Introduction to HFT

Please do not glaze over this post. This affects you. Especially the demographic that reads PGurus. Many of you may be playing the stock market actively or through Mutual Funds that are now becoming commonplace. If you have Netflix or Amazon Prime subscription, you may have seen movies like The Wolf of Wall Street or The Big Short. These will give you a general idea of how scams based on Stocks and other financial instruments happen.

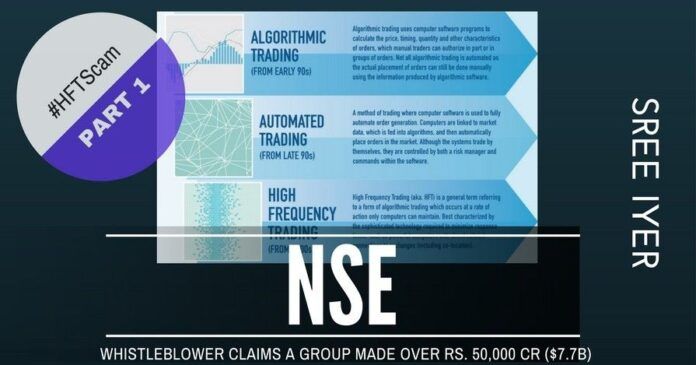

If you are an avid reader, you may have even read Flash Boys by Michael Lewis. If you have not, I highly recommend my post What is High Frequency Trading and How it affects you. This appeared in April 2015 in MoneyLife. This is a fairly comprehensive article that details how High Frequency Trading (HFT) works. The links in the posts point to some fairly significant events that happened in the past, when exchanges stopped trading to listen to Michael Lewis and others who alleged that the “Stock Market is rigged”!

Here is a 11-minute must see video that talks about how HFT consistently beats the competition. This is important as this video visually shows how HFT can be a lethal player when it is located near the server that arbitrates the sale of a stock. This is also called co-location. Other technical terms such as Front running, Spoofing are also described in this video. Not only that, this video also suggests solutions that will make HFT systems lose their advantage, thereby leveling the playing field.

What is this series about

In this series, I will detail how your hard earned money is being ripped off by some unscrupulous traders using HFT algorithms. By design, HFT based trading is rigged, according to Michael Lewis, the author of Flash Boys. CNBC aired this 23-minute video in which the CEO of a newly created exchange tried to bluff his way out of the allegations made by Michael Lewis. This exchange of “pleasantries” caused a stoppage of trading in several US exchanges! Michael Lewis contended that the way Stock Exchanges were currently designed, it systematically disadvantages a certain set of investors. Note to Day traders – You cannot beat the HFT machines because of the way they are located so close to the exchanges.

This detailed video by Brad Katsuyama, the founder of IEX (Investors Exchange), describes how his team has found a way to level the playing field for all investors. Brad tells how from his personal experiences at Royal Bank of Canada (RBC) the devastation HFT was inflicting upon the investors. The entrenched HFT based firms tried their hardest to stop IEX from becoming a stock exchange but with spirited help from volunteers (myself included), the US Securities Exchange Commission (SEC) saw through the mudslinging and granted permission for IEX. At least in the United States, there are exchanges that level the playing field for investors.

A Whistleblower who worked at NSE blows the lid off a scam

We are in possession of a document by a whistleblower, who used to work at the NSE (National Stock Exchange). The whistleblower has named specific companies and brokers who indulged in this. Their nefarious methods of getting information that is supposed to be kept a secret are also shown. I will do my best to explain relatively difficult stock market jargon. Fasten your seatbelts and enjoy the ride!

To be continued…

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] Part 1, I defined a few terms associated with High Frequency Trading (HFT) explained its beginnings and how it was gamed in the United States of America. Part 2 describes the […]

[…] In Part 1, I defined a few terms associated with High-Frequency Trading (HFT) explained its beginnings and how it was gamed in the United States of America. Part 2 describes the amount of money looted by a small set of players, close to Rs.50,000 – Rs.70,000 crores ($7.7B – $11.5 B) over a five-year period. In Part 3, how a few benefited at the expense of many was described. This is Part 4. […]

[…] Part 1, I described how computers entered the Stock markets and how in the recent times High-Frequency Trading (HFT) has been gaming the markets in the United […]

[…] Anatomy of a crime P1 – How some benefited from HFT… […]

The ones with superior programs and close to the main server made money. The “small” investor never makes money by trading. Only by investing and choosing correctly.

HFT is a rip off. First you call in ” Investors” Build up training programs. Boost their ego with things and use charts as the basis. Then you rip them off slowly.

Remember HFT is also applicable to currency trading, Bonds Interest rate derivatives etc.

HFT in all it’s form is a fraud on the people. If institutions and Govts give approval it means someone somewhere is on the take.

Good article.

Pleased to share my publication at Amazon kdp vide URL http://www.amazon.com/dp/B075HR3G96