Bernanke got the subprime crisis wrong?

“Subprime is Contained” – Fed Reserve Chair Ben Bernanke, March 2007.

Bernanke, the then Chair of the Federal Reserve had in a testimony to the Congress said that the Subprime sector of the housing sector and there will not be any spillover effects to the rest of the housing sector, let alone the overall economy.

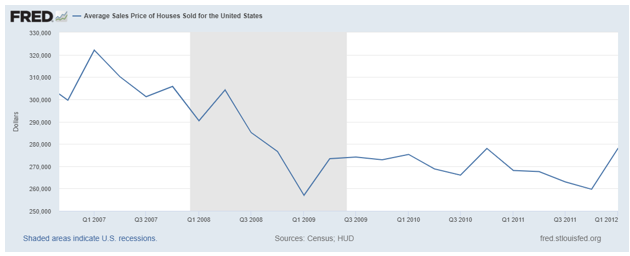

Uncannily Bernanke had picked the very top of the housing bubble when he made that infamous observation and what followed in the years subsequent to the bursting of the housing bubble is now referred to as the Great Recession. It would take an extraordinarily lax monetary stance by the Federal Reserve for the decline in housing prices to bottom over the next 5 years. The consequence of this monetary inflation for more than a decade is the consumer price inflation that we are observing today.

Interest rates that were brought down to near zero by December 2008 would stay at that level till 2022 except for a fleeting attempt to normalize during 2018. Not only was Bernanke wrong about the subprime crisis, but he got a number of other macroeconomic forecasts completely wrong.

- The housing bubble burst leading to the Great Recession – This is an extremely well-documented and understood fact requiring little elaboration.

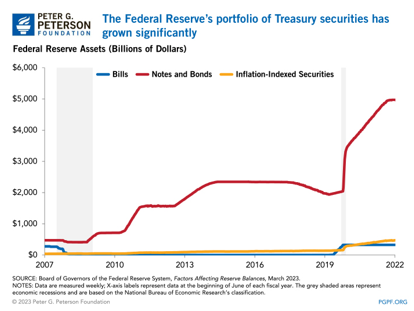

- The non-temporary nature of QE and how the expansion of the Fed balance sheet to monetize government deficits is now taken as standard operating procedure.

Bernanke June 2009 – “The Federal Reserve will not monetize the debt”.

Bernanke May 2017 – “…the central bank could reduce its $4.5 trillion balance sheet by as much as half. “I think they’re aiming for something in the vicinity of $2.3 to $2.8 trillion, something like that”.

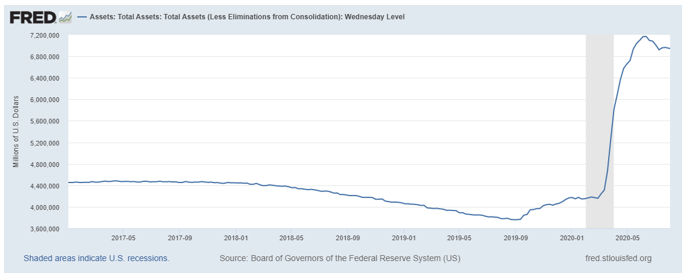

Even if Bernanke did not fully understand the consequences of QE during 2009, it should have been quite obvious in 2017 that a rollback/ taper of the deficit financing is impossible. For the record, the Fed’s Balance sheet is now nearly double the 2017 number and is at $8.5 trillion. It was 0.9 trillion before all this started during July 2008.

- The consumer price inflation problem that Bernanke had said he can solve within 15 minutes is becoming a permanent feature though the media still treats the issue as a temporary one despite the last 2+ years’ experience.

Bernanke Dec 2010 – “We could raise interest rates in 15 minutes if we have to. So there really is no problem with raising rates, tightening monetary policy, slowing the economy, reducing inflation at the appropriate time”.

While I could expand on the list, the objective is to point out how Bernanke got the basics wrong. These are policy blunders and these ought to make the public, academia, and the media at large question the very competence of the Federal Reserve on basic economics. The Federal Reserve, since the days of Greenspan, has led the US and the world economy on the primrose path of easy money and we are faced with a Hobson’s choice at this point – either a severe deflationary depression today or a hyperinflationary depression tomorrow.

For all practical purposes, there is no middle ground to tread. Yet, how has the world reacted to these easy money policies that have brought the US economy to the brink? We have awarded Bernanke the Noble Prize in Economics!!! Without exaggerating, this surely would have to be the equivalent of awarding the Noble Peace Prize to Adolf Hitler or Joseph Stalin.

