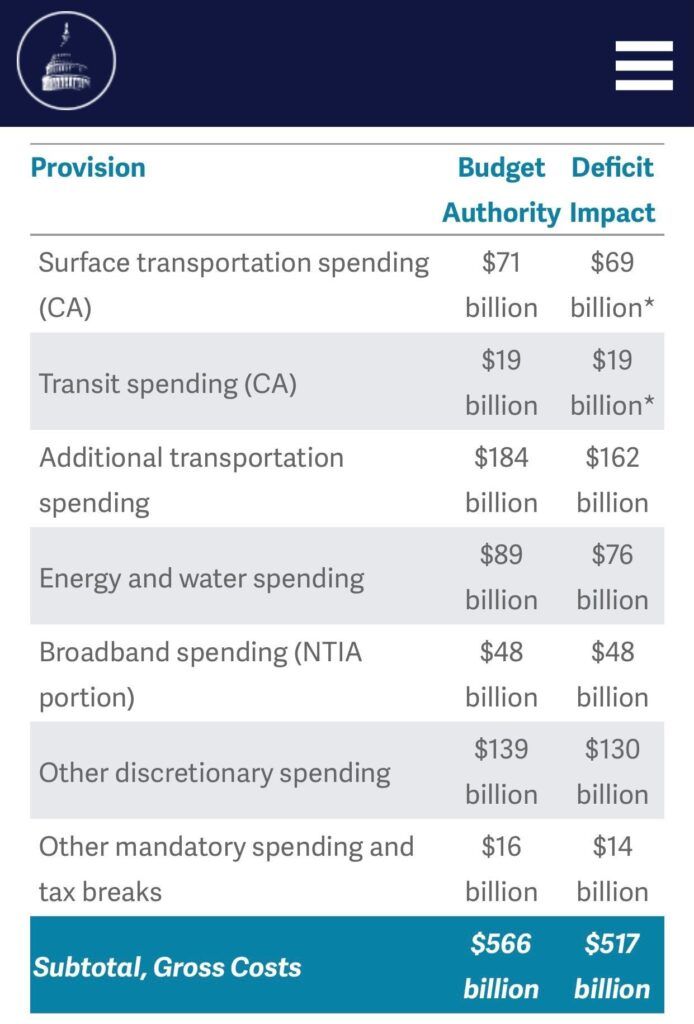

Let us now transition into the infrastructure or what we call the infrastructure expansion or a spending budget. So, what does that infrastructure plan comprise of? This is the bipartisan plan that’s been agreed to between the Democratic and Republican Senators[5]. It makes up republican senators being here about ten to twelve Republican Senators, including Mitch McConnell, supported this 566 billion, which potentially can expand up to 1.2 trillion dollars mandate.

