The series, so far…

We described the nuances of currency trading and how they are different from stocks/ options.

Defines simple terms such as Hedging and Derivatives.

Describes the challenges Small and Medium Enterprise (SME) exporters faced in 2007-09.

Explains the Wonderful World of Exotic Derivatives

This is Part 5.

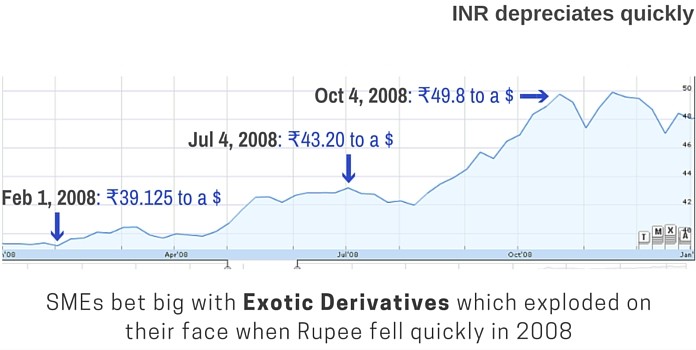

Were the SME exporters fully cognizant of the risks of a derivatives trade? Was there a teaser from banks that allowed these exporters to make easy money in the first few transactions? Invariably exporters bet on small amounts and tasted success. Did this spur the exporters and further encouraged by banks to take on bigger bets? And when their bets went awry, exporters were stuck with massive losses. It did not help matters that the Rupee started depreciating quickly (see illustration below):

This (massive losses based on Exotic derivatives) is the crux of the issue. What is interesting to note here is that these transactions were not only undertaken by the foreign and private sector banks, but also by various nationalized banks, who were known for their prudence.

In their exuberance to sell these exotic derivatives, experts opine that these banks have violated many of the well-intentioned guidelines issued by the RBI on these matters. RBI had several rules in place to protect SMEs, some of which are listed below:

-

“In order to ensure that SMEs understand the risk of these products, only banks with whom they have credit relationship are allowed to offer such facilities. These facilities should also have some relationship with the turnover of the entity”.

-

The Bank through verification of documentary evidence is satisfied about the genuineness of the Underlying Exposure.

-

As per RBI Circular, only hedging to protect currency risk is permitted. There is no relationship between the currency in which the exporter is exporting and the currency of the option contract as suggested by the banker (in several instances, the exporter dealt with the US Dollar but was given KIKO options for USDEUR (US Dollar to Euro)).

In effect, there is a two-fold violation of the RBI Regulations: One, in the very design of these structured products and Two, in the manner in which these products were marketed to innocent exporters, both of which are violative of FEMA and the Regulations made by the RBI thereunder.

The net result: Exporters suffered massive losses on account of such fraudulent contracts as it exploded in their face. The magnitude of the loss as at December 31, 2008, as per RBI’s own conservative estimate was Rs. 31,719 crores ($6.55 billion).

In 2009, a Public Interest Litigation (PIL) was filed by a businessman in the High Court of Orissa, alleging that up to Rs. 25,00,000 crores ($516 billion) was siphoned off in the derivatives scam. On August 28, 2009 the High Court ordered a CBI inquiry to look into this. On December 24, 2009, based on a preliminary CBI report and replies from the RBI, the Orissa High Court ruled for the PIL petitioner and further directed the CBI to investigate into the alleged offences.

In the ruling (Page 88), several prominent Private and Public Banks were asked to respond to the issues raised by the petitioner: State Bank of India, ICICI Bank, HDFC Bank, HSBC Bank, Standard Chartered Bank, CitiBank, ABN Bank and Axis Bank. At the time of the writing of the judgment (Dec 2009), none had.

The Fixed Income Money Market and Derivatives Association (FIMMDA), an association of banks, financial institutions, primary Forex dealers and insurance companies, moved the Supreme Court on the 19th of February to stay the Orissa High Court order.

FIMMDA told the apex court that such derivatives losses were a result of the global financial crisis and not a conspiracy. The high court order would adversely affect their ability to use derivative contracts as a hedging tool for their own accounts and in dealing with the exporters and importers. Based on this, the Supreme Court stayed the High Court order for a CBI investigation.

And this is where the matter stands, 6 years later. Why the delay in hearing this case? Is it because of its implications? Isn’t justice delayed, justice denied?

(To be continued…)

Note:

1. The conversion rate used in this article is 1 USD = 48.43 Rupees.

2. Text in Blue points to additional data on the topic.

3. SMEs in this series implies Small and Medium Enterprise exporters.

- Subramanian Swamy approaches Supreme Court on Govt’s modification of 2G Scam Judgment to avoid auction of Satellite Spectrum - April 23, 2024

- Defence Minister Rajnath Singh visits Siachen. Reviews military preparedness - April 22, 2024

- Amit Shah’s shares in the Stock Market almost doubled in the past five years - April 21, 2024