Fitch cuts US credit rating from AAA to AA+

Rating agency Fitch recently downgraded the US government’s Foreign Currency Issuer Default Rating from AAA to AA+. The downgrade apparently was on account of the expected fiscal deterioration over the next few years, the growing debt burden, and the repeated debt-limit standoffs and last-minute resolutions.

The rationale makes little sense. Now don’t get me wrong. I think the US ratings should be Junk or “D” which is the lowest rating on the Fitch scale. In fact, a default (for all practical purposes), by the US government is a certainty at this juncture. But for the reasons provided by Fitch, ratings deserve to be AAA. Fitch is either mortally afraid of stating the real reasons or they are really clueless – the readers can come to their own conclusions.

The downgrade

The expected fiscal deterioration, the growing debt burden, etc. are all valid reasons. In fact, as I had written earlier “Powell’s ‘Subprime is contained’ Moment”, multi-trillion dollar deficits are soon going to the order of the day[1]. To place this deficit in context, the expected revenue in 2023 is expected to be $4.8 trillion (fiscal 2022 revenues were $4.9 trillion). The deficit for 2023 is projected to be $1.5 trillion and this is supposedly at a time of near full employment, robust GDP growth, and stock markets up nearly 10% over the last 12 months.

In fact, it’s this preemptive Keynesian stimulus of $1.5 trillion and the under-reporting of consumer price inflation that is masking the deep recession in the US Economy.

The debt burden is also set to increase. The housing bubble 2.0 burst is just around the corner (and the QE that would be required this time would dwarf the QEs needed after the 2008 crash. A $40 trillion national debt (nearly $33 trillion now) by the end of 2025 is a very probable outcome. At a 5% interest rate, about 2 trillion will go towards interest payments alone.

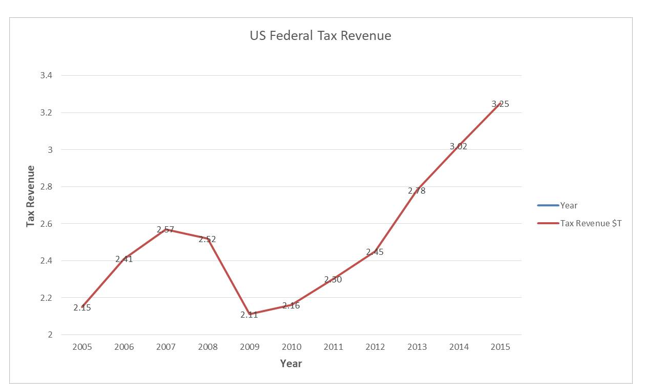

What will happen to the Federal tax revenues during the housing bubble 2.0 burst? Between 2007 and 2010, there was a nearly 20% decline in Federal revenues and it was not until 2013 did the revenues cross the 2007 numbers. There is every reason to believe that the decline could be even greater than what happened during the 2008 crisis. So we might even have a situation wherein nearly 50% of the revenues go towards servicing only the interest on the national debt. The US government expected fiscal numbers more than justify it being declared as a Banana Republic!!! A downgrade from AAA to AA+ is a sham.

But then I had also stated that for the reasons provided by Fitch, the ratings should still be “AAA”. Why is that? The United States government has the unique privilege of being able to borrow in the currency that it can print at will and has repeatedly shown that it will do so. So whatever the magnitude of obligations, the US government can always clear them as long as it’s denominated in US Dollars.

History of the debt ceiling

Since the creation of the debt ceiling in 1917, the US government has always increased it to meet its obligations – albeit with the occasional delay. Perhaps more than 100 times. As ironically stated over and over again by US politicians, “the US government always pays its bills”. They do very conveniently forget to mention that the claim is valid as long as the bills are denominated only in US Dollars.

As we speak, the US government has temporarily suspended the debt limit and this would well be the equivalent of Aug 15th, 1971 when Nixon temporarily closed the “Gold Window”. So the US government might never have the self-imposed restraint on it again.

But even if they reintroduce the debt limits, and the chances are almost 100% that these limits will always be increased when required allowing the government to spend at will. To argue that US politicians have suddenly discovered the virtues of living within their means is to place confidence in the Congressmen that they will do what is economically correct and not what is politically expedient. The US will never default on its nominal payments and hence there is no reason to downgrade the AAA rating on that front.

Why the Junk Reco?

There are two ways to default – and this is especially true when dealing with Central Banks. Even more so when dealing with the Central Bank that is managing the reserve currency of the world.

- First is the honest method of default which is bankruptcy i.e.to accept that the resources on hand do not allow for servicing the debt obligations and asking the lender to take a haircut on the outstanding amount.

