Part 1 of this series is called Entrenchment. Part 2 talks about How Ajay Shah shaped the narrative. This is Part 3.

In a Casino, the House always wins

Go to any Casino is the world. You may think that you have a good game – be it Blackjack or any card game where you fancy your skills. But no matter how good you are, the House (meaning the Casino) always wins. Transpose this to the real world and if C-Company controlled the Casino that is the Indian Financial Market, it will ensure that the player (meaning India) always loses. At every step of the way, it would appear as if it is a fair game… But is it?

Back to Bombay

A quick look at the rise of Ajay Shah – According to his resume[1], he finished his Ph. D. (Doctor of Philosophy) in 1993, while working at Rand Corporation and came back to India to be the President of his Dad’s company, Centre for Monitoring Indian Economy Pvt. Ltd. (CMIE). Dr. Narottam Shah, his father, was a well-respected name in the Bombay markets, having pioneered the first database of stocks, their performance, dividend payouts etc. We must keep in mind that a Floppy Disk or a CD-ROM was the preferred exchange medium at that time. Internet had not gone graphical yet.

Jumping straight from a Ph. D. degree to becoming the President of a company is a rarity and I suppose Ajay Shah got a head start into the networking circles of Bombay’s markets (it did not become Mumbai till 1995).

National Stock Exchange (NSE) commenced operations in 1994 and was a fully electronic exchange, as opposed to the 140-year old Bombay Stock Exchange, which too was trying to go electronic. The founding Chairman of NSE, Dr. R H Patil was encouraging everyone to get on board on the electronic exchange bandwagon and is some ways Ajay Shah’s growth mirrored that of NSE.

NSE prospered under Patil

There were huge barriers to becoming a broker on the BSE (Rs. 1 crore or higher entry fees) and Dr. Patil dismantled them by making entry fees a non-interest bearing deposit. Electronic trading made it possible to separate trading, ownership and management[2]. For instance, you did not need Stock ownership certificates anymore. Everything could be done electronically.

Seeing the ease with which stocks could be traded electronically, the NSE stole a march over BSE and was within a year doing more business than the staid 140-year old bourse that started in Dalal Street.

The NIFTY 50 Index

Ajay Shah and his wife Susan Thomas are credited with creating the NIFTY 50 Index of 50 of the best Indian companies, as compared on various parameters. Some say that NIFTY 50 was inspired from the term Nifty Fifty that was used in the 70s in the US, to mean the most sought-after stocks. The fact that the new exchange NSE embraced it and introduced it to the traders and investors made Ajay Shah and Susan Thomas famous. Shah is supposedly an articulate speaker of the English language and this caught the attention of the St. Stephens’ College educated Babus in Delhi as well as the mandarins in the Finance Ministry. Slowly but surely Ajay Shah along with Ravi Narain at the NSE, who became its CEO in 2001, started getting a vice-like grip over India’s markets. A small club formed around NSE, some politicians from Mumbai and Babus of Delhi, which tried to actively keep anyone new from entering into their turf[3].

How Jignesh Shah was kept out

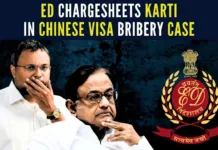

This is where the plot thickens. Having captured the pole position in the form of India’s leading Stock Exchange, the C-Company[4], of which Ravi Narain, Ajay Shah, Dr. K P Krishnan are card-carrying members, used every trick in the book to keep Jignesh Shah out of the Stock Exchange business.

Narain could only wring his hands in despair, as Jignesh Shah’s MCX was beating NSE-promoted NCDEX hollow[5]. In a short amount of time, MCX established an unassailable lead in the Commodities exchange business (see Figure 1). Worse was to follow. NSE’s Indian Power Exchange was rendered irrelevant when Financial Technologies India Limited (FTIL)’s IEX garnered most of the market share in electricity trading. Similarly, in the currency derivatives segment, Shah’s MCX-SX overtook NSE within a year of its launch.

Exchanges promoted by FTIL took unassailable leads over the equivalent NSE offerings in every asset class from Commodities to Currencies to Electricity that caused a lot of heartburn to the C-Company[6].

The reason C-Company wanted to keep everyone except NSE under pressure became evident when the High Frequency Trading Scam blew up in the faces of NSE top management. Up to 14 people have been contacted and Securities Exchange Board of India (SEBI) is looking into the charges (although they are taking their own sweet time doing it). The Central Bureau of Investigation has in the meanwhile stepped in to file a First Information Report (FIR) against one broker OPG Securities and has also named Ajay Shah in it[7].

A friend in need…

As soon as news spread that Ajay Shah was named in the FIR, his circle of carefully cultivated friends swung into action. A previous Chairman of NSE, and the current Chairman of NIPFP (National Institute of Public Finance and Policy), shoots off an email to every person of stature in the present dispensation, claiming that poisonous lies are being spread about him (Ajay Shah)…. And that Truth and Ajay’s honor shall prevail…

Why should his superior vouch for his integrity? Is it because many in the government are complicit with what happened in the HFT Scam and they have not only participated in the loot, but also ganged up to block investigations? Surely if Mr. Shah is as pure as driven snow (as the above email suggests), he should have nothing to fear from the investigation. Except if the previous statement is not true.

Continued…

References:

[1] Ajay Shah CV – nipfp.org

[2] R H Patil: The man who revolutionized Indian stock market – Jul 23, 2016, Economic Times

[3] C-Company: How Jignesh Shah became the No. 1 target of P. Chidambaram – Mar 2018, Amazon.com

[5] How Ravi Narain built the NSE, and then lost his grip – Jun 4, 2017, Moneycontrol.com

[6] FTIL – an engine that created millions of jobs – Nov 18, 2017, PGurus.com

[7] Ajay Shah named in CBI FIR in NSE Scam. Should he step down from NIPFP? Jun 3, 2018, PGurus.com

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] jobs and prosperity for its growing population is going to be impossible. By rigging the NSE, C-Company, deprived tens of thousands of eligible companies of critical investment, which down the line […]