NewsX channel put out a wonderful expose on Non-Performing Assets (NPAs), after investigating several companies that have become NPAs. Over a period of 50 days, their team scanned the length and breadth of the country and unearthed some startling figures.

In a wide ranging discussion on various aspects of NPAs I am listing a few that I mentioned in this panel discussion.

What are NPAs?

Non-Performing Assets are those loans in a bank for which either the principal or interest are overdue for more than three months[1]. These are required to categorize them to be one of the following three types – Substandard, Doubtful and Loss assets.

- Substandard assets: Assets which has remained NPA for a period less than or equal to 12 months.

- Doubtful assets: An asset would be classified as doubtful if it has remained in the sub-standard category for a period of 12 months.

- Loss assets: As per RBI, “Loss asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted, although there may be some salvage or recovery value.”

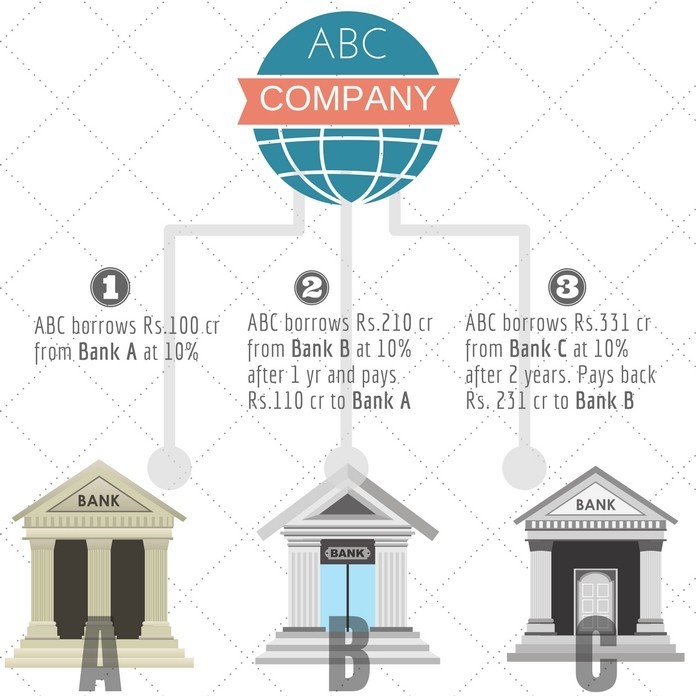

Evergreening of Loans

Many creative methods have been employed to not classify loans as NPAs. One of them is Evergreening. To understand this, look at Figure 1. ABC Company takes out a loan for Rs. 100 crores from Bank A at 10% interest. At the end of one year, ABC has to pay Rs.110 crores to Bank A. But for various reasons, ABC has not been able to come up with the money. So what does it do? ABC goes to Bank B and using the same assets takes out a loan for Rs.210 crores. Out of this, it pays out Bank A Rs. 110 crores and keeps Rs.100 crores for itself. The same plays out the following year when ABC takes an even bigger loan from Bank C to pay off Bank B. Every step of the way, Rs. 100 crores is accruing to ABC company but it is lost in kickbacks if the asset is either non-existent or doubtful. Once this circle gets broken, whichever Bank is having the last loan of ABC has an NPA on its hands.

But if it is a legitimate business, an Evergreen Loan is beneficial if used properly[2].

For the complete video click here.

References:

[1] Definition of Non Performing Assets – Economic Times

[2] What is an “Evergreen Loan” in Banking? budgeting.thenest.com

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

Inflated project cost plans, supported by ruling government (Khangress, later copied by BJP), part of the money goes to election funding, many of the loans are given to shell companies which exist on paper only. Toll tax points are cash generating points & also one of the means of converting white to black & black to white. Why not every vehicle sold by an automobile manufacture to carry a universal toll tax RFID sticker which is mandatory, & each owner is responsible to have some money balance in it. If it is negative charge penalty. As the vehicle moves or cross toll tax gate, automatically the amount is deducted.

In this way cash can be avoided & illegal transaction can be put to test.

Running a manufacturing industry in india is like having a tiger as pet. As long as you feed it, it plays with you and once you stop feeding it attacks you. In order to keep the tiger satisfied, the owner begs , borrows or steals money to feed it. Ultimately a stage is reached, when the pet has to be killed or the pet kills the master.

At the start no industrialist is a criminal. He becomes a criminal due to many reasons and becomes seed for NPAs due to Competitiveness in market, obseletness of product, bribes to different entities, change in tariffs by govts, power cuts,labour isues and not receiving bills in time. Hence for survival he adopts the model as detailed by Shri Iyer. Large Cos with multi activities with subsidiary Cos survive as funds are switched and a single product entities perish. At the same time loans obtained thru manipulation and recommendation by ineligible people will become NPAs and banks are aware of it.

80% problem of NPAs is solved if we create a law that all bill payments must be honored on due date or else , jail to defaulter. Mind you 70% will go to jail especially in govnt depts. No country can avoid NPAs, but a genuine mechanism has to be evolved to appraise a honest businessman and pull him out of quicksand or else the country will suffer as they are the wealth and employment creators of the country.

Y the bank B gives loan without showing profit?

Good Q. Next time you run into Ms. Kochhar, quote this and ask them why – https://www.pgurus.com/icici-bank-head-chanda-kochhar-and-husband-on-the-radar-of-probe-agencies-for-doubtful-loans-to-debt-ridden-videocon-group/