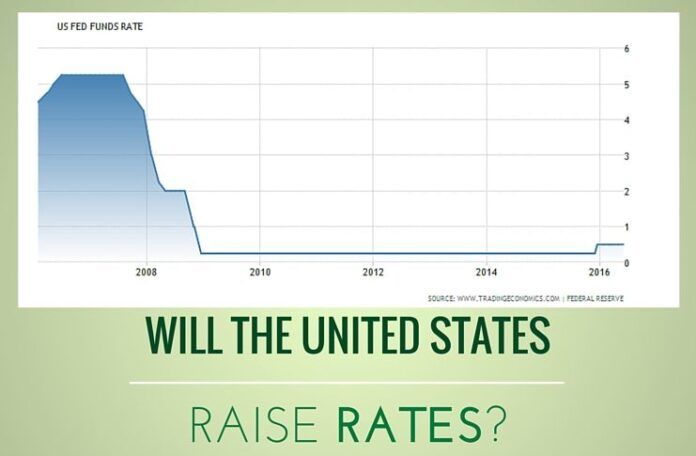

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]W[/dropcap]e told you so! In an article we wrote several months ago, we predicted that the chance of a rate hike in 2016 was close to zero. And we are being proved right (Yellen could still surprise us but we think a case is being built for not raising rates at all).

All that hawkish Fed talk in recent weeks, together with the marketplace’s knee-jerk reaction, seemed kind of stupid after Friday’s dismal jobs report. Expectations for a summer rate hike fell into a sinkhole, last Friday after the Labor Department reported that nonfarm payrolls grew by only 38,000 in May, amounting to the worst monthly increase in five that was jobs years. A decline in the unemployment rate to 4.7 percent arrived only because 664,000 Americans dropped out of the work force.

All of that occurred amid a growing chorus of Fed members professing that a rate rise was imminent and appropriate.

Subsequently just that fast, expectations changed. Dealers who were pricing in a 58 percent chance of a July rate increase took down the odds. Within two hours of the payroll report’s release, no rate hike was projecting until at least December.

“Just when they come out and begin talking about how good the economy is, we get some of the worst economic data in the recovery,” said Peter Schiff, creator of Euro Pacific Capital and a regular Fed critic. “This recovery has never been real. It is always been a bubble, and bubbles burst, that’s their nature.”

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]W[/dropcap]ith the recovery not able to hit on all cylinders and an election looming, Schiff thinks the more likely course is for the Fed not to move before eventually starting another round of quantitative easing and perhaps reversing the December rate rise, the first in a lot more than nine years.

“They do not want to disclose how poor the market is and undercut (President Barack) Obama and (Democratic presidential frontrunner) Hillary (Clinton).”

Bill Gross said that the poor payrolls data “could be enough to prompt the Fed to delay another rate increase until September. Yellen should provide more insight on the Fed’s thinking on Monday.”

September had just a 46 percent chance by noon Friday, according to the CME. November has only a 49 percent probability, with December now the most likely beat for a rate hike, at 66 percent percent the day before.

The Fed has had a significant communication problem with the market this season, a fact it has emphasized in recent communications through meeting minutes and the Beige Book economic report.

Multiple officials have spoken out recently attempting to bridge that gap, simply to have it widen once again Friday. While not everyone was giving up on a summer rate rise — UBS said it believes the Fed will move twice this year — the communication problems remain.

“There should be one voice, not 15.”

- Elon Musk postpones India visit. Non-clarity in Tesla partner and Starlink license might be the reasons - April 20, 2024

- NIA confiscates Pak-harboured Khalistani terrorist Lakhbir Singh Rode’s key aide’s land in Moga - April 19, 2024

- Prime Minister Narendra Modi: A Gujju businessman who does not invest his precious time for a losing battle - April 13, 2024