No moral dimensions are involved in explaining oil prices but there are powerful economic blind spots at work

In the Agathe Christie fable of Murder on the Orient Express, the most affable detective Hercule Poirot offers two explanations for the murder of Ratchett, which happens on a moving train. Given the complex moral dimensions involved, Poirot eventually recommends the simple but incorrect explanation which is accepted by the police.

There are apparently no moral dimensions involved in explaining oil prices, but there are powerful economic blind spots at work. That said, the wreck that the Keynesian economists have created for the world economy, and these all-good-assets-bubble which has just started unwinding, perhaps create a moral imperative as well. For want of a better phrase, I will term these as the “99% explanation” and the “1% explanation”. 1% would probably be a great exaggeration of the number that have even heard about, let alone subscribe to, Austrian economics – probably 99.99% and 0.01% would be a better reflection of the division in the ranks – if one can even call it that. However, for the sake of simplicity, I will stick to whole numbers.

The 99% explanation

Since the COVID-19 epidemic associated lifting of controls and lockdowns, the world has been on a tearing growth with the two leading economies – US and China recording 5.97% and 8.1% GDP growth respectively in 2021. This growth, facilitated by an accommodative monetary policy by all central banks, has caused severe constraints on the supply chain and has caused an increase in the price of all commodities, including crude oil. This has resulted in inflation growing at levels that are well above the mandate of central banks. Or in other words, an increase in crude oil prices due to the strong growth has resulted in inflation rates going up.

With central banks increasing interest rates (BoE has already increased, the US Fed has indicated a series of 6 to 8 increases each typically 25 bps over the next 2 years), this should moderate the growth in these economies. This nuanced policy of central banks should result in a moderation of growth leading to a reduction in the demand for commodities. So we will witness a reduction in the price of crude oil in the months and years ahead as these interest rates hikes begin to work through the system.

So lucid and simple!!!

The 1% explanation

Inflation (i.e. an expansion in the supply of money and credit) is causing crude oil and indeed the entire basket of commodities to go up. Obviously, a very different definition of inflation has been used and I have to point out, that this used to be the original definition till the Keynesians took control of the economics in every possible forum – Govt, academia, and think tanks.

Just for the reader to understand the difference, I would refer to a previous article “Are we at the inception of an Inflationary Depression?”.[1]

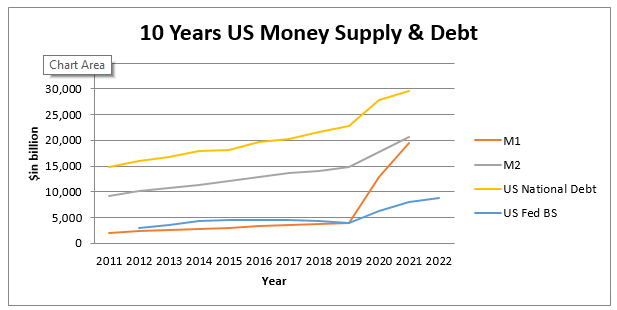

Whatever financial measure of money/ credit one wants to use, M1, M2 or the US National Debt or the size of the US Fed Balance Sheet – all have witnessed exponential growth in the last couple of years. Most importantly, despite the promises of the US Fed to taper the QE program, the end to this growth is nowhere in sight in my opinion.

So where does this lead us? As I see it, this is going to be the start of a bull run in the price of crude oil that is going to last for another 5 to 10 years in which the price of crude oil is going to increase substantially. Can crude oil go to 200, 300, 500, 1000?

The problem with price forecasts is the unit of accounting that is used next to the numbers 200, 300, 500, and 1000 i.e. the USD. The US Dollar today is a free-floating abstraction whose value is in the minds of holders but is otherwise intrinsically worthless. As indeed all national currencies today are – with some differences that actually make the situation worse for the USD vis-à-vis other currencies. So it is not possible to define a ceiling to crude oil prices because it is impossible to define the floor for the US Dollar. Other than its intrinsic worth which is zero and in which case, crude oil should be priced to infinity in terms of USD.

Gold is and has been for the last 5000 years a much more reliable unit of accounting i.e. money. I do expect the price of crude oil to go down when measured in terms of ounces of gold rather than USD. So using an ounce of gold, we can buy around 19 barrels of oil, and going forward, we should be able to buy perhaps around 25 barrels per ounce of gold over the next few years. So prices of crude oil, as indeed other commodities in general, will fall when measured in terms of real money i.e. gold. That should satisfy the deflationists, if there are any still around (although just to complete the argument, I have to point out that the deflationists’ arguments are in terms of fiat money i.e. USD).

So whether the price of crude oil goes up or down over the next 5 to 10 years, depends on the unit, one is going to measure it with. Something with a history of serving the purpose of money over thousands of years (i.e. gold) or something that has been foisted upon the unsuspecting world by Keynesian economists in the last 50 years (i.e. USD)? Suffice to say as a conclusion of the 1% explanation that 2022 might well be the last year ever in which we will witness a double-digit price of crude oil in terms of USD – at least on an annual average basis if not Spot. Most probably, the latter as well.

That is saying something especially given that the crude oil futures were trading negative less than a year back. That time period (Apr 2020) when the futures of the most precious liquid commodity on the planet was trading negative was also the bottom of the CRB Index and now the stars are perfectly aligned for an inflationary depression in the decade ahead.

Conclusions

So which is the correct forecast i.e. the 99% or the 1% explanation? I have laid out the arguments and the readers can choose. Perhaps a re-reading of the “Are we at the inception of an Inflationary Depression?” might help if one is unable to decide.

I have very few doubts as to what would be the talking points on the mainstream media or in the policy assumptions of governments. The arguments, if any, would be whether the stimulus should be used to fund capital projects or directed towards personal consumption – and there would fierce debates as to what the correct alternative is given the circumstances. But as Austrian economists would poignantly say, that is indeed a distinction without a difference.

As far as crude oil prices are concerned, governments will point to the usual suspects – supply constraints, terror premium, Russia/ Ukraine, greedy capitalists, reckless speculators, capitalism, growth, etc. And the gullible media as well as the public will accept this version lock, stock, and barrel.

The one and the only real reason why prices go up on a secular basis are that governments live beyond their means and they use the central banks to monetize their deficits. It is no different this time in the case of crude oil and we have just embarked on a stagflationary period that will last a decade. The roaring twenties of the previous century (1921-1929) are going to be replaced by the busted twenties in the current century (2022-203X).

The other difference between the Great Depression and today, which is a reason for hope in an otherwise gloomy economic forecast, is this – the governments blamed the Great Depression (1929 – 1946) after the roaring twenties on the gold standard. They very systematically severed the link to gold starting with the confiscation of gold by FD Roosevelt in 1933, followed by Bretton Woods (1944), and Nixon eventually closed the Gold Window (1971). This time around, hopefully, we get back on the gold standard after the depressionary decade ahead. But I am also equally sure that will happen only after the governments have exhausted all other options – including the incredibly naive idea of Central Bank Digital Currencies – and are eventually forced by the markets to do so.

That then is the memo.

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

Reference:

[1] “Are we at the Inception of an Inflationary Depression? – Jun 17, 2021, PGurus.com

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- 2008 Redux? YES and NO - October 23, 2023

- Is there a conundrum in the US Housing Market? - September 21, 2023

- Why the Fitch downgrade doesn’t make sense - August 14, 2023