[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]Y[/dropcap]ou want a loan for a house or a flat from a commercial bank then your Credit Information Bureau (India) Limited (CIBIL) score is important for the bank. CIBIL’s products, especially the CIBIL Score and the Credit Information Report(CIR) are very important in the loan approval process. The credit score helps a loan provider to quickly determine, who they would like to evaluate further to provide credit. Even though the credit rating is only a decision support system many banks use the score for the decision making. The CIBIL Score ranges from 300 to 900. Data indicates that loan providers prefer credit scores which are greater than 750

Once the loan provider has decided which set of loan applicants to evaluate, it analyzes the CIR in order to determine the applicant’s eligibility.

Once the loan provider has decided which set of loan applicants to evaluate, it analyzes the CIR in order to determine the applicant’s eligibility. Eligibility basically means the applicant’s ability to take additional debt and repay additional outflows given their current commitments.

That is the importance of CIBIL.

“TransUnion CIBIL Limited (Formerly: Credit Information Bureau (India) Limited) is a Credit Information Company (CIC) founded in August 2000. Post Inception, we have come to play a critical role in India’s financial system. Whether it is to help loan providers manage their business or help consumers secure credit faster and at better terms, the use of CIBIL’s products have led to a massive change in the way the credit life cycle is managed by both loan providers and consumers.”

https://www.cibil.com/about-us

History:

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]T[/dropcap]ransUnion was originally formed in 1968 as a holding company for the railroad leasing organization, Union Tank Car Company. The following year, it acquired the Credit Bureau of Cook County, which possessed and maintained 3.6 million card files. http://www.transunion.com/about-us/company-history

In 2010, Goldman Sachs Capital Partners and Madison Dearborn Partners acquired The Marmon Group.

Below is a history of TransUnion as it was acquired by one company after another:

-

In 1981, a Chicago-based holding company The Marmon Group acquired TransUnion for approximately $688 million.

Cunningham, Lawrence. “Book: All One.” Berkshire beyond Buffett: The Enduring Value of Values,.”. New York Columbia Business School. Retrieved 13 May 2015.

-

Almost thirty years later, in 2010, Goldman Sachs Capital Partners and Advent International acquired it from Madison Dearborn Partners

http://dealbook.nytimes.com/2012/02/17/advent-and-goldman-to-buy-transunion-in-3-billion-deal/?_r=2

-

In 2014, TransUnion acquired Hank Asher’s data company TLO. On June 25, 2015, TransUnion became a publicly traded company for the first time, trading under the symbol TRU.

http://www.insidearm.com/news/00007124-transunion-closes-acquisition-of-tlo-afte/

TransUnion has evolved its business over the years to offer products and services for both businesses and consumers. For businesses, TransUnion has evolved its traditional credit score offering to include trended data that helps predict consumer repayment and debt behavior. This product, referred to as CreditVision, launched in Oct. 2013.

https://www.gobankingrates.com/personal-finance/transunions-creditvision-better-lending-rates/

Its SmartMove™ service facilitates credit and background checks for consumers who may be serving in a landlord capacity.

In September 2013, the company acquired eScan Data Systems of Austin to provide post-service eligibility determination support to hospitals and healthcare systems. The technology was integrated into TransUnion’s ClearIQ platform that tracks patients demographic and insurance related information to support benefit verification.

http://www.bizjournals.com/austin/news/2013/09/24/transunion-acquires-austins-escan.html

In November 2013, TransUnion merged with TLO LLC, a company that leverages data in support of its investigative and risk management tools. Its TLOxp technology aggregates data sets and using a proprietary algorithm to uncover relationships between data that were not possible before.

http://www.vcpost.com/articles/18598/20131123/court-gives-approval-transunion-tlo-merger.htm

As part of its fraud protection products, it also offers business a tool called DecisionEdge that aggregates the data needed to prevent fraud through a system that customizes the information needed to finalize a transaction.

http://it-online.co.za/2014/10/27/transunion-enhances-fraud-detection/

For consumers, TransUnion offers credit monitoring and identity theft protection tools. The company’s app offers a function called CreditLock that allows an individual to unlock and lock their credit to help protect against fraudulent activity.

