Rahul Gandhi and Sharad Pawar were in the news recently on allegations that they have companies registered in the United Kingdom (UK) and used them to receive kickbacks. This begs the important question as to why they need to create companies in the UK. Several reasons have been cited, one of the most significant ones being that tax havens such as Cayman Islands, Singapore and Hong Kong are either British Overseas Territories or have some umbilical cord like links with the Empire on which the Sun never used to set. It is a different matter now that the Kingdom goes through several days a year when the Sun does not even bother taking a peek!

A company registered in UK enjoys easy banking facilities in many of the currently popular Tax havens (Switzerland is not the go-to country any more. In 2009, UBS AG, a Swiss financial services company reached a landmark deferred prosecution agreement with the U.S. government and agreed to turn over the names of more than 4,000 American account holders). In the aftermath, the Internal Revenue Service has netted more than $5 billion from 38,000 Americans who came forward under a voluntary disclosure program.

Recently, India too tried taking the same approach but their collection was a measly ₹3,770 crores ($575 million) from 638 individuals. Various estimates put the amount of money from Indians in Tax havens at ₹100,000 crores ($ 15 billion).

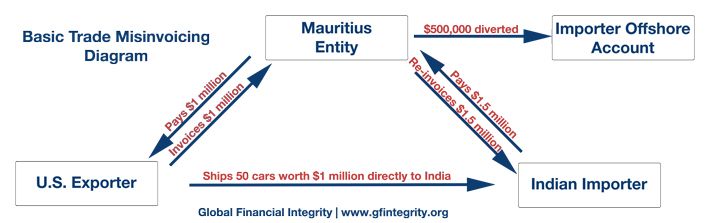

How is the kickback money getting routed to the Tax havens? Let us take a look at the picture below, from Global Financial Integrity.

In this case of import over-invoicing, the Indian importer illegally moves $500,000 out of India. Although he is only buying $1 million worth of used cars from the U.S. exporter, he uses a Mauritius intermediary to re-invoice the amount up to $1,500,000. The U.S. exporter gets paid $1 million. The $500,000 that is left over is then diverted to an offshore bank account owned by the Indian importer.

Let us try and apply this to the scenario of Rahul Gandhi allegedly getting kickbacks in the GSCN Scorpene submarine deal. The exporter would be either the DCNS (French Scorpene submarine manufacturer) or their spares supplier and the Indian importer would comprise of one of more from Mazagon Docks Limited (MDL), Flash Forge Pvt. Limited and others who were approved by DCNS/ MDL as part of the indigenisation effort of the Submarines. It is a safe bet to assume at this time that the Offshore accounts would have been created using the British Companies that are associated with Rahul Gandhi. So what is missing in the picture?

- The name of the Mauritius entity (conduit company) which got the full amount. Unlike UK, Mauritius does not publish names of the Directors in the companies registered there. Trust us, we checked! We may not be able to get these details but the Indian government can. By the way, it does not have to be Mauritius, but it is the most likely candidate.

- It is also not known at this point as to which one of the Tax Havens the money has been routed to. Find the conduit company and all shall be revealed.

The longer Rahul Gandhi chooses to be silent about this, the more the needle of suspicion will point at him. If all this is smokes and mirrors, then he should answer our questions and get the monkey off his back.

Finally the United States is getting really serious about cracking down on all kinds of Tax shelters. It is pushing hard on Caribben and Central American nations by issuing summons. The moral of the story is that the money can run but it cannot hide. What is needed is political will to get the job done.

Note:

1. The conversion rate used in this article is 1 USD = 66.70 Rupees.

2. Text in Blue points to additional data on the topic.

- Elon Musk postpones India visit. Non-clarity in Tesla partner and Starlink license might be the reasons - April 20, 2024

- NIA confiscates Pak-harboured Khalistani terrorist Lakhbir Singh Rode’s key aide’s land in Moga - April 19, 2024

- Prime Minister Narendra Modi: A Gujju businessman who does not invest his precious time for a losing battle - April 13, 2024