Parts, 1 & 2 of this series, The eminent “Yes” man at SEBI – C B Bhave allowed NSE co-location scam, can be found here. This is Part 3.

Mr. Bhave gamed the system to his advantage

NASDAQ and NYSE started High-Frequency Trading (HFT) around 2005 and by 2010. Today almost half of trading was being done amongst the HFT machines, meaning brokers trade using High-Performance machines without human intervention. This speeded up the trades and also increased the volatility of the stocks, but the high volumes made everyone look the other way to the pitfalls that the technology came with.[1]

In India, the National Stock Exchange (NSE) had started Direct Market Access (DMA) facility for select clients and this can be thought of as allowing some to use HFT machines to trade in Indian markets[2].

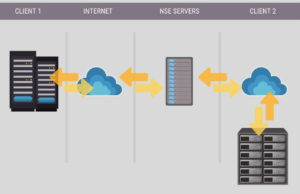

A conceptual implementation of HFT-based trading is illustrated in Figure 1.

High-Speed Computers ran algorithm-based trading of stocks between each other, without manual intervention. Rules on how to trade, the limits, margins, etc. were determined algorithmically and hence it is also referred to as Algo trading. The Human element in decision-making is eliminated.[3]

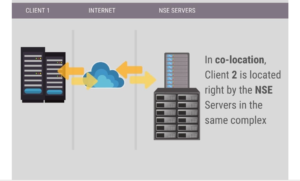

Programmed computers could react to events in ‘milli-seconds’, i.e. even before the human mind could decide if it wants to trade. Breakneck (low latency) speed in trade order execution and cancellation is the key characteristic of HFT. It gives a decisive winning edge when blended with the ‘co-location’ facility. The co-location facility is offered by a stock exchange to a limited number of members to install their trading servers in close proximity to servers of the exchange which disseminate the order book data and match bids with offers and execute trades. To understand co-location, see the conceptualization of a co-located Stock Exchange as shown in Figure 2. The time for trading information to travel via the internet (cloud) is eliminated and therefore, Client 2 can respond much faster to the market gyrations. Figure 1 above shows the scenario when both Clients 1 and 2 are not co-located. In such a case, the access time for both is more or less the same.

Since the difference in latency between co-located members and others is a small fraction of a second, this latency advantage can be used to mop up small mispricing and variations in bids and offers, i.e. by way of what is known as ‘jobbing’ or ‘scalping’. Though price moves in jobbing or scalping are smaller, the members who are given the privilege of DMA access and colocation facility can use the latency advantage to make a huge profit by either placing large orders or by using that advantage continuously throughout the day leading to huge cumulative profit at the end of the day. The latency advantage is two-fold, a) the co-located member (the algorithm in his server) – is able to see the order book and detect mispricing or significant price variations in bids and offers ahead of the rest of the market, and b) armed with this advance information key in the scalping orders which get executed ahead of the rest of the market. By the time rest of the market is able to view the order book, the bids and offers are already executed and hence the rest of the market is left with less favourable bids and offers. Since the mispricing is detected and orders are keyed in by the algorithm there is no manual intervention of the broker. Sounds like gobbledygook? How about a simple real-life example?

Monu and Sonu – Close yet distant

The benefits of co-location can be understood by this simple example. While it is not a one-to-one mapping of what happens at a Stock exchange that supports co-location, it is close. Monu and Sonu are best friends who go to the same school, using school buses, there are two of them. Monu’s house is right opposite the bus stand while Sonu lives three streets away and it takes him about 10 minutes to walk from his home to the bus stand. Let us assume that the buses don’t come at the exact time every day but more or less at the same time with a gap of 5 minutes. Since Monu lives right opposite the bus stand, he will easily be able to board the first bus every day, whereas Sonu may miss it more often. Monu is the co-located server and the common man trading in the market from the comfort of his/ her home is Sonu.

C B Bhave’s dubious role

As Palak Shah wrote in his book Market Mafia, as the Chief Regulator of the Stock Markets, Bhave, should have been more vigilant. That co-location services were being offered by the NSE came to be known only when NSE published its Annual Report, of having commenced co-location services in January 2010. Bhave should have stopped co-location trading forthwith and ensured that access to the system is equitable to all traders. By allowing a co-location facility Bhave permitted NSE to create a privileged class who would enjoy the benefits of institutionalized and legalized insider trading and front-running.