Legal and regulatory issues:

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]I[/dropcap]n 2003, Judy Thomas of Klamath Falls, Oregon, was awarded $5.3 million in a successful lawsuit against TransUnion. The award was made on the grounds that it took her six years to get TransUnion to remove incorrect information in her credit report. http://usatoday30.usatoday.com/money/perfi/credit/2005-09-27-credit-report-usat_x.htm

TransUnion has also been criticized for concealing charges. Many users complained of not being aware of a $17.95/ month charge for holding a TransUnion account.

In 2006, after spending two years trying to correct erroneous credit information that resulted from being a victim of identity theft, a fraud victim named Sloan filed suit against all three of the USA’s largest credit agencies. TransUnion and Experian settled out of court for an undisclosed amount. In Sloan v. Equifax, a jury awarded Sloan $351,000. “She wrote letters. She called them. They saw the problem. They just didn’t fix it,” said attorney A. Hugo Blankingship III of Blankingship & Associates in Alexandria, Virginia. http://www.law.com/?id=1155648410038&slreturn=20160906012418

TransUnion has also been criticized for concealing charges. Many users complained of not being aware of a $17.95/ month charge for holding a TransUnion account. In March 2015, following a settlement with the New York Attorney General, TransUnion, along with other credit reporting companies, Experian and Equifax, agreed to help consumers with errors and red flags on credit reports. Under the new settlement, credit-reporting firms are required to use trained employees to respond when a consumer flags a mistake on their file. These employees are responsible for communicating with the lender and resolving the dispute

https://www.consumeraffairs.com/privacy/transunion.html

About CIBIL:

CIBIL stands for Credit Information Bureau (India) Limited. It is India’s first Credit Information Company, which was founded in August 2000. After establishment, CIBIL played a vital role in Indian Financial System. It helps in collection and maintaining records of Individual payment affecting loans and Credit Card. The member bank and all the credit institution submit their records to CIBIL on monthly basis. The information received from banks and credit institutions would be used to create Credit Information Report and Credit Score that are provided to credit institution to help in evaluation and approving loan applications.

Objectives of CIBIL:

It takes pride in having the topmost credit information sharing in India that makes enable the credit grantor in accepting payment and information backed decisions.

CIBIL has gained knowledge, experience and expertise to offer data and technology backed solutions.

Wide gamut solutions were developed diligently for helping our customers in making intelligent decision in entire stage of customer life cycle.

Evolution of CIBIL:

Apr 2011: individuals were able to avail CIBIL TransUnion Score

Sep 2010: First centralized database on Mortgages in India- CIBIL Mortgage Check was launched

Jul 2010: CIBIL Detect – India’s first repository for information on high-risk activity was initiated

Nov 2007: CIBIL TransUnion Score introduced to Banks

May 2006: Started Commercial Bureau operations

Apr 2004: CIBIL Launched Credit Bureau services in India (Consumer Bureau)

Aug 2000: CIBIL was Incorporated basis the recommendations made by the Siddiqui Committee

Nov 1999: CIBIL is also Report submitted by Siddiqui Committee for setting up India’s first Credit Information Bureau

https://www.cibil.com/our-evolution

Functions of CIBIL:

The Consumer Bureau of CIBIL keep its dynamic information repository of India for providing its member comprehensive risk management tools

Consumer Credit Information is important tool used by credit grantor at the time of new customer acquisition.

Portfolio Review provides the credit grantor with a comprehensive view of their borrower’s credit relationships across multiple lenders.

http://www.jagranjosh.com/articles/what-are-the-roles-and-functions-of-cibil-1445327240-1

What is the role in the Loan Approval Process?

Post completion of the desired score– loan provider will request for the applicant’s income proof and other relevant documents in order to finally sanction the loan.

What this means for you as an individual?

