In Part 1 of this series, we described the nuances of currency trading and how they are different from stocks/ options. Part 2 defines simple terms such as Hedging and Derivatives. Part 3 of this article describes the challenges Small and Medium Enterprise (SME) exporters faced in 2007-09. This is Part 4.

In an article penned in 2002, Warren Buffett wrote that derivatives are financial Weapons of Mass Destruction (WMD), carrying dangers that, while now latent, are potentially lethal. Noted Chartered Accountant and eminent columnist, S Gurumurthy, calls derivatives as Intercontinental Ballistic Missiles (ICBMs) after the recent spate of credit derivatives originating from the US hitting financial institutions across the Atlantic in Europe.

The then Finance Minister P Chidambaram proudly proclaimed that India was insulated from the Financial Crisis of 2007-08. As a country, India may have dodged the crisis but some segments were affected.

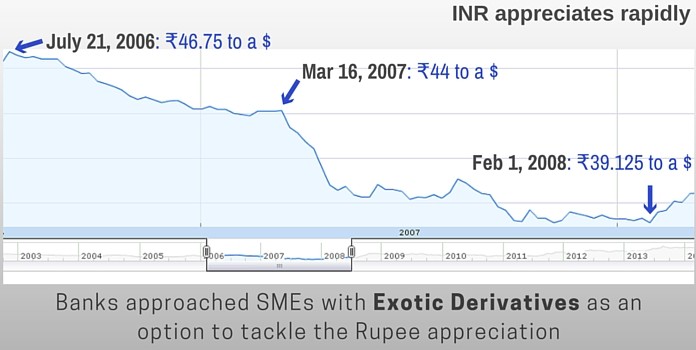

Figure 1. Rupee exchange rate versus the US Dollar from mid-2006 to early 2008

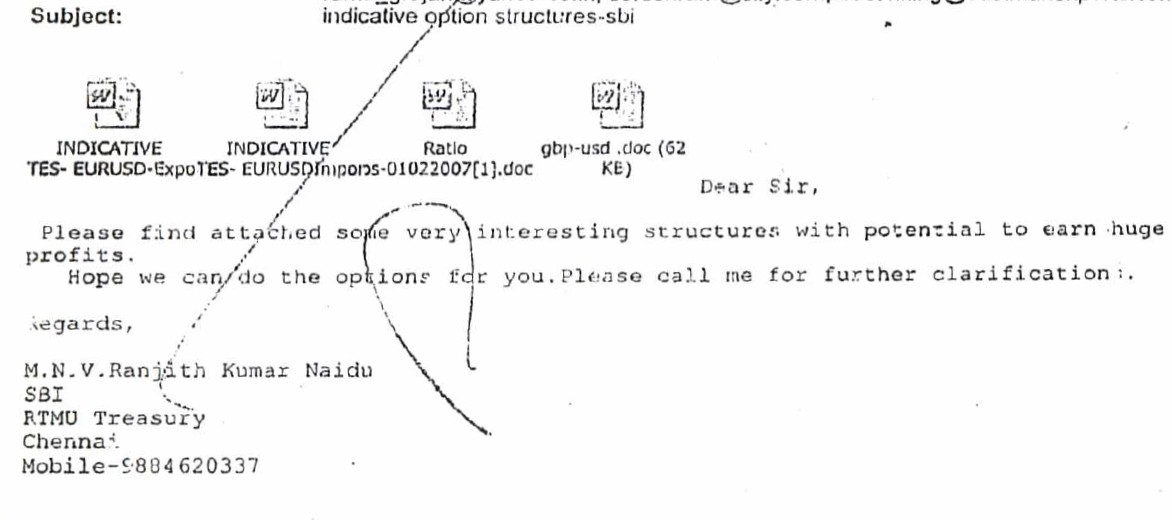

SME exporters were approached by Banks who told them that they had some exotic derivative products that were legal, structured to help them ride the storm of the appreciating Rupee. Several SMEs got a letter similar to the one below around February 1, 2007. If you look at the finance chart above, you will see that the Rupee had just started appreciating around this time.

These exotic derivatives were marketed not just in India but also in Sri Lanka, Malaysia, Indonesia, Japan, Korea, Hong Kong SAR, Taiwan, China, Brazil, Mexico, and Poland. The direct cost to non-financial firms of these derivatives losses, based on the sum of national estimates, is $530 billion. Possibly 50,000 firms in at least 12 economies have suffered derivatives losses, according to Bloomberg wire.

A popular derivative that was sold in these countries was called Knock In Knock Out (KIKO). The details are explained here but in summary, if the upside of the bet was 100, the downside was 200 (for the same amount of variation). KIKOs were always a combination of a call and a put. In order to be traded as a zero premium transaction, the KIKO’s strike price along with the knock-in and knock-out barrier points are chosen so that the combined value of the bought and sold strips of options sums to zero. The primary objective of the zero-premium structure is to make it easier to sell to the banks’ customers—they pay no initial costs and financial accounting rules allow it to be reported as a hedging transaction.

Here is an example:

Consider an actual Korean KIKO. Its total notional principal consists of 12 monthly call options, each with a notional principal of $250,000, and 12 monthly put options, each with a notional principal of $500,000. The total, or the sum of these 24 options, is (12 * 250,000 + 12 * 500,000) $9 million. Remember that a call is a bet that expects a gain in value of the asset and a put is expecting a loss. See how the puts are at two times the value of the calls. A monthly call means every month on a specific date, the options will expire.

Back to India, the first set of contracts involving “exotic” derivative uniformly resulted in “profits” for the exporters across the country. See the chart above. The rupee continued to appreciate vis-a-vis the US Dollar until February 1, 2008. Unfortunately, it is this profit that lured the exporters into a false sense of complacency, to make bigger bets. SMEs started trading in other currency futures such as the EURUSD (The exchange rate between the Euro and US Dollar), GBPUSD etc. What started out as a hedging measure had become a full-blown speculation in foreign currency derivatives!

Note:

1. Text in Blue points to additional data on the topic.

2. SMEs in this series implies Small and Medium Enterprise exporters.

- Subramanian Swamy approaches Supreme Court on Govt’s modification of 2G Scam Judgment to avoid auction of Satellite Spectrum - April 23, 2024

- Defence Minister Rajnath Singh visits Siachen. Reviews military preparedness - April 22, 2024

- Amit Shah’s shares in the Stock Market almost doubled in the past five years - April 21, 2024

Amazing and Enlightening Episode again.

Sir Please make this more pages per episode and also the frequency more

Thanks for Educating