It is important to remember that many SMEs2 saw considerable growth only after the reforms of 1991, initiated by the Rao government. There may have been an implicit assumption that the Rupee would decline just to keep exports competitive. But when the Rupee appreciated for the first time, after several years of steady, gradual decline, the SMEs were caught off guard. Exporters who got say forty-five Rupees in early 2007 to a US Dollar all of a sudden on account of the appreciation of the Indian Rupee began to get a mere Forty Rupees to a Dollar around March, 2007. In short, what was hit was the top line of every exporter and it began putting extraordinary pressure on their very commercial viability. This risk of a fluctuating Rupee vis-à-vis other currencies – technically called Forex Risk – that was nominal till late 2006 had aggravated by the first quarter of 2007. Accelerating inflows of the US Dollar made the Rupee appreciate faster. A majority of them did not use any hedging techniques (see our previous post on how you can hedge for stability) to cushion the blow; In fact many of them did not even have a Chief Financial Officer (CFO)!

Enter the Banker, who promised SMEs that he/ she had just the solution for their problem. It was the Banker who approached the SMEs (this is crucial as the exporters never approached the bankers in the first place) and marketed certain “exotic” derivative products devised by them, claiming that these contracts are tailor made and structured products, legally tenable, designed specifically to effectively manage such conditions – read Forex risk arising out of the appreciation of the Indian rupee of Indian exporters. In fact, some averred that these contracts would result in profits over and above mitigating the extant forex risks faced by Indian exporters thereby explicitly converting a risk-mitigating tool into a profit-enhancing tool.

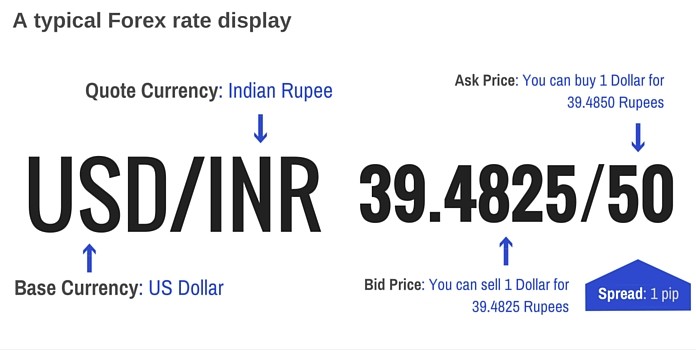

Before we dive into Exotic derivatives, a brief look at what is Forex trading and some terminologies (courtesy Oanda) by looking at the illustration below:

Anatomy of a Currency Pair

-

The first currency listed in the currency pair is called the base currency; the second currency is referred to as the quote, or sometimes counter.

-

When published with an exchange rate, the currency pair indicates how much of the quote currency is required to purchase one unit of the base currency. For example, USD / INR = 39.4825 indicates that one dollar can buy 39.4825 rupees.

-

When selling a currency pair, the exchange rate shows how many units of the quote currency you will receive when selling one unit of the base currency.

-

By enforcing these strict standards on how to refer to currency pairs, mistakes are reduced and it is easier to keep exchange rates organized and clearly understood.

-

When trading currency pair derivatives you are not trading the underlying; you are trading a derivative of this market.

Exchange Rates and Spreads

-

Each currency pair listed by your broker is accompanied by an exchange rate that shows the bid and ask price for the currency pair.

-

The bid price is the rate that your broker is willing to pay for the currency pair; in other words, this is the rate you receive if selling to the market.

-

The ask price is the rate at which your broker is willing to sell and represents the rate you must pay to buy the currency pair.

-

The bid price is always less than the ask price because brokers pay less than they receive for the same currency pair. This difference – known as thespread – is how your broker generates much of his/ her revenue.

-

The illustration above shows how brokers typically display a currency pair to show the current bid and ask price.

-

In this example, the bid is 39.4825 rupees to each dollar, while the ask is 39.4850 rupees to each dollar.

-

The bid price is always shown before the ask, and because the difference between two prices tends to be very small, brokers usually only display the last two digits when showing the ask price.

-

Pip = “Price Interest Point”.

-

A pip measures the amount of change in the exchange rate for a currency pair.

-

For currency pairs associated with INR, one pip is equal to Rs. 0.0025 or 4 pips make 1 paisa.

-

There are only 4 currency trading combinations done with the Rupee – USDINR, GBPINR, EURINR & JPYINR. All of them carry the same pip value.

You can see the Forex counters in airports, railway stations etc. to allow passengers to convert from one currency to another. The spread there however is much bigger because the amount of currency transacted is less.

To re-cap, we now know what hedging is, what currency trading is and what derivatives are. In the next post, we will talk about Exotic Derivatives.

Note:

1. Text in Blue points to additional data on the topic.

2. SMEs in this series implies Small and Medium Enterprise exporters.

Very informative waiting eagerly for the other lot .Please make more pages as it is a waiting game