Since, the credit score and Credit Information Report (CIR) not only helps loan providers identify consumers who are likely to be able to pay back their loans, but also helps them to do this more quickly and economically. This translates into faster loan approvals.

Until recently, there was little visibility and transparency with regards to the loan approval process and the elements that loan providers used to evaluate your loan application. Since, CIBIL has made your credit score and CIR available to you, you will be able to see how valuable a customer you are to loan providers.

In alignment with our creed, CIBIL empowers both loan providers and individuals to see their world more clearly and hence, take better and more informed decisions.

https://www.cibil.com/about-us

CIBIL Collects money from bankers for scoring and also from customers for providing their score if they ask for it.

The total income/ Profits of CIBIL are not clear since they are not available easily. We estimate that CIBIL may be earning more than Rs. 100 crores in a year.

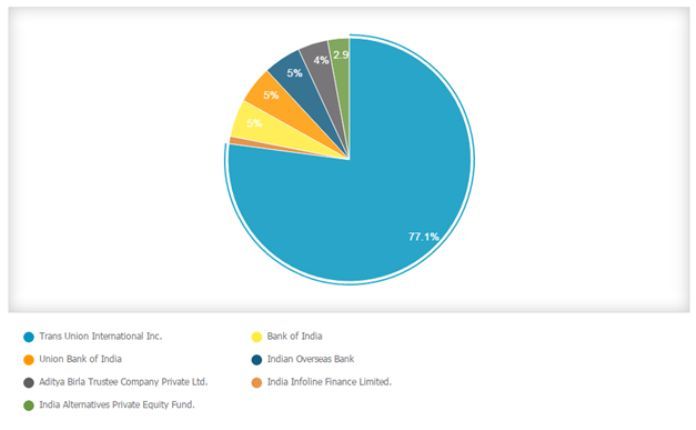

The diversified shareholding pattern includes the following entities:

https://www.cibil.com/shareholding-pattern

From the Shareholding pattern it is clear that 77% of shareholding is with Transunion International Inc. This imply that millions of credit data of Indians are held/ controlled by a foreign private company. We also do not know about their sharing arrangement if any with other international security agencies like the CIA etc.

This whole scheme has come into existence during UPA time and more so when

-

Chidambaram was the Finance Minister—See Annexures. So it is one more albatross on our neck gifted by the UPA. Sooner we get rid of this better for us.

It is important that we re-visit this entire CIBIL model of mortgaging our interest before global capital since we are sure we have enough expertise and capability available among our own domestic companies – both in the Public and Private sectors.

Credit data of millions of Indians is too sensitive to be held in HK or London or NY. Let India decide about this important issue.

No.11(1)/2008‐FIPB

Government of India

Ministry of Finance Department of Economic Affairs

(FIPB Unit) * * * * *

North Block, New Delhi – 110 001

Dated the 29th May, 2008

PRESS RELEASE

Based on the recommendations of Foreign Investment Promotion Board (FIPB) in its meeting held on 23rd May, 2008, Finance Minister, Shri P. Chidambaram has approved 14 Proposals of Foreign Direct Investment amounting approximately to Rs. 825.75 Crore. The proposals relate to Ministries/Departments, namely Chemicals & Petro‐chemicals, Industrial Policy & Promotion, Information & Broadcasting, Urban Development, Tourism and Economic Affairs.

(Prabodh Saxena)

Director (FIPB) 23093558

E‐mail: prabodh.saxena@nic.in

To

The Deputy Director General (M&C)

(Shri B.S. Chauhan) Ministry of Finance

Copy to:

- PPS to JS(FT)

- NIC (DEA)

- Facilitation Counter

- DIPP (FDI – Data Unit)

CIBIL-Should Our Credit Data Be With a Foreign Company-Oct-5-2016 by PGurus on Scribd

- नकली खबर लक्षण है, बीमारी नहीं! - April 16, 2018

- Fake News/ Accreditation and Sedition - April 4, 2018

- Two Poisonous Seeds - March 15, 2018

Equifax also in possession of microfinance consumer credit info. Cibil is also entering into that segment.