Navin Upadhyay

New Delhi

Summary:

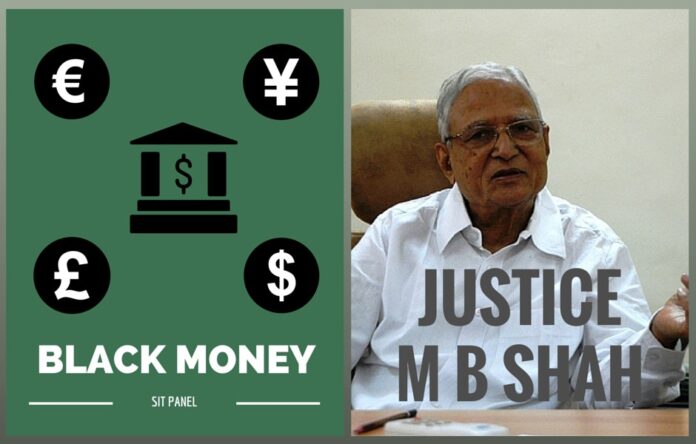

Cricket betting, Participatory Notes (PN), Money Laundering in stock market and in donations to schools, colleges and religious institutions are some of the major sources of black money generation in India, according to the Supreme Court-appointed Special Investigation Team (SIT). The SIT headed by Justice M B Shah (retd). submitted it their report to the Finance ministry on July 24.

In its detailed report, the panel asked the Government to put in place effective measures to recommend. SIT called for effective norms to prevent betting in cricket, made special mention of the Indian Primer League (IPL) which has been mired in a mega scandal involving spot fixing and money laundering. Recently, another Supreme court-appointed panel ordered suspension of two of the IPL teams for involvement of its officials in betting.

The SIT on black money also called for bringing donations to educational and religious bodies under tax net and stronger norms for regulating Participatory note. It said that the Security and Exchange Board of India (SEBI) should scrutinize ownership details of P-note holders and cases of unusual rise in stock prices and inform other agencies such as Central Board of Direct taxes (CBDT) and Financial Intelligence Unit (FIU) for action.

The SEBI recently barred more than 250 entities, including individuals and companies, from the securities market for suspected tax evasion and laundering of black money through stock market platforms. In one such instance price of a scrip rose from Rs. 10.20 to Rs. 489 in 150 trading days – a rise of 4694%. The SIT obtained the background details of these cases and studied them. A typical pattern is observed to be followed in such cases.

“…It is apparent that illegal activity of cricket betting requires to be controlled by some provisions which are deterrent to all concerned…”

– SIT Report on Black Money.

Suggesting that market regulator SEBI should find out beneficial ownership of Participatory Notes (PN), an instrument used by foreign investors to invest in India, the panel said, “It is clear that obtaining information on ‘beneficial ownership’ of P-notes is of crucial importance to prevent their misuse. SEBI needs to examine the issue and come up with regulations where the ‘final beneficial owner’ of P notes/ODIs is known.”

In a shocking revelation the Panel said that about Rs.85,000 crores ($13.29 billion) came in through P-notes from Cayman Islands, which has a total population of about 54,000. “It does not appear possible for the final beneficial owner of ODIs originating from Cayman Islands,” it said.

The panel said that in case of black money generation of the education sector and from donations to religious institutions and charities, the CBDT should promptly finalize assessments, and if necessary, take punitive action.

Asking for crackdown on shell companies which are set up by entities to evade taxes and result in generation of black money, the panel said: Serious Frauds Investigation Office (SFIO) under Ministry of Company Affairs needs to actively and regularly mine the MCA 21 database for certain red flag indicators. These red flag indicators could be based on common DIN numbers in multiple companies, companies with same address, same contact numbers, use of only mobile numbers, sudden and unexpected change in turnover declared in returns etc. These indicators are illustrative in nature and the SFIO office can prepare a set of indicators based on its own experience and consultation with other law enforcement agencies like CBDT, ED and FIU.

It said sharing of information on such high risk companies with law enforcement agencies: Once certain companies are identified through data mining above, the list of such high risk companies should be shared with CBDT and FIU for closer surveillance.

On holding of cash beyond a limit, the panel said, “If holding of cash is restricted and regulated, to a large extent, it would control circulation of black money within the country and discourage stashing of money abroad”.

The panel called for criminal prosecution of donors and those from education and religious intuitions who accept undisclosed donations under Prevention of Corruption Act.

“For this, it would require legislative change which is necessary because now–a–days, donation to educational institutions which are in demand, is rampant. In some cases, it goes up to Rs 1 crore and more. This would go a long way in curbing the generation and circulation of black money…”

– SIT Panel on Black Money

The SIT said: “Nobody can object for charity donation but at the same time, that when large amount is donated, it should be only accounted money and that payment should be by account–payee cheque to the charity or the institution.”

“Even if gift of jewelry is made to a charity or institution, it should be by mentioning donor’s name and his/ her PAN Number.”

Note:

1. The conversion rate used in this article is 1 US Dollar = 63.85 Rupees.

- The rise of Patanjali:An Indian yogi’s challenge to MNC giants - January 26, 2016

- Padmas – a blend of excellence, politics and ideology - January 25, 2016

- Scared of hispopularity, British wanted to hang Netaji - January 24, 2016