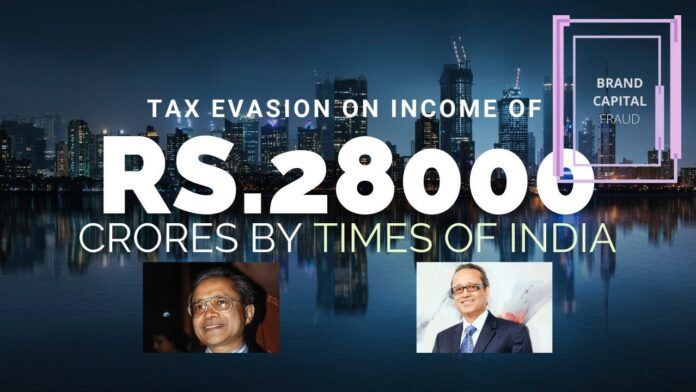

The Times of India Group is on the radar of tax agencies for tax evasion of its huge advertisement collection of Rs.28,000 crore for the past two decades. According to the complaint filed by a senior marketing staffer turned whistleblower and some minority shareholders, Times of India Group company Bennett and Coleman Company Limited (BCCL) has formed an internal division called Brand Capital and was collecting huge money for advertising and paid news and never showed this income as revenue. According to the complaint, to avoid paying tax this huge income collected of more than Rs.28,000 crores was shown as Long-Term Capital Gain.

The detailed complaint with a series of documents showing the huge income from the dubious Brand Capital income says that this dubious trick was invented when Samir Jain took control of Times of India when his father Ashok Jain absconded from India due to a series of money laundering and smuggling charges in the late 90s. Brand Capital was earlier known as Times Private Treaty and then Brand Equity Treaties.

The complaints say that the Times of India Group will enter into an agreement with companies who wish to advertise and charge special rates for advertising and publishing favourable news for their brand building, sales promotion, stock exchange price fluctuation and even campaign against their rivals. The Group’s other media organizations like Economic Times, Radio Mirchi, Times Now and ET Now will also be used for these covert operations to those who agree to the terms of Brand Capital.

“This is how it acquired its entire Rs.28,000 crores and shown it as investment concealing that this is entirely business income. Full advertisement revenues are shown as investments held by Brand Capital which is earlier known by different names like Times Private Treaty, Brand Equity Treaties and so on. There are more than 800 companies in which Brand Capital holds investments. It is getting these investments in lieu of publishing advertisements and brand building and not plain Private Equity type investment,” said the complaint filed by the whistleblower.

The complaint also said that sometimes the Times of India Group accepted flats for advertisements from real estate companies. The documents attached to the complaint show that from Lodha Developers, the Times of India Group accepted two flats worth around Rs.10 crores in Mumbai in 2007 for advertising. This dubious deal by Times of India is reflected in Lodha Group’s information to SEBI and the company’s filing to the Registrar of Company (RoC) too. “As of date of this Draft Red Herring Prospectus, we have transferred one flat in Lodha Bellissimo located in Mahalaxmi, Mumbai valued at Rs.41.8 million to BCCL and in accordance with the terms of the agreement, another flat in Lodha Bellissimo valued at Rs.57.8 million will be transferred to BCCL prior to December 2009,” said the real estate company’s filings to the RoC. The complaint filed by the Whistleblower and several minority shareholders expose thousands of crores worth dubious deals executed between Times of India Group and several companies including multinational firms.

“BCCL has similar investments in Flipkart, Yatra, Uber, Quikr, Infibeam and several such companies. It owns huge real-estate. All these deals prior to 2010 were direct barter deals of which the above example like Lodha is provided. Later, it became smart and started making two agreements – one of the investments and another of advertisements. So it actually started cutting cheques for investment but the same money came back in form of advertisement revenue, which attracted tax,” said the complaints detailing how Times of India Group controlled by Samir Jain and Vineet Jain evaded paying taxes on the huge Rs.28,000 crore advertisement revenue collected. The complaint also said that as media organization, Times of India Group arm-twisted the companies to enter into dubious deals with their shoddy arm Brand Capital.

BJP leader Subramanian Swamy recently filed a petition against Times of India Group’s owners, Jain family, to various agencies seeking a probe on the huge tax evasion and money laundering through shell companies. In his petition to Prime Minister Narendra Modi and other agencies, Swamy accused the largest media company Times of India Group majority shareholders Samir Jain, Vineet Jain and their mother Indu Jain of floating several shell firms and indulged in dubious buyback of stock exchange-listed shares from minority shareholders in covert ways and creating a huge tax loss. Swamy accused Jains of making a tax loss of Rs.625 crores[1].

References:

[1] Subramanian Swamy urges probe by Income Tax, ED, CBI, SEBI and SFIO into the huge tax violations, money laundering in Times of India Group – Dec 25, 2019, PGurus.com

- Prime Minister Narendra Modi: A Gujju businessman who does not invest his precious time for a losing battle - April 13, 2024

- NIA arrests two accused Shazib and Taahaa in Bengaluru’s Rameshwaram Cafe blast case from Kolkata - April 12, 2024

- National Herald scam: Adjudicating Authority upholds Rs.752 crore assets attached by ED - April 11, 2024

BCCL has similar investments in MCX, Metropolis Stock Exchange (MSEI), Future Retail, Meru Cabs etc and many other companies also. BCCL, being publishing house who is verifying whether there is no conflict of interest by holding such investments and its main object of publishing. If there is tax evasion it is great loss to the government and stringent action is required to be taken against them.

Going by this , it’s not just IT evasion. GST too

[…] खबर को अंग्रेजी में यहाँ […]

Why everytime it is only Dr. Swamy to do all the work & petition. What are the IAS & IRS (revenue services) people doing ? Why Judiaciary is sleeping, but wake up till late night for Afzal Guru & other Porkistan supporters ? Why BJP is also closing its eyes

[…] Courtesy: Pgurus.com […]

Government of India having more than 6% share holding must crack down this SIN called Times of India Group. During Indira Gandhi days till Emergency declaration, Times of India for more than 10 years under the control of Bombay HC appointed Directors. later Indira made a deal and during Emergency gave it back to fraud Jains. That is why it Times of India is called Times of Indira. PM Narendra Modi must ORDER Income Tax to tax the non-taxed Rs.28000 crore from Samir-Vineet Jains