Gold in the Goldilocks zone

With Gold touching $2000, this is going to be one of the popular topics for conversations in the media and economic circles in the weeks ahead. I am also certain that very few would cover this event from the perspective it really ought to be done. There are 2 fundamental issues with the above question – the first is a Socratic one. And the second, perhaps, a more practical one.

First things first – Let’s say that a dozen apples cost Rs.360 or Rs.30/apple. Then can we say that the price of a Rupee is 1/30th of an apple? Mathematically it is much the same, but expressing the price of a “money-like” item in terms of a commodity that is perceived as much less suitable for that purpose indeed sounds odd, to say the least.

Most readers will find it very hard to appreciate the next few lines – The above example of the INR and Apple is even more relevant for the way we express the price relationship between Gold and USD. One has 5000 years of history of being used as money (we will soon get to why it is indeed the case) and the other – at the end of the day – is a piece of paper. And paper, copies of which are being digitally issued as if there is no tomorrow.

Temporarily demonetizing Gold, which is what Nixon and Kissinger managed during the early 1970s, has resulted in this perverse situation of Money (i.e. Gold and Silver) being defined in terms of pieces of paper. At that time, the US Dollar was defined as 1/35th of an Ounce of Gold. It’s an important distinction – Gold was not priced at $35/Oz, but the other way around. Mathematically much the same, but philosophically a difference that is as profound as it can possibly get.

Moving onto the more mundane issue – it’s really not about how high Gold goes, but more about how low the Dollar will go. Mathematically readers might think of it as the same issue stated differently. But once again as in the case of pricing of Gold in USD terms, it’s going to be the difference between – say – night and day.

The price of most goods and services e.g. cost of a house, the salary of teachers/ soldiers, a barrel of crude, a ton of iron, a bag of grain – when priced in terms of units of Money is going to stay within a narrow band over centuries if not thousands of years. Quite unlike the case when priced in USD. So it’s not really the case that the price of these goods and services has gone up. More realistically, the price of USD has been going down.

So perhaps best to rephrase the title to reflect the economic realities. It should read “Dollar at 1/2000th of an Ounce of Gold – How Low can it go?”.

Now that the problem has been defined accurately, it’s a much easier question to answer.

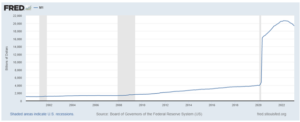

Before proceeding further, readers might find it worthwhile to read my previous article – Why 2023 HAS to be worse than 2008 – Pt II[1]. Towards the end, I alluded to the $100T question of the massive expansion of the Fed Balance sheet witnessed over the last decade and a half.

Now in terms of the pricing of Gold, there are multiple components of the Money Supply – M1, M2, M3 and an even greater number of theories about which should be used for the purpose of Gold backing and what % the backing should cover. But at the lower end of the spectrum – M1 which includes currency and “On Demand” deposits – should be the barest minimum and we will go with that for this article.

Historically, the % of Gold backing behind the Money Supply has been between 20 and 40%. Not that it was a sound idea to start with – it was the long history of the stability of the classical gold standard that permitted such fractional reserve operations. In the solution that emerges out of this current Ponzi Central Banking system blowing up, it is going to be difficult to theoretically justify anything less than a 100% backing for at least the M1 component of the Money Supply.

Anything less is a fractional reserve system; by definition, it is a Ponzi scheme. Having been burnt at the stakes for trusting national currencies, there would be a public uprising to justify another Ponzi scheme. Or maybe I am just overestimating the memory prowess of the average Joe.

M1 and Gold Backing

Let’s do rough back-of-the-envelope calculations on this:

- M1 is about 20T dollars.

- The US Fed has gold reserves of about 8100 MT or about 300 MOz.

So a 100% Gold backing of M1 will translate to a price of nearly $70,000/Oz. Maybe the US will convince the world to accept a 20% backing – which has been the lower end of the historically accepted range. That would still imply a price of nearly $15,000/Oz.

But the real interesting part is not the rear view mirror as represented by the M1 chart, but looking ahead. The banking crisis will certainly worsen in the years ahead prompting the Federal Reserve to crank the presses even harder. So is a $100T M1 number an inconceivable phenomenon? Where will that send the Gold price and will a 20% backing be acceptable at that point?

As I wrote in the previous article, what started in 2023 will make 2008 look like the proverbial Sunday school picnic. This is indeed going to be the death spiral of Keynesian economics and the US Dollar. China would in all probability launch the Gold backed Yuan at some point this decade and that would indeed be the final nail in the coffin for the USD.

Many think tanks have also forecasted a 3rd World War. But as I see it, the most devastating and long-term consequences are going to be witnessed in the treasury markets than in the battlefields. The cause and effects are going to be so intertwined that most are going to miss the larger picture.

The India Situation

Let me start with an obvious confession – I owe my loyalties to libertarianism and Austrian Economics. So from an economic perspective, I see little difference between the two main parties Congress and BJP – both run gigantic deficits, both are for Central Banking, both constrain individual liberties in nauseating ways and I could go on. The differences that individual members argue passionately about are hardly material from an economic perspective. On the current course, the INR is slated to meet the fate of the USD forecasted above.

But given the massive private ownership of Gold that Indians have, we do have a chance to make a mind-blowing change and do one better even when compared to the Gold backed Yuan. In some ways, I draw hope from what has happened on the India Stack from a technology perspective. To do an equivalent from a monetary perspective would require an extraordinary clarity of economic thought. Will we make the transition?

I think I should stick to forecasting Gold and the USD. And on that front, it will be at least $50,000/Oz before we return to a situation of the Dollar being described as 1/50,000th an Ounce.

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

Reference:

[1] Why 2023 has to be worse than 2008 – Part 2 – Mar 21, 2023, PGurus.com

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- 2008 Redux? YES and NO - October 23, 2023

- Is there a conundrum in the US Housing Market? - September 21, 2023

- Why the Fitch downgrade doesn’t make sense - August 14, 2023

So long over rated US$ diminishes in its value, it is good for the world. American has misused its position & destroyed nations. It is karma pay back time now.