Powell’s Moment

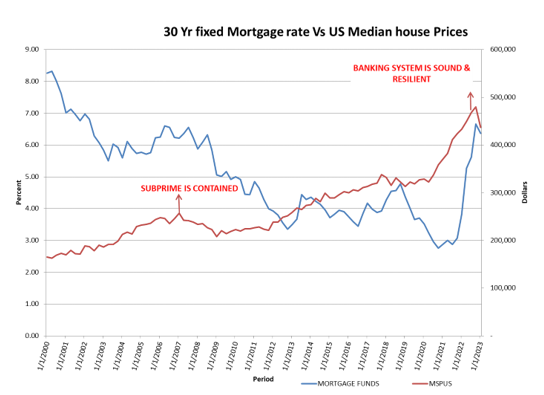

“Banking system is sound and resilient” – Jerome Powell on May 03, 2023.

This is remarkably similar to the Bernanke “Subprime is contained” statement in terms of the timing and lack of understanding of the fundamentals. Powell had made this after the collapse and the subsequent takeover of First Republic Bank on May 01st. Prior to this, Silicon Valley and Signature Bank also met a similar fate during March 2023.

But as I will explain, there is no chance that Powell can escape the consequences of his words unscathed the way Bernanke did. The fallouts listed below are imminent though the end game (i.e. hyperinflationary depression) would play itself out over the next few years.

So what is Powell missing about the big picture?

- The Banking crisis in the US/ worldwide has just started. The banking crisis is just an outcome of the declining values in the MBS and treasury securities held by these banks. There is no way for the banks to liquidate these assets and realize the value carried on the books.

- The bursting of housing bubble 2.0 in the US has just started. Both retail housing and commercial real estate face a downturn that will be substantially worse than what was experienced during the 2008 crisis.

- The combination of high consumer price inflation and extended recessions is going to result in a Federal Reserve policy that could dwarf the size of the earlier QEs (which in itself was a response to the Great Recession). This will substantially reduce the value of the US Dollar vis-à-vis other currencies and more importantly, the market money of Gold.

While banking is certainly going through a massive crisis, it is easier to understand the extent when the rationale of the housing bubble 2.0 burst and increasing consumer price inflation (translating into higher interest rates) are understood first.

Bursting of the Housing Bubble 2.0

Quite unlike in 2008 when the US Fed denied the existence of the housing bubble, Powell has been more realistic this time around. He made this remark in Dec 2022 “Coming out of the pandemic, [mortgage] rates were very low, people wanted to buy houses, they wanted to get out of the cities and buy houses in the suburbs because of COVID. So you really had a housing bubble, you had housing prices going up [at] very unsustainable levels and overheating and that kind of thing”.

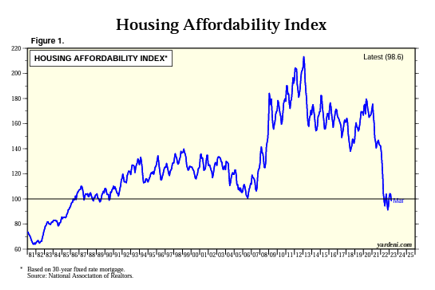

Housing Affordability Index indicates whether a typical family has enough income to qualify for a mortgage for a typical him. An Index of 100 is the level at which income meets the mortgage criterion. The Index takes into account not just housing prices but also interest rates and incomes and this index is now lower than the 2008 levels.

But what caused the steep decline in the Affordability Index from nearly 180 to less than 100 in the last 15 months? A good part of this decline could be attributed to the steep increase in house prices till Q4 2022. But primarily it is the fed funds rate going up to 5% which has led to a dramatic reduction in the affordability. This movement in the Fed funds rate has caused an increase in the 30-year Fixed Rate mortgage to more than double from 3.22% on Jan 01, 2022, to nearly 6.6% today.

So while a 2008-style downturn in housing prices is now a certainty, whether the downturn is temporary (limited to a few years) or otherwise would primarily be a function of interest rate movements. If the Fed can reverse course in the current tightening cycle and go back to ZIRP or near ZIRP, then affordability can improve as happened during the early 1980s or immediately post the 2008 housing crash.

As the graph above indicates, the initial phase of a rate-tightening cycle actually causes housing prices to accelerate. Perhaps under the mistaken belief that the rate hikes are primarily a function of a red-hot economy. It seems to take a considerable lag of about 12 to 24 months from the onset of the rising cycle for the housing speculators to come to terms with reality. In the US, the median prices reached a peak of nearly $480,000 during Q4 2022, and it’s unlikely we cross that number for the foreseeable future. During Q1 of 2023, it was under $437,000 implying a near 10% correction and this will substantially worsen in the years ahead.

The primary variable in determining the depth and duration of the housing downturn would be the directional movement in interest rates. The average reader might be tempted into assuming that the interest rate is something that the US Fed can set at will. So the unwitting assumption might be that a housing crash that could rival 2008 would again lead to ZIRP. Or at the very least, a considerable reduction in interest rates.

Unfortunately not this time. As the world will realize shortly, the US Fed did not solve the 2008 crisis with QE and ZIRP, but merely postponed the pain while worsening the underlying economic imbalances i.e. the proverbial kicking of the can down the road. The difference this time around is that we have reached an economic cul-de-sac of stagflation.

