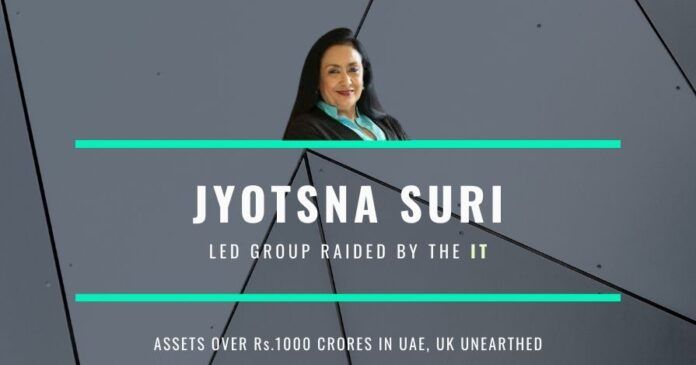

Noted businesswoman Jyotsna Suri, promoter of Lalit Hotels and Bharat Hotels Group is now caught for stashing Rs.1000 crores-worth assets abroad illegally. The Income Tax Department (IT) on Friday after conducting a two-three days-long search declared that she acquired a thousand crores worth assets in many foreign countries and was involved in tax evasion and be prosecuted under the new Black Money Act and Benami Act.

The Income Tax authorities revealed that Jyotsna Suri is owning assets in the United Arab Emirates (UAE), the United Kingdom (UK) and having several bank accounts that were not at all declared and would be liable for prosecution under the Black Money Act also

The IT raid at Jyotsna Suri’s home and offices have got the rumor mills buzzing in Delhi and Mumbai business circles. Jyotsna Suri, the wife of hotelier late Lalit Suri, is well known for her proximity with former Finance Minister late Arun Jaitley. Lalit Suri and his wife were also very close to many top politicians including Congress President Sonia Gandhi and former Finance Minister P Chidambaram. Jyotsna’s private jet was available to many political heavy weights. She was also the head of many Industrial bodies such as the Federation of Indian Chambers of Commerce and Industry (FICCI).

The Income Tax authorities revealed that Jyotsna Suri is owning assets in the United Arab Emirates (UAE), the United Kingdom (UK) and having several bank accounts that were not at all declared and would be liable for prosecution under the Black Money Act also. “The investigation has successfully lifted the veil, leading to detection of undisclosed foreign assets of more than Rs.1,000 crores, apart from domestic tax evasion of more than Rs.35 crores which may lead to consequences under the Black Money Act, 2015, as also, action under the I-T Act respectively,” the Central Board of Direct Taxes (CBDT) said.

“Foreign assets include investment in a hotel in the UK, immovable properties in UK and UAE and deposits with foreign banks,” it said. The CBDT said the group is a “leading member of the hospitality industry, running a hotel abroad and a chain of luxury hotels under a prominent brand name situated at various locations in India”.

“The search operation has so far resulted in the seizure of unaccounted assets valued at Rs.24.93 crores that include Rs.71.5 lakhs in cash, jewellery worth Rs.23 crores and expensive watches valued at Rs.1.2 crores,” the statement said. The department had launched raids at 13 premises of the group, Suri and others on January 19 in and around Delhi.

In mid-2014, BJP leader Subramanian Swamy in his petition in the Black Money case (intervening application in Ram Jethmalani’s main case) in Supreme Court accused Bharat Hotels of illegally obtaining the Foreign Investment Promotion Board (FIPB) clearance during Chidambaram’s tenure and routed more than Rs.200 crores. Swamy’s petition said that the FIPB clearance was given to a London based firm Richmond Enterprises to invest only Rs.50 lakhs and that the actual money that came was more than Rs.200 cores (reminds one of INX Media!), citing the documents. There was no company named Richmond Enterprises in London and the firm was actually from Panama Islands, a tax haven.

- Subramanian Swamy approaches Supreme Court on Govt’s modification of 2G Scam Judgment to avoid auction of Satellite Spectrum - April 23, 2024

- Defence Minister Rajnath Singh visits Siachen. Reviews military preparedness - April 22, 2024

- Amit Shah’s shares in the Stock Market almost doubled in the past five years - April 21, 2024

Because of all these corrupt leaders of upa regime, India stands at the top in corruption. Chidambaram might have committed so many corrupt deeds which might be difficult to prove

I fully agree with Dr. Venkat. I am a 70+ Sr. citizen. Reading about allegation of corruption against Politicians since my childhood but have not seen even a single politician being punished. I doubt I will be able to see a politician being punished for corruption in my lifetime. How much I wish to see Chiddu & son, Sonia & son along with SIL, Lalu & sons and Mayabati in Tihar before I die.

Himansu Sir,

Vohra Committee Report is directly accusing Sharad Pawar of helping Tiger Memon to conduct Bombay Serial Blasts in exchange for a bribe of 10 crore

–

The same Vohra Committee Report also implicates Sharad Pawar in allowing & helping Dawood Ibrahim flee India for a consideration of 60 crores.

–

The Vohra Committee Report was not released to publication by the previous UPA regime for obvious reasons

–

What are the compulsions for the current NDA regime???!!!

Why is this current NDA not making the Vohra Committee Report public???!!!

Why is Sharad Pawar not yet arrested???!!!

What was the necessity to honor such criminals with PadmaVibhushan award???

Is there no in any of central ministries who can dare to reveal the truth & how they were fooled or subverted or pressurized ? Is there no soul who is brave to his or her mother’s milk or gratitude towards the soil on which he or she is born ? Are they so timid ?

The Suri family has been a very close operator for the Family, as was unearthed in 1977 itself.

Sir,

Tell us honestly, do we Indians ever have a chance to say, “We are no more corrupt !” If YES, When can we expect this to happen?

Depth of your information is so marvales thank you.

Wasting reams and reams of paper, writing long columns, making endless speeches on curbing Corruption, the top Netas in both camps be it NDA is or UPA rule no meaningful conviction has ever happened. The top corrupts go scot free. It stops with sensational ut burst. There is no semblance of walk the talk. Tired of these types of news.