In 2010, It is believed that C B Bhave had sent Professor Pathak and some people from the Securities Exchange Board of India (SEBI) to tour the United States (US) for studying how High-Frequency Trading hardware should be designed and installed in order to allow co-location. Ajay Shah allegedly met this team in the US and may have been privy to the discussions[4].

But was this not too late? For NSE to have commenced co-location services in Jan 2010, they would have had the hardware installed months prior! That this could be true can be gleaned from another anomaly that occurred on the NSE on May 18, 2009[5].

Another piece of telling evidence: The NSE site had put on its About Us/ Organization page, the availability of co-location services on April 10, 2009, itself! This was subsequently deleted, but we have a snapshot of the same from Wayback Machine, a site that archives the trillions of data of the internet.

UPA returns but trading stops at NSE

Stock markets in India were shut in seconds once they started trading at 10 AM on Monday, May 18, 2009. SENSEX and NIFTY, two widely tracked benchmark share indices that gave the world a pulse of India’s economy, had hit a 10 percent upper circuit, the ceiling. Norms required a two-hour cooling-off to re-start trade after the first ceiling.[6]

At 11.55 AM both the indices had a deja-vu. They hit another 10 percent upper circuit in ‘seconds’ on trade re-commencement. Now the norms required markets to be shut for the entire day. Benchmark indices had galloped a stupendous 20 percent, ‘in seconds.’ The mood on the street was surely buoyant as just a day before, on Sunday, the Indian National Congress-led United Progressive Alliance (UPA) was declared to have won 262 seats, just 10 short of a majority, in the 15th Lok Sabha elections held that year. Manmohan Singh was the first Prime Minister since Jawaharlal Nehru in 1962, to be re-elected for a consecutive five-year term.

For the markets, the story was two consecutive upper circuits within ‘seconds’ of opening – historic. But the total volumes traded that day were abysmal Rs.127 crores (roughly $28.22 million as per conversion rate of the rupee at Rs.45 per US dollar) on the Bombay Stock Exchange (BSE) and Rs.170 crores (roughly $37.77 million) on the National Stock Exchange (NSE), (derivative to be checked) ridiculously low for a 20 percent rise in equity benchmarks anywhere in the world. Clearly, the index gains that day were not quite in the manner of serendipity but more like events matching stupidity as markets were shut before any of the large institutions could even trade. How could a near trillion-dollar market-cap trading platform hit two upper circuits on the back of such measly volumes? Could this have been due to HFT and co-location services already in place by this time? CBI should investigate.

All FIIs are not created equal

Once the hardware was in place, it is alleged that a few Foreign Institutional Investors (FII) who were close to P Chidambaram were given access to trading in the NSE under the Direct Market Access (DMA) scheme. That such arbitrary procedures took place under Chidambaram’s watch can be seen from what happened in 2012, when the NSE suffered yet another flash crash[7].

Almost $60 billion was wiped out from the stock market value of various companies in India due to a flash crash that occurred on Oct 5, 2012. The NIFTY index witnessed a 16 percent drop and trading was stopped at the exchange by Ravi Narain[8]. A massive plunge like this would have necessitated the market to be closed for the rest of the trading day. But it resumed after fifteen minutes, because the then Finance Minister, P Chidambaram called up Ravi Narain and told him to start it forthwith![9]

Continued…

Reference:

[1] High Frequency Trading: Evolution and the Future – Capgemini

[2] NSE started TBT co-location services illegally in 2010 with the SEBI looking the other way – Aug 23, 2018, MoneyLife

[3] Understanding High-Frequency Trading Terminology – Jan 31, 2022, Investopedia

[4] Ajay Shah named in CBI FIR in NSE Scam – Jun 3, 2018, PGurus.com

[5] The Market Mafia: Chronicle of India’s High-Tech Stock Market Scandal & The Cabal That Went Scot-Free. Hardcover – Nov 07, 2020, Amazon.in

[6] Indian stocks soar 17% on election – May 18, 2009, CNN Money

[7] NSE flash crash pulls Nifty down by 15.5% – Oct 06, 2012, ToI

[8] Indian shares suffer $60bn ‘flash crash’ – Oct 05, 2012, Financial Times

[9] Behind the professional veil of a Stock Exchange – Dec 27, 2016, The Economic Times

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

This loot is so open, so obvious. Why there is not even a whisper in MSM? Why the finance ministry is also silent or are they doing something about it? Will any of these looters pay for their sins or the deep state will protect them and they will have the last laugh? Only God has to help us, the common people?