When I first read this story in the Business Standard[1], I thought that this was another one of those things that looks promising but will peter out in the end. But imagine my surprise when I read that the Securities and Exchanges Board of India (SEBI) has registered a case with Mumbai’s Economic Offences Wing (EOW) against the 300 brokers of NSEL under Forward Contract Regulation Act, 1952, for illegal trading in commodities in the platform[2]. Congratulations to the SEBI for moving so quickly. In order to ensure that justice is swift, I would request SEBI to clarify a few things –

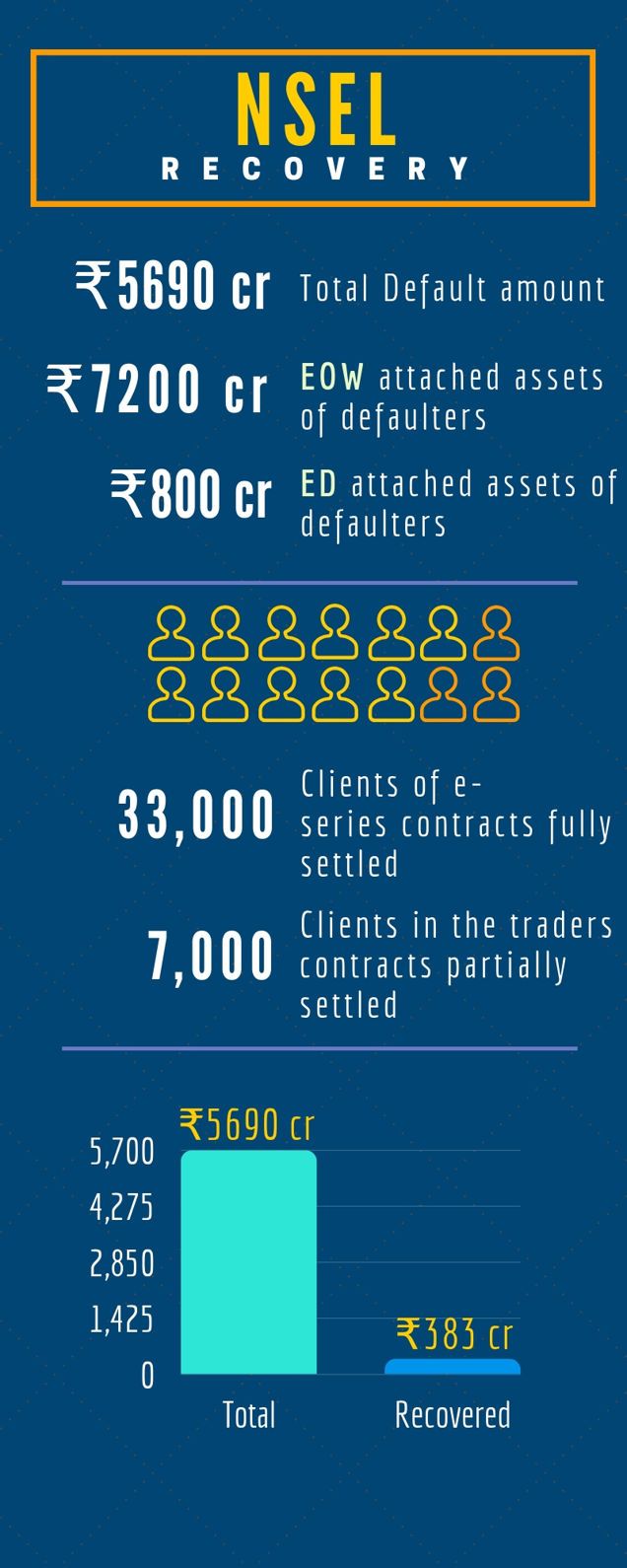

- Are you taking action against the remaining 22 defaulting members who traded on the NSEL? Two have paid up fully. As of June 2018, only Rs.383 crores has been recovered from these defaulters[3].

- About 30 owe close to 70% of the money. Concentrate your efforts on these 30. Examine their foreign bank transactions, especially through banks like ICICI Bank and HDFC Bank. There is a wealth of information that will make your task easy. Go after them swiftly and recover the money. Settle this manufactured crisis at NSEL once and for all[4]. Return the money owed to the long suffering stakeholders. Will you do this?

EOW must unfreeze 63 Moons operational accounts

The scope of the crimes committed in NSEL is now well defined. EOW currently has Rs.7200 crores of assets from the suspected defaulters[5], which is more than the Rs.5600 crores in the NSEL scam (see Figure 1). With SEBI moving decisively to narrow in on NSEL, the EOW must un-freeze the operational accounts of 63 Moons. These are two separate entities and freezing 63 Moons assets smacks of an attempt to deny oxygen to the technology group. What are you waiting for, EOW?

SEBI, act now!

It behooves SEBI to act quickly in this case. Justice delayed is justice denied.

References:

[1] SEBI issues show-cause notices to 300 brokerages in NSEL case – Sep 27, 2018, Business Standard

[2] NSEL case: On SEBI’s complaint, Mumbai Police’s EOW registers case against 300 traders – Sep 28, 2018, MoneyControl.com

[3] List of 24 defaulters and their payments as of June 2018 – Jun 26, 2018, NSEL.com

[4] NSEL crisis: Manufactured for whose benefit? Apr 6, 2018, PGurus.com

[5] NSEL scam: Mumbai police attach FTIL’s operational accounts – Apr 6, 2018, Livemint.com

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023