[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]G[/dropcap]old –the yellow metal, is one of the favourite metals shopped in India, especially during weddings and on few other auspicious occasions such as Akshaya Tritiya, Diwali (Dhanteras) etc., gold is purchased by us. Even the poorest try to buy gold on specific dates in the year as it is considered auspicious.

Indian Government has launched three new gold schemes; indeed govt. has realized the importance of Gold towards the growth of economy. Now let us see what the three schemes are and how they are going to be implemented:

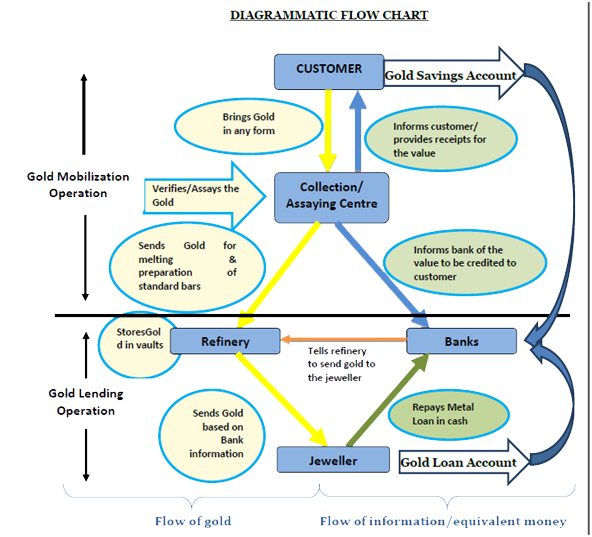

- Banks will accept Gold Deposits from the public & you can earn the interest of 2.5% on gold for underlying idle gold in the house, on maturity, depositor can get the cash equivalent of the gold at that time. The minimum quantity of gold that a customer can bring is proposed to be set at 30 grams, so that even small depositors are encouraged. Gold can be in any form (bullion or jewelry).

Utilization of the gold deposits by the Bank –

- CRR/ SLR: To incentivize banks, it is proposed that they may be permitted to deposit the mobilized gold as part of their Cash Reserve Ratio (CRR)/ Statutory Liquidty Ratio (SLR) requirements with RBI. This aspect is still under examination.

- Foreign Currency: Banks may sell the gold to generate foreign currency. The foreign currency thus generated can then be used for onward lending to exporters / importers.

- Coins: Bank may convert mobilized gold into coins for onward sale to their customers

- Exchanges: Banks to buy and sell on domestic commodity exchanges, where mobilized gold can be delivered.

- Lending to jewellers:For lending to jewelers

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]T[/dropcap]his scheme involves gold monetization, which means melting down the gold in the form of gold bars. So if you deposit a gold necklace it doesn’t mean you will get back the same, you will be receiving it back in the form of Gold bar. Hence, this scheme get a little complicated as most of the women would not be willing melt down their beloved jewellery in to Gold bar, unless and until there are in real need of Money. Further, temples would also not like God’s jewelry to be melted. In fact for a specific festival, a specific set of jewelry is set aside – so most likely temples will not part with their gold. So the objective of the government to mobilize the gold held by the household looks difficult.

Click here for the Gold Monetization Scheme from the Government

- It will sell Sovereign Gold Bonds to people who want to buy gold in future; the bond will carry an interest of 2.75%. People who want to buy gold for marriage which are years away can buy these bonds instead of physical gold, which will in turn help the government to reduce the import to some extent. Here we would be investing in Gold bonds instead of Rupee bonds, also, the gold price are internationally linked to the dollar; hence we would be investing in dollar bonds which may impact the interest rates.

- They will sell Indian Gold Coins; as said earlier Indians tend to buy gold on many occasions every year they may be encouraged to buy these gold coins and they can be useful for gifting purposes, however the success of this scheme will be determined at people’s level, time is say it all.

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]S[/dropcap]o far the Scheme has attracted only 400 grams according to reports even though coins have been sold in good number—more than 6000.

Other than the aspect of Gold jewelry returned as bar form which is not going to be popular among women who are interested in the original jewelry design etc the important issue is that Gold is used as collateral in small businesses like retail trade/ small restaurants etc.

Vegetable vendors/flower sellers/ small shop keepers or one truck owners etc use gold jewelry as security for borrowing in the non-bank financial markets –from money lenders etc. They may not have any other assets like shares/bonds/LIC certificates or even houses to give as collateral.

As I have elsewhere mentioned the simple model for measuring the performance of our economy is as follows, by watching my flower seller:

If I see both her bangles- while measuring flower to me- then economy is fine. If she has only one, then things are not fine since she has mortgaged the other one for her working capital. If she does not have both bangles then recession has set in.

In that context it is imperative that Government implement MUDRA initiative in full-fledged model –integrating financial markets- so that the “unorganized” sector gets loans based on future income rather than only collateral for this Gold scheme to succeed.

Currently public sector Banks are showing their traditional lending of less than Rs 10000 as Mudra lending. They are even showing past lending also. But that is just statistics for MUDRA not real one.

But MUDRA initiative is to create a larger framework of integrating last mile lender into the system and reduce cost of lending. Not just PSB banks’ lending to the unorganized sector. Let us wait for legislation expected in this winter session on this MUDRA initiative of integrating all financial markets namely organized and unorganized and bringing in the last mile money lender for Re-financing similar to NHB role in housing market.

Elsewhere we have shown that nearly 60% of aggregate credit requirements of trade is met by Non-bank sources and all of them rely on Gold jewelry for security. [India Uninc—Tata Westland—2014]. The certificate of deposit of gold will not be an acceptable collateral by money lenders etc.

Hence one can say that Mudra success is sine qua non (something that is absolutely needed) for Gold monetization scheme to succeed.

- नकली खबर लक्षण है, बीमारी नहीं! - April 16, 2018

- Fake News/ Accreditation and Sedition - April 4, 2018

- Two Poisonous Seeds - March 15, 2018

Excellent, simplified and more effective workable suggestions/options which can result in a win-win situation for all.