- Second, the more insidious method is to default through inflation. This is a choice that is available only to Governments as only they can create inflation to devalue the currency.

a. The most simple way is to have a negative real interest regime as the US has had for nearly the last 15 years. Holders of Treasuries lose not in nominal terms but in real purchasing power terms. They get paid whatever Dollars they were promised, but these currency units have lost substantial purchasing power in the intervening period.

My proposition is that the primary route of default by the US government in the years ahead is going to be inflation and not bankruptcy. So if the Fitch rating is referring to the risk of default in nominal terms which is what they seem to indicate, the chances are indeed near zero and the US government deserves a rating of AAA; but in terms of purchasing power, it ought to be Junk. There is an inflationary tsunami right ahead that these rating agencies are refusing to recognize.

The inflation tsunami ahead

That the housing bubble 2.0 burst is right ahead, perhaps even in a matter of weeks, should not be a surprise to regular readers. I have explained the same in “Why 2023 Has to be Worse than 2008 – Pt I” and “Why 2023 Has to be Worse than 2008 – Pt II“[2][3].

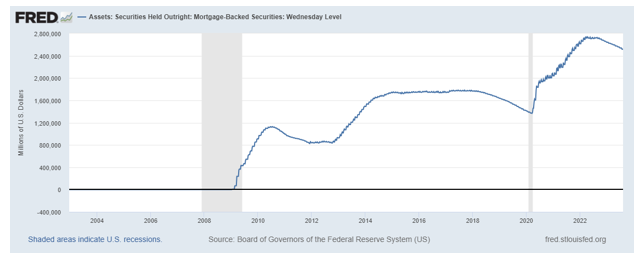

For those who still deny the existence of the bubble, the very basic question to be asked is, why is the US Fed holding 2.5+ trillion of MBS portfolios on its books? As I have written this housing bubble is bigger than the 2008 bubble primarily on account of ZIRP rates for nearly 15 years. As if that was not sufficient to re-inflate the bubble, the Fed has actively purchased the MBS portfolio’s propping up asset prices.

The basic ingredients of bubble pricing in assets and the dramatic increase in interest rates that reduces affordability are already in place. It’s only a matter of time before the sellers realize that waiting for a better price is not going to be beneficial and the trickle of inventory will turn into a flood. Perhaps this time around, commercial real estate will lead the burst and the retail collapse will follow.

How about the timing of the housing bubble 2.0 burst? Perhaps in the weeks ahead – if not weeks, maybe a matter of months. The fuse was lit with the increase in rates and the QT; it’s too late to do anything now.

So where does the inflation come from?

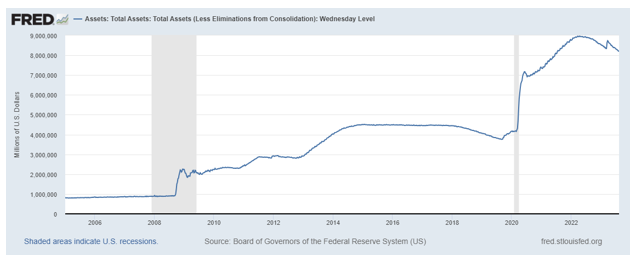

The size of the US Fed Balance sheet was less than $1 trillion prior to 2008 and it now stands at $8+ trillion.

Just to remind the readers, inflation is just an expansion in the supply of money and credit. All of the inflation created by the US Fed post-2008 has resulted in higher asset prices – stocks, bonds, and real estate. The manifestation of the historical inflation into consumer prices has just started and we have a long road ahead.

The inflation tsunami is of course going to come when the Fed transitions from the current QT to QE. It’s only a matter of time and when the housing bubble bursts, the Fed will be forced to go back to QE. The monetary inflation is going to be the massive expansion of the US Fed balance sheet. Double-digit consumer price inflation (even with all of the manipulated numbers) is going to be the result.

The Fitch Ratings

What Fitch has assumed in the marginal downgrade of the ratings are the following:

- That the US Congressmen are going to be responsible and stick to the debt limits instead of increasing them.

- In terms of sequencing of the expenses of the US government, they are going to place a greater preference for debt repayment rather than internal obligations such as social security, medicare, and the US military expenditures.

Otherwise, the marginal downgrades do not make sense. The ratings can continue to be AAA for the record in terms of the nominal repayment of the commitments of the US government in US Dollar terms. However, the holders of the US currency, in any form, are in real danger of losing most of their purchasing power in the years ahead via inflation

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

Reference:

[1] Powell’s “Subprime is Contained” Moment – May 31, 2023, PGurus.com

[2] Why 2023 has to be worse than 2008 – Jan 05, 2023, PGurus.com

[3] Why 2023 has to be worse than 2008 – Part 2 – Mar 21, 2023, PGurus.com

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- 2008 Redux? YES and NO - October 23, 2023

- Is there a conundrum in the US Housing Market? - September 21, 2023

- Why the Fitch downgrade doesn’t make sense - August 14, 2023