The Narendra Modi government should be commended for cracking down on the High-Frequency Trading scam that occurred during the regime of the United Progressive Alliance (UPA). The Central Bureau of Investigation (CBI) named one of the brokerage companies, OPG Securities’ owner Sanjay Gupta along with Ajay Narottam Shah, the brains behind the operation[1]. I wrote a series titled HFTScam which detailed how a few vested interests milked the shareholders out of close to Rs.50,000 – Rs.75,000 crores ($7.7 billion to $11.5 billion at an exchange rate of Rs.65 to a dollar) over 2010-2014[2]. Now the chickens are coming home to roost. To get the complete lowdown on this scam, I urge the readers to follow the complete series titled Anatomy of a Crime[3].

Now that CBI has filed a First Information Report (FIR), a predicated offence is registered.

How did they do it?

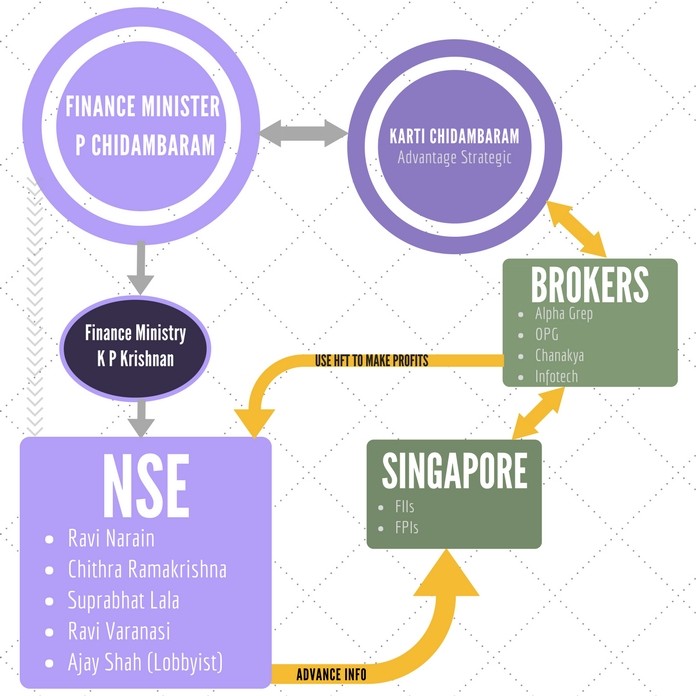

The then Finance Minister Chidambaram (PC), realized that there was far more money that can be made in stock markets (the Harvard education helped) than in deal kickbacks. Chidambaram, for reasons unknown, favored the National Stock Exchange over others[4]. Lobbyist Ajay Shah was a blue-eyed boy of P Chidambaram and a close aide of the then capital market secretary K P Krishnan. Susan Thomas, wife of Ajay Shah and her sister Sunitha Thomas (wife of National Stock Exchange (NSE)’s then trading head Suprabhat Lala) formed HFT firms like Infotech and Chanakya to exploit the loopholes in NSE architecture. They then turned around and sold their technology to brokers such as OPG. Needless to say that they shared the pie with those who enabled them the backdoor access. Figure 1 below shows the complete nexus:

The CBI has only charged OPG Securities so far. Other firms on the list of 22 brokers who logged in early on the NSE servers repeatedly include Kredent, Pace, Religare Securities, NYCE, Motilal Oswal, Kotak Securities, DE Shaw, SMC Global, Crimson, Advent, Mansukh Stock Brokers, JM Global, AB Financial, Indus Broking and Quant Broking[5]. It remains to be seen if CBI will probe their practices too. Ultimately, the main kingpin, who oversaw this is Mr. P Chidambaram and it perhaps will shock his own party persons when they come to know how he milked the Stock Exchange in plain sight.

