Most frightening decades ahead

Regular readers should by now understand that we are looking at one of the most frightening decades ahead. Whether it is going to be worse than the 1940s is something that only time will answer, but I wouldn’t in the least be surprised if it indeed proves to be the case. Just to provide a recap and for the sake of the uninitiated, I would refer to two recent articles[1][2].

I believe that we are well past the stage wherein anything meaningful can be done to resolve the macroeconomic imbalances without unprecedented disruptions. In fact, followers of Austrian Economics would know that this has to be the end game once the world moved away from the Gold standard which it did in 1971. It has taken a while to play itself out, but yes, we are indeed in the infamous Keynesian “Long Run” as we speak.

Let me start with the most basic question – the world has been through many boom-bust cycles over the centuries and so why should it be any different this time. I think there is a very crucial distinction that the above argument misses. I would like to point out that we have not been through anything like this earlier i.e. under a completely unhinged fiat currency system. Skeptics can point towards the stagflationary bust of the 1970s, and that would indeed be partially correct, with the exception that the boom prior to the 1970’s still happened under a loosely tethered monetary system. Consequently, the boom time malinvestments were limited and it was this gold imposed constraint during the boom that allowed Paul Volcker to put interest rates at 22% subsequently to curtail the inflation.

Therefore, make no mistake – We have NEVER been through an artificial boom similar to what we have experienced between 1980 to 2021 in human history during which the entire world has been on a fiat currency system. It has been a one-way street – downwards for interest rates and upwards for debt, financial assets of equities/ bonds, and real estate – over this entire 40 year period. IT IS INDEED DIFFERENT THIS TIME!!!

| If I want to emphasize only one point in this article, it is that the Governments will blame the entire economic collapse on free markets, greedy speculators, and Capitalism. What is happening is anything but Capitalism. The defining feature of a Capitalistic system is the absence of Central Bank that conjures money out of thin air and manipulates interest rates for political ends. Both these – money supply and interest rates – are legitimate functions of the free markets requiring ZERO Government intervention. The solution to this economic malaise lies in a return to Capitalism, individual liberty, and the Gold Standard. |

With no restraints whatsoever, the central bankers have operated in a manner that would put drunken sailors to shame. The accumulated US national debt that took nearly 200 years to reach the first $1 trillion which it did in 1981 is now increasing at the rate of $0.5 trillion a month. In the midst of this central banking binge, we have interest rates at 0% at a time when the CPI by most independent estimates is higher than the worst inflation that the US economy experienced during the 1970s. Even the most doctored CPI as calculated by the US government puts inflation at nearly 7%.

So why can’t they raise the interest rates like Paul Volcker did during the early eighties?

The budget outlays for the US government for FY 2021 is $6.8 trillion with revenues at $3.8 trillion leaving a deficit of $3T. The overall US Govt debt is nearly $30T and so a nominal 2% interest rate would increase the interest service requirements without any principal repayments by $0.6T. Or restating, with other things remaining equal, the outlay would have to be $7.4 trillion with revenues at $3.8 and the deficit at $3.6. Of course, other things rarely remain equal and an interest rate of 2% would crush the leveraged US economy sending the revenues sharply downwards and the budget outlays would balloon due to the recession-induced stimulus.

| At 0% Interest Rates | At 2% Interest Rates (other things remaining equal) |

|

||

| Budget Outlays | $ 6.8 T | $ 7.4 T | $ 8.0 T | |

| Revenues | $ 3.8 T | $ 3.8 T | $ 3.0 T | |

| Deficit | $ 3.0 T | $ 3.6 T | $ 5.0 T |

Assuming a very nominal $600 B stimulus and a 20% contraction in revenues.

Central bankers – Incompetent or lying?

At the very least, they are extraordinarily incompetent with a very faulty understanding of macroeconomics. The other possibility is that they understand the issues to a reasonable extent, but are just lying for political purposes. Let me take the case of Bernanke to illustrate the above.

- When questioned under oath as part of the Senate proceedings about whether the subprime housing crisis was contained in 2008, Bernanke answered in the affirmative. Years later, after he had relinquished his position at the US Fed, Bernanke went on to say that he did not believe that the subprime was contained but had to toe the line of the then Bush administration to prevent a collapse of the entire housing market.

Now one can argue that Bernanke’s actual understanding of how the housing bubble was going to unwind was limited during his tenure at the Fed and that he was actually lying in the post-Fed interactions just to appear smart. Possible though unlikely. - Grave enough the extent of lying/ incompetence might be in the above case of the subprime fiasco, it pales in comparison to his observations on the Fed’s ability to control inflation.

When asked to comment about the Fed’s ability to control long-term inflation in 2010 as a consequence of the artificially low-interest rates and QE’s, Bernanke said he is “100% (confident)…. We can raise interest rates in 15 minutes if we have to”. Though it was pretty much taken at face value by the mainstream journalists, followers of Austrian Economists pointed out the absurdity of his assertions even back then. It would take a decade for inflation to rear its ugly head, but now the Fed stands completely exposed in its inability to raise interest rates from “0%” even in the face of rampant inflation.

Was it another instance of lying? Or is it sheer incompetence? In the case of inflation, I think it is the latter. Schooled in the Keynesian tradition, most central bankers think of inflation as a consequence of high growth/ low unemployment and can never fathom the current scenario the US economy is in – recession and inflation at the same time.

So why is the Fed not raising rates in the face of galloping inflation? US GDP growth at 5%+ is at a record high and unemployment is at a record low. So raising rates from “0%” should be no problem at all whatever school of economics one subscribes to… So why is the Fed procrastinating and not solving the inflation problem in 15 minutes?

