Incompetents hang on longer in India than anywhere else

- Rudyard Kipling, The Gate of the Hundred Sorrows

Something that Kipling wrote more than a hundred years ago still rings true. Some of the bureaucrats (generalists with shallow knowledge) are placed in places of importance for reasons other than their competence. This template has been perfected by the Congress regimes over the decades. It gets worse – unless they are caught like in the 2G scam, they cannot be fired. It is this feeling of invincibility that makes them rather useful for politicians to do their dirty deeds. And when the politicians are out of power, these loyal minions will ensure that their erstwhile masters are not caught. Such is the case with the regulation of Commodities markets in India.

Known to be especially close to Lalu Prasad Yadav, as District Magistrate, he used to take what many used to joke as His Masters Voice (HMV) orders from the then Chief Minister (CM) Lalu. Want to declare a curfew for settling scores? No problem. Ramesh Abhishek was there to do it.

Need for Commodity exchanges

Chicago Mercantile Exchange (CME) was perhaps the first commodity exchange in the world when it started operations in 1898. Why was an exchange needed for Commodities? To provide a centralized marketplace where commodity producers can sell their commodities to those who want to use them for manufacturing or consumption. The beauty of a commodity futures exchange is that a wheat farmer can lock in a price for his crops months before they’re even harvested. This process increases business survival among farmers, and the exchanges always make sure there’s a buyer for every seller, provided their prices meet.

FMC – the Regulator

The Forward Markets Commission (FMC) was established in 1953, under the Finance Ministry. Those were the socialist days when everything was controlled with permits and licenses. FMC first came to the fore in 1955 when it intervened in the Cotton Futures market[1]. The move was backed by the then Commerce Minister T T Krishnamachari, (who himself was alleged to have been trading in cotton markets), and the FMC succeeded in disrupting what was arguably a thriving cotton futures market. Trust the government to make a mess of a working system.

While the Commodities Futures market has been around for a while, the Commodity Spot Market[2] came much later, in fact in 2004.

Commodity Futures vs Commodity Spot Market

What is the difference between Futures and Spot as far as commodities go? It is similar to what they mean in Stocks. Spot is the equivalent of selling/ buying stocks today whereas, in the futures market, you can specify conditionally to buy or not buy, sometime in the future. You would go to the spot market if you wanted to buy or sell something today. On the other hand, you would go to the futures market if you want to buy or sell something at a future date but you want to fix the price today[3].

The Multi Commodity Exchange (MCX) allowed investors to hedge and manage risks in commodity futures. After getting qualified to be part of Spot Commodity Exchanges, the Financial Technologies India Ltd. (FTIL) came up with the National Spot Exchange Limited (NSEL). MCX started operations in 2003 while NSEL started in 2008. For more see Figure 1.

Spot Commodity Exchange – an MMS initiative

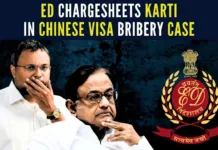

The year was 2004. The then Prime Minister Manmohan Singh actually wielded some power. Based on numerous recommendations from institutions in India and abroad, a need for a vibrant spot market to ensure efficient and uniform pricing for agricultural commodities in the spot market was identified. This received the endorsement and support of the then government including the Prime Minister Manmohan Singh. Similar sentiments were echoed by the then Finance Minister P Chidambaram in his Union Budget 2004 address. Commodity Spot Exchanges started sprouting.

PC wanted Yes Men

The case of Ramesh Abhishek, the current Secretary of the Department of Industrial Policy and Promotion (DIPP), is an interesting one. When Chidambaram wanted certain events to happen in a certain way, he would get a Babu of his “choice” installed. Ramesh Abhishek, who has a Masters in Arts in International Relations and Affairs, first becomes a member of FMC in 2011 and then becomes the Chairman of Forward Markets Commission in 2012 after PC regains the Finance Ministry (the information about him in LinkedIn about being Chairman from 2011 is incorrect). Note that FMC at time was under Dept. of Consumer Affairs, not Fin Min! Just shows the influence and power wielded by PC in UPA-2. A quick check of his academic background reveals zero knowledge of Finance or Markets yet the UPA government thought him fit to occupy the highest position in FMC. His role would become clear in the months and years to come.

Create a problem and then walk away…

Where was Abhishek before coming under the umbrella of PC? He is an IAS officer from Bihar cadre. Known to be especially close to Lalu Prasad Yadav, as District Magistrate, he used to take what many used to joke as His Masters Voice (HMV) orders from the then Chief Minister (CM) Lalu. Want to declare a curfew for settling scores? No problem. Ramesh Abhishek was there to do it. He even organized election booths in such a way that they can be handled conveniently by the CM’s political goons1. Those days, there were no Electronic Voting Machines (EVMs).

Dubious role as FMC Chairman

After the cotton futures incident of 1955, Abhishek’s regime will go down as one of the biggest regulatory disasters ever to have struck India. How he killed a growing market and harmed a fast growing multi-class exchange enterprise at the behest of his political masters and instead of solving a problem he walked away from it, shows his true colors. And as he nears the end of his IAS innings, he is being positioned by the evil genius for an even more diabolical role. More on this in the coming episodes…

Continued…

References:

[1] The Target by Shantanu Guha Ray – Amazon.in

[2] How Chidambaram and C-Company placed hurdles in the way of FTIL – Part 7 – Nov 24, 2017, PGurus.com

[3] Spot Market vs Futures Market – 6 Key differences – TradingSim.com

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

Ramesh Abhishek is power hungry IAS officer who always makes sure that people allude to his image and business and provide commerce directly or indirectly to his children and close relatives. Disclosure of properties and asset details must be asked from him, his wife, his children and in-laws and co-brother L K Agrawal. A look at his Facebook and LinkedIn profiles will demonstrate his naked show of connections and illusions he wants to create. Earlier favourite of Lalu and then PC (https://tennews.in/ramesh-abhishek-lalus-ace-advisor-under-scanner/) and now BJP

Ramesh Abhishek is power hungry IAS officer who always makes sure that people allude to his image and business and provide commerce directly or indirectly to his children and close relatives. Disclosure of properties and asset details must be asked from him, his wife, his children and in-laws and co-brother L K Agrawal. A look at his Facebook and LinkedIn profiles will demonstrate his naked show of connections and illusions he wants to create. Earlier favourite of Lalu and PC (https://tennews.in/ramesh-abhishek-lalus-ace-advisor-under-scanner/) and now BJP

Commodity exchanges have never helped Farmers thou ostensibly that is why they were formed in the first place.F&O is for intermediaries and only they end up making money. It was further aided by the fact that contracts are cash settled. So exchanges are all about making money, instead if farmers are given wherewithal in terms of financing. cold storage facilities, transparent pricing info and facility to sell where they get the best price then it would actually create a vibrant market place. Doesn’t matter what you name it.