Ajay Shah’s role

Ajay Shah is an IIT-Bombay and a University of Southern California graduate. He holds a critical post as a Professor in the National Institute of Public Finance and Policy (NIPFP). NIPFP is an autonomous research institute in the Ministry of Finance and allegedly got grants with no accountability on how they were spent. Ajay Shah enjoyed the confidence of the then Finance Minister P Chidambaram and is believed to be the brains of this operation.

How did this come about?

High-Frequency Trading in the United States took off during the period 2005-2009 when co-location was allowed and brokers had computers with sufficient processing power and fast connectivity to various exchanges so they could front run any order2.

In 2010, It is believed that C B Bhave had sent Professor Pathak and some people from the Securities Exchange Board of India (SEBI) to tour the United States (US) for studying how High-Frequency Trading hardware should be designed and installed in order to allow co-location. Ajay Shah allegedly met this team in the US and also may have been privy to the discussions.

Once the hardware was in place, it is alleged that a few Foreign Institutional Investors (FII) who were close to PC were given access to trading in the NSE under the Direct Market Access (DMA) scheme, approved by the NSE in 2008[6].

What is also alleged is that NSE may have started allowing HFT and co-location without obtaining approval from the government[7].

Ajay Shah must step down from NIPFP

With his name now in the CBI charge sheet, it behooves Ajay Shah to step aside from his post at the NIPFP until the probe finishes. This is the least he can do. It is sad to see officials in key positions drag their feet until they are forced out (as seen in the ICICI crisis where Chanda Kochhar has been finally asked to go on an indefinite leave pending an investigation by a judge).

Now that CBI has filed a First Information Report (FIR), a predicated offence is registered. The proceeds of crime (POC), to begin with Rs.1200 crores, that NSE is supposed to have earned from the Co-location server has been ordered by SEBI to be kept in an escrow account. Since the filing of the FIR, these are POC and the Enforcement Directorate (ED) in my opinion should attach it immediately. Agencies must act quickly and not drag its feet. This is one aspect that the Modi Government needs to fix.

References:

[1] NSE Co-location case: CBI registers case against OPG Securities owner Sanjay Gupta, others – May 30, 2018, MoneyControl.com

[2] Anatomy of a crime P2 – The amount of the HFT loot – Sep 25, 2017, PGurus.com

[3] Anatomy of a crime series – Sep-Oct 2017, PGurus.com

[4] Who benefited from the HFT scam? Oct 4, 2017, PGurus.com

[5] NSE co-location case: SEBI heat now on brokers who logged in first repeatedly – Oct 12, 2017, MoneyControl.com

[6] Direct Market Access – Apr 3, 2008, NSEIndia.com

[7] NSE crisis: Will SEBI initiate a deeper probe into the alleged unfair trade practices? Jun 8, 2017, Firstpost.com

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] Ajay Shah named in CBI FIR in NSE scam. Should he step down from NIPFP? Jun 3, 2018, […]

[…] Ajay Shah named in CBI FIR in NSE scam. Should he step down from NIPFP? Jun 3, 2018, […]

[…] Ajay Shah named in CBI FIR in NSE Scam. Should he step down from NIPFP? Jun 3, 2018, […]

Your report on the NSE scam, as I read it, is very concise and to the point sought to be brought home. Kudos to Pgurus.

Very shallow write up with lots of factual mistakes.

Rebut with facts.

Stock market is a ready made platform for leagally carrying out high value frauds. Stock prices are rigged by brokers and rampant inside trading is the norm. Many educated young persons waste their valuable time in online speculation. I feel the level of financial manipulation can be brought down by prohibiting speculative trading. There should be a minimum 3 year lock-in period for stocks to be traded.

“(as seen in the ICICI crisis where Chanda Kochhar has been finally asked to go on an indefinite leave pending an investigation by a judge).”

Bank has denied the above news

@Sree Iyer: Sir why don’t you join politics, there is a need for intelligent people like you in politics who can expose these things happening in the country and also yield power for all right reasons.