2022 – The great unravelling

As explained in the introduction, what we are living through is a very unique period and there is no precedence to a bubble built on fiat money in the asset classes of bonds, equities, and real estate unraveling one after another. Thankfully, we do have as reliable guides in “Human Action”, “Man, Economy, and State” and “The Wealth of Nations”. Standing on the shoulders of these giants, maybe we can begin to extrapolate on the decade ahead.

What Jerome Powell promised in the last Fed meeting was to taper the QE and launch a series of rate hikes – possibly 3 quarter-point hikes in 2022 and another 3 more in 2023. So even under the “most hawkish” scenario, we are looking at an interest rate of about 1.5% by end of 2023. This is when the inflation is likely to be substantially higher than the 7% due to the monetary inflation creation over the previous decade (and this has been explained in the first article – Are we at the inception of an Inflationary Depression). At a negative real interest rate of -5%, this probably has to be the most dovish monetary policy since the creation of the US Fed in 1913.

But can Powell deliver on at least the above absurdly low expectations? Not a chance in my opinion.

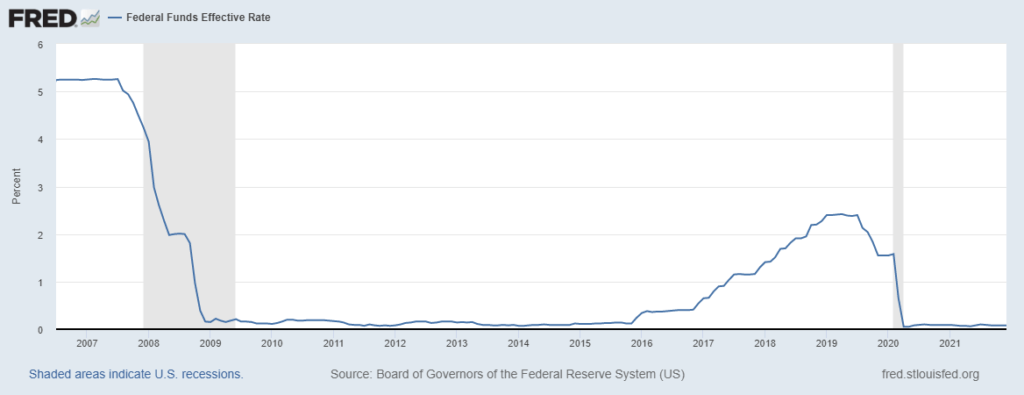

Since the Great Recession of 2008 prior to which the Fed funds rates were at 525 bps, the Fed has attempted one rate hiking cycle in the last 14 years. It briefly managed to hike the rates to 250 bps between 2016-18 before the bond markets started freezing and we had the overnight liquidity crisis in the Repo markets. The Fed swiftly brought it down to zero, Covid providing a convenient excuse, though I would have to point out that the easing had started even prior to Covid.

Technically, I would have to point out that the appropriate monetary response to Covid would have been a hike in the rates and QT to soak up the excess money supply in the face of falling supply/ production. The supply chain disruptions are just a manifestation of excess money in circulation. Just imagine if we all get a Million Dollars tomorrow, there would be supply chain constraints in the production of Ferrari’s. Or in other words, the supply chain bottlenecks are not causing inflation (i.e. Consumer price Inflation), but rather inflation (i.e. monetary inflation) is causing the supply chain disruptions.

As long as we continue on the path of negative real interest rates, and the Fed is very likely to do so for the foreseeable future, we will have the so-called supply chain disruptions and ultimately increase consumer price inflation.

The maximum interest rate that the leveraged US economy can now handle is about 0.5% before we start having markets freezing once again causing the Fed to drop the rates back to zero. Maybe we will get one rate hike of 25bps or utmost two hikes totaling to 50bps before the eventual capitulation of the US Fed to the distress calls from the capital markets. That is if the US Fed even attempts one.

Given the experience of 2016 – 18, it is possible that the US Fed would have learned its lessons that raising interest rates is not a “15-minute activity”. So why even embark on an exercise that is doomed to be reversed. It would be easier to sell excuses that inflation is because of excess growth and hence its good. Given the prior utterances on many policy matters, something to the above would not be entirely outlandish and would be consistent with the economic gibberish that the US Fed and the other central banks have been selling to the gullible media.

Of course, the mere act of tapering could cause either the US housing bubble 2.0 or the bond bubble to burst. I suspect it would be the former given the much smaller size, but the act of either raising or nor raising interest rates would eventually cause an unwinding of the bond bubble. It is going to be an event for the history books, and decades down the line, historians would be asking “How in the hell did the world at large trust in pieces of paper as money?”

That of course is an event that will happen a few years down the line. For the here and now, the specific forecasts for 2022 are given below.

- The Fed would attempt 1 or 2 rate hikes, but would quickly reverse course and take the Fed funds rate back to zero. There is virtually zero probability that the Fed hikes rates 3 times in 2022 and again repeats the act in 2023.

- The onset of a recession in the second half of 2022 would last for years and years to come. This could well be triggered by a collapse of the housing bubble 2.0

- Inflation to be at least as high as it was in 2021 on a comparable basket (the Fed is changing the composition of the CPI basket and hence the disclaimer).

- Gold to make all-time highs and perhaps cross $2500/oz.

- US national debt to cross $36 trillion.

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

Reference:

[1] Are we at the Inception of an Inflationary Depression? – Jun 17, 2021, PGurus.com

[2] Is the world about to be Weimared? – Nov 04, 2021, PGurus.com

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- 2008 Redux? YES and NO - October 23, 2023

- Is there a conundrum in the US Housing Market? - September 21, 2023

- Why the Fitch downgrade doesn’t make sense - August 14, 2023