Consumer Price Inflation & Recessions Ahead – Concurrent & Worsening

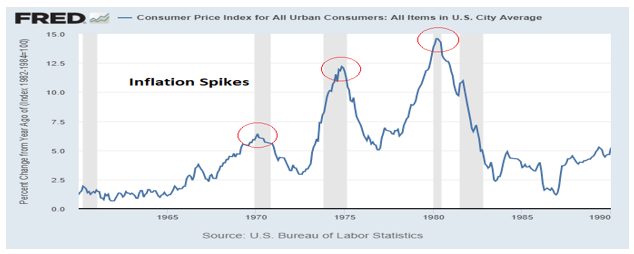

The comparison of the current inflationary trends to what the US witnessed during the 1970s has been made in several forums. If anything, the current decade would be substantially worse than the 1970s on account of the US trade deficits, ballooning fiscal deficits and the national debt on account of which raising interest rates to counter consumer price inflation the way Volcker did is almost impossible.

While the accumulated monetary inflation since the 2008 crisis is sufficient for consumer price inflation to surpass the 1970s records, the biggest driver will be the QE that lies ahead.

For about 20 months starting Jan 2018, the US Fed steadily reduced the balance sheet from a little over $4.4T to about $3.8T – a near 14% reduction. In a dramatic reversal during Sep 2019, courtesy of the Repo crisis, the US Fed then changed course and within the next 8 months, the balance sheet nearly doubled to $7.2 trillion.

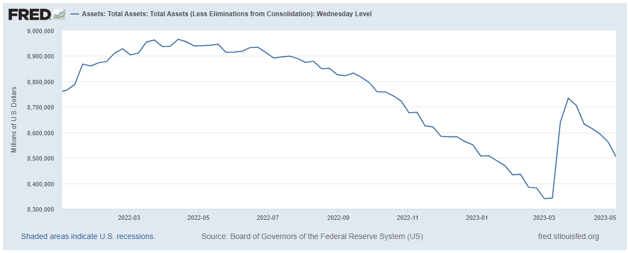

The latest round of tapering lasted less than a year – from about $8.95T during Apr 2022 to about $8.35T by Mar 2023 – or less than a 7% reduction. How much is the expansion over the next 6 to 8 months going to be? My guess is it will at the very least be $12T before we end 2023. Multi-trillion deficits are going to be the order of the day and the US Fed is going to be the ONLY lender to the US government at the prevailing rates.

Mises had given this analogy of an economy addicted to cheap money as the equivalent of a drug addict on heroin. The longer and higher the dosage that somebody is addicted to, the more severe is going to be the withdrawal symptoms when the drug is stopped. Similarly, when the flow of easy money is even reduced, the economy shows signs of stress in various parts. There need to be ever-increasing doses to give the illusion of economic stability.

However, the withdrawal symptoms are part of the cure of de-addiction. Similarly, the disease of malinvestment caused by cheap credit needs to be cured by the recession. A recession does the job of reallocating resources from bubble industries to capital-starved ones.

Given that a lassiez faire approach to handling the oncoming recession is an intellectual impossibility (that incidentally will be the ideal solution as well), we can be certain that more of what seemingly worked during 2008 would be tried again. So unlimited QEs is going to be the only solution that the Fed will even contemplate as a response to handling the housing burst 2.0-induced downturn. This monetary inflation is going to result in high consumer price inflation that will make the 1970s number look tiny by comparison.

Where will that send the interest rates? & the value of the portfolio’s held by the banks?

Where does the Bailout stop?

It should be obvious by now that the current housing bubble is far bigger than the 2008 one. Additionally, the 2008 backstopping solution of ZIRP is no longer an option and hence the deleterious consequences of the housing bubble burst are going to be substantially worse. The decline in the value of the portfolios held by the bank – on account of declining asset values as well as increasing interest rates – is going to run into trillions.

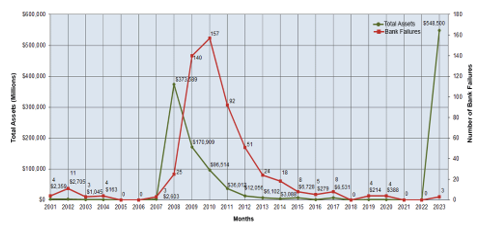

A total of more than 300+ banks failed during the period 2008-2010. Does anyone even remotely believe that the count in the current unwinding cycle that has not even officially started going to be just 3? A very interesting feature of the current banking downturn is that the assets held by the 3 banks that have failed so far are just a tad lower than the combined assets of the 300+ banks that failed in the previous cycle.

So forget the soundness of the banking system; the FDIC is going to need a bailout shortly. The only unanswered question at this point would be whether the US Fed will require a bailout. Everything points in the direction of one.

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- 2008 Redux? YES and NO - October 23, 2023

- Is there a conundrum in the US Housing Market? - September 21, 2023

- Why the Fitch downgrade doesn’t make sense - August 14, 2023