In my earlier post on GSTN, I had detailed how the Department of Expenditure (DoE) had red-flagged the GSTN expenses and the recommendations of the Rajya Sabha Select Committee on GST.

On August 30th, after the meeting of the empowered committee of State Finance Ministers, it was decided that a committee of ministers will be set up to monitor the expenses of GSTN.

Replying to on an RTI from Subramanian Swamy, the Ministry of Finance has replied that GSTN did not obtain clearance from the Home Ministry before incorporating the company. A copy of the same is shown at the end of this post.

Here is a trail of how this debate on GSTN has evolved. In each of the boxes below, additional information can be accessed by clicking on the text in Blue.

August 7, 2016: PGurus publishes article on GSTN on Private Ownership |

August 8, 2016: Question asked in Lok Sabha on this and replied by the Finance Minister. |

August 8, 2016: Dr. Swamy writes to the PM, expressing concerns on the ownership structure and security of Data. |

August 19, 2016: Prof. R Vaidyanathan advises caution on the role of private players in a non-proft company and on the security of Data. |

August 24, 2016: In a reply to an RTI by Rajya Sabha member Subramanian Swamy, the Department of Revenue replied that no clearance was obtained from the Home Ministry. |

State Governments are asking questions

In a meeting of Finance Ministers from various states, the funding of GSTN was debated vigorously. On August 30th, after the meeting of the empowered committee of State Finance Ministers, it was decided that a committee of ministers will be set up to monitor the expenses of GSTN. The concern about GSTN running up huge expenses is being felt both by the Center and the States.

The way forward

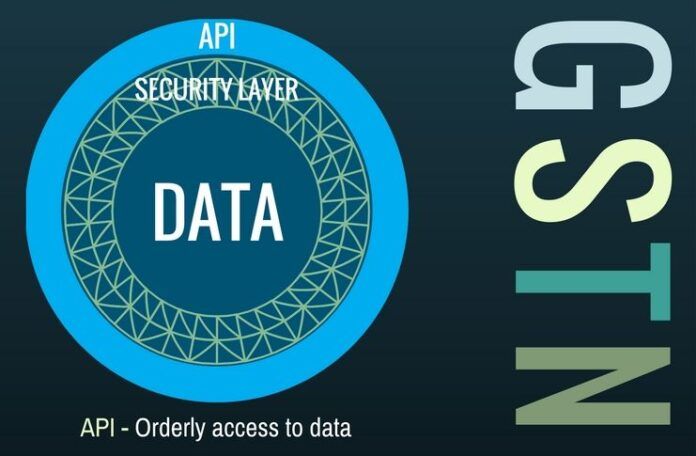

In my humble opinion, the Banks and Stock Exchanges should be divested of their holdings in GSTN and be bought back by the Government. GSTN should only be maintaining the Application Programming Interface (API) around the data, which is the most important entity. Authorized Software vendors can connect to the GSTN API. All banks of India should be able to manage the GSTN proceeds as long as they can work with the GSTN API. Implement it based on the model adopted by the United States’ Internal Revenue Service (IRS).

Funding GSTN

GSTN can charge a fee for allowing access to its API. This could be on a per-transaction basis. As the number of transactions increase, so will the revenue, which in turn can pay for the infrastructure needed to support it.

Opinions expressed are personal.

Reply to RTI by Subramanian Swamy, dated Aug 24, 2016:

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023