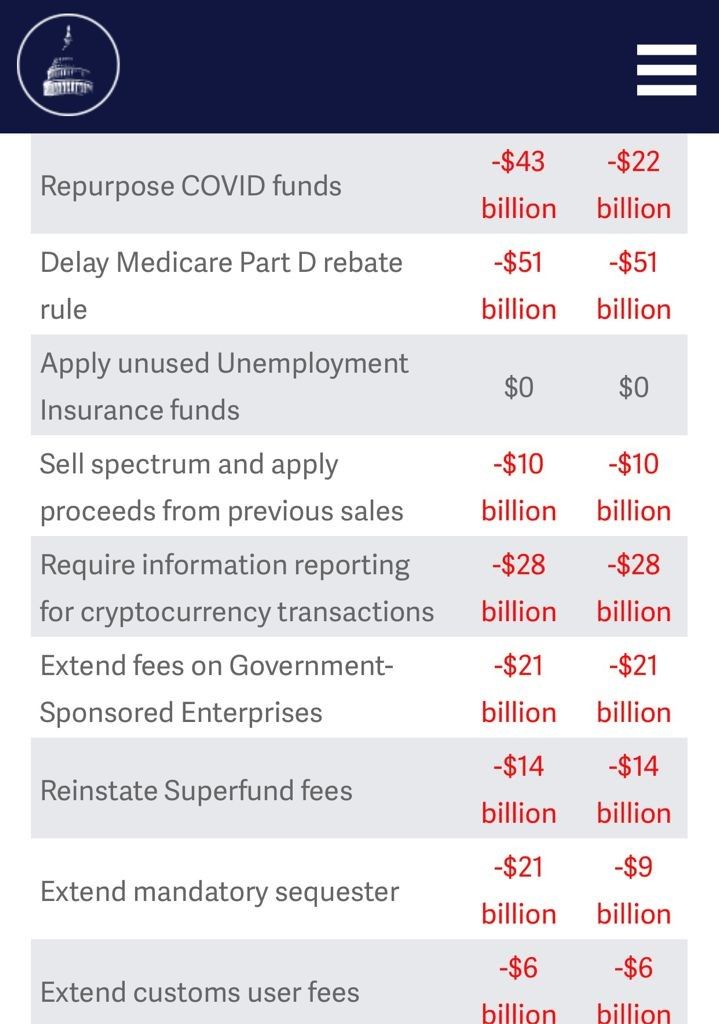

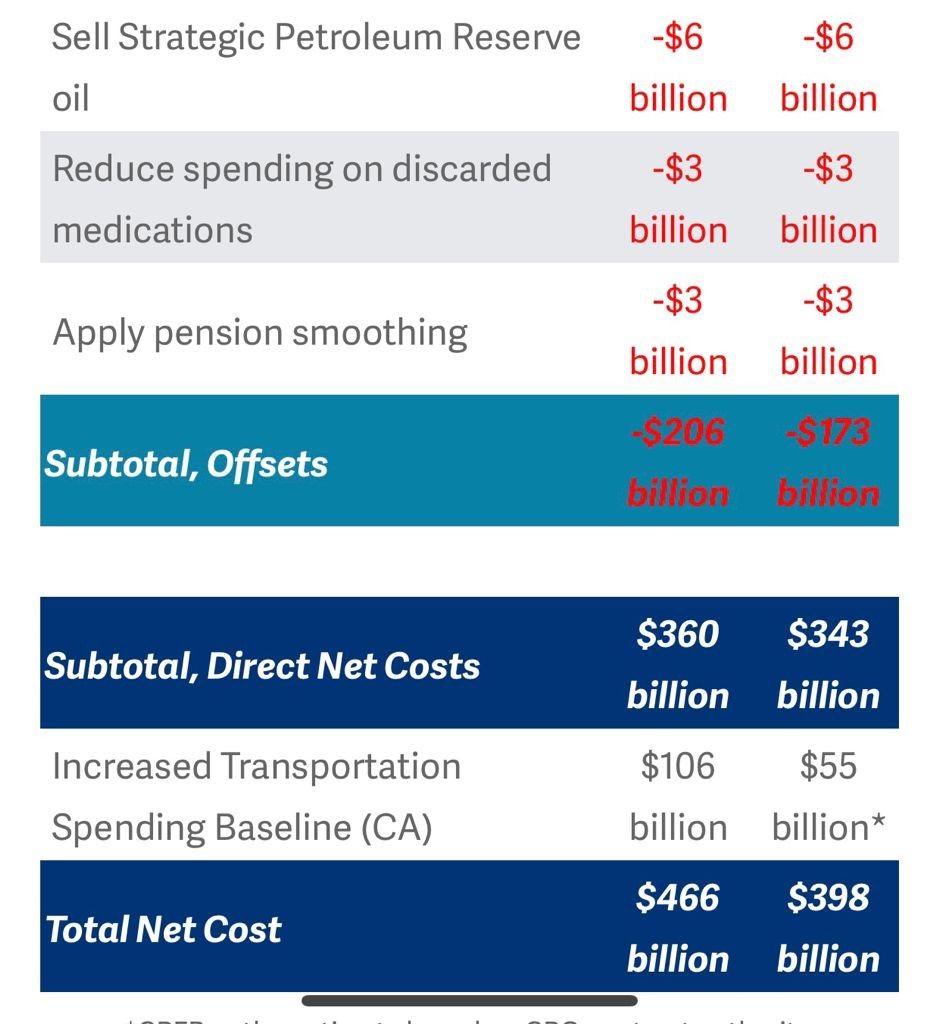

So that’s broken up as Transportation – 71 billion; Transit Transportation – 71 billion; Additional Transportation 184 billion; Energy and Water – 89 billion dollars; Broadband spending – 48 billion dollars, Discretionary spending 139 billion dollars and so on. This is what goes to local governments, this and that, and the earmarks. Other mandatory spending and tax breaks are given as rebates. This roughly makes up 566 billion dollars. The deficit impact of this is USD 517 billion; some of these things get written off and then you have some of these also flowing through by virtue of rebates. There is a deficit contribution of 517 billion emanating from this.

The Congressional budget will give you or show you the breakup of the numbers in the report. The breakup of this shows that there is a net cost or net deficit contribution of 400 billion dollars (roughly 398 billion dollars) as a deficit impact to the overall deficit that will kick in, post 28.5 trillion dollars, accommodating any budget deficit that arises as a result of the expansion. Plus, one of the first line items is this USD 566 billion contributing 400 billion dollars to the long-term deficit.

In conclusion…

This is the breakdown of the budget, the deficits, and the sinking effect of money that is being borrowed in an indiscriminate manner and this is where the Republican objections come from in the whole issue of this budget deficit and stimulus[6]. This is almost like motherhood and apple pies. The progressive agenda of spend free with no accountability. There’s no evidence anywhere that says what a spend of this magnitude can result in. You saw that in the first stimulus which was kicked in 2020 which was needed to lift the United States out.

But that cannot become their basis for the habitual expansion of the budgets and building up the deficits that are the overarching message. But somehow Democrats have held on to that that there was a one-time charge of almost 14% stimulus. That is, you know if you recall the 2.2 trillion dollars plus there was another 500 and then there was the other one trillion that got added. So, in the end, it was 998 billion. So, this is the one that Democrats are using as a justification for the budget expansion[7].

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

References:

[1] A Closer Look at the Record $3.1 Trillion Deficit in FY 2020 – Oct 27, 2021, CRFB

[2] An Update to the Budget and Economic Outlook: 2021 to 2031 – COB

[3] Debt Ceiling Deadline: What It Means and How Congress Can Act – Aug 02, 2021, WSJ

[4] Why Are Democrats Inviting Republicans to Hold Them Hostage Over the Debt Ceiling? – Aug 06, 2021, New Republic

[5] Bipartisan infrastructure deal but key Republicans are not on board – Jun 25, 2021, The Hindu

[6] Republicans Denounce a Senate Power Play They Have Used Themselves – Feb 10, 2021, NY Times

[7] Here’s what the latest $2.2 trillion stimulus bill from Democrats includes – Sep 29, 2020, CNBC

- World Bank Courts controversy - September 18, 2021

- China’s pervasive influence in just about everything - September 18, 2021

- The six point plan of Mr Biden and his ulterior economic agenda - September 10, 2021