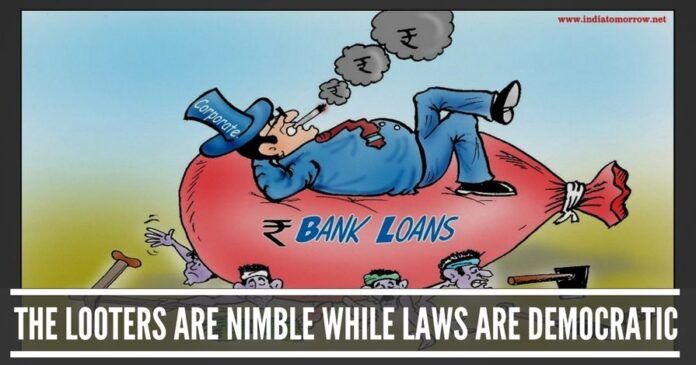

The corporate entities are calculated and cunning, forever on nimble feet

Even as the massive Punjab National Bank fraud continues to be an endless drama, with the alleged ROTOMAS Bank fraud looms in the background, the increasing brigade of politicians and social media activists are baying for the Prime Minister’s blood each day.

The guidelines for issuing a LOC are contained in the Union Home Ministry’s Office Memorandum dated 27th October 2010 which is attached for the information of the readers.

They are saying that Vijay Mallya first, in 2016, and now jewelers Nirav Modi and Mehul Choksi, now, have been allowed to flee India by PM Modi by neither (i) issuing them a Look-out Circular detaining them before reaching the Immigration Counter at the international airport, nor by (ii) impounding (revoking) their Indian Passports, the key travel document for going abroad.

Sadly, neither the social media regulators nor the “free for all” debates on TV Channels have stopped this outcry, thereby aiding and abetting their accusation of connivance in a humongous crime by the PM and his government. And this has left many disturbed about the man who acquired his exalted seat of power by his claim that he himself would not be financially nor let others be so.

This abetment by influential TV anchors, their shouting “debaters” and the print and visual media has thrown up the shameful ignorance of all concerned. And the biggest group which must be held most guilty of this negligence must be the PM’s government itself and his BJP office-bearers who have kept mum on the issue. All they had to do was to go to Google guru on their mobiles or personal computers to find that the above allegations in the matter against our PM and his government were lies, nothing but lies. They forgot the egg thrown on their face by the judiciary when a Greenpeace activist Priya Pillai, who was offloaded by the police from a Delhi flight to London in January 2015 after a Lookout Circular was issued to her. Truly have they all been engulfed by the “loud” silence of ignorance and its fall-out of neglecting the necessary action of informing about the truth to the public at large.

See the Look-out Circular element first.

A “Look out circular (LOC)” is a circular letter used by authorities to check whether a travelling person is wanted by the police. It may be used at immigration checks at international borders (like International airports or seaports). In India, LOC has a given preformed which have identification parameters and help police to catch the persons concerned.

The guidelines for issuing a LOC are contained in the Union Home Ministry’s Office Memorandum dated 27th October 2010 which is attached for the information of the readers. Part 8 of that Memorandum gives the guidelines for the issuance of a LOC. And 8(g) therein lays down that “Recourse to LOC is to be taken in cognizable offences under IPC (Indian Penal Code) or other penal laws….”

In the case of Vijay Mallya, the case/s he was confronted were repayments of loans from 13 commercial Banks of India which were hanging for some years since 2013 in the Bengaluru Debt Recovery Tribunal. Non-repayment of Bank loans in time is not an offence under the IPC or other penal laws. He was immune from the issuance of a LOC. Nor had he been convicted till he flew off to London on 2nd March 2016.

Could Mallya’s Indian Passport have been impounded till he flew off that night?

It is Section 10(3) of The Passports Act, 1967 which lays down the provisions under which warrant the impounding (revocation) of an Indian Passport. This Section is attached. Do you find any provision that warranted the impounding of Mallya’s passport even as his loan repayment was being heard in the Bengaluru Debt Recovery Tribunal? And remember, he was a Rajya Sabha Member, reportedly holding a Diplomatic Category Passport?

In total contrast to the way our judicial system’s laggard approach, below are excerpts from a report of March 9, 2016 in “The Hindu” newspaper clearly revealing the nimble way our corporates tend to act.

By the way, there are some telling observations on the function of that above Tribunal which were revealed by Mrs Arundhati Bhattacharya, Chairman, State Bank of India, in interview to senior journalist, Shekhar Gupta, on March 14, 2016 (http://www.rediff.com/business/interview/mallya-saga-interview-why-sbi-has-so-far-failed-to-recover-money-from-vijay-mallya/20160314.htm)

wherein she stated that

(i) The SBI went to the Debt Recovery Tribunal, (DRT), Bengaluru, in 2013 to recover its loans to Kingfisher/Vijay Mallya and that there have been 81 hearings till the date of the rediff.com interview

(ii) Vijay Mallya has filed several cases against the SBI in the DRT and the SBI has filed counterclaims. There are 22 cases SBI are fighting here, and overall there have been 508 hearings. The number of adjournments is more than 180.

(iii) The SBI consulted the Attorney General of India about going to the High Court / Supreme Court but were told that the law demanded that the DRT should first be approached.

In total contrast to the way our judicial system’s laggard approach, below are excerpts from a report of March 9, 2016 in “The Hindu” newspaper clearly revealing the nimble way our corporates tend to act.

Quote: “Industrialist Vijay Mallya left the country the very day the banks, to which he owed over Rs. 9,000 crores, moved the Debt Recovery Tribunal (DRT). The information came to light at a hearing before the Supreme Court on Wednesday.

“Thirteen banks, led by State Bank of India (SBI), represented by Attorney-General Mukul Rohatgi and advocate Robin Ratnakar David, told a Bench of Justices Kurian Joseph and Rohinton Nariman that the liquor baron is said to have left the country on March 2, (Wednesday), the day they approached the DRT.

“Mr Rohatgi said he was told about Mr Mallya’s departure by the CBI. Hardly 24 hours earlier, (Tuesday), the banks urgently moved the court to restrain Mr. Mallya, a Rajya Sabha member, from leaving the country.” Unquote (http://www.thehindu.com/news/national/vijay-mallya-has-left-india-centre-informs-sc/article8331337.ece.)

The date of this Mallya flight blows up another canard that is often spread by the NaMo-haters-cum-baiters that someone in his government tipped off Mallya about the urgency to flee. This is utter nonsense. One or the other among Mallya’s battery of lawyers must have told him about the Debt Tribunal case going to the Supreme Court on 2nd March 2016. He seized or the information and leaped… to London on one day prior to D-Day!

And here’s another example of our corporates’ nimble ways when in trouble. This one is from the newspaper “Business Standard” dated February 15, 2018.

Quote: “A lookout notice was issued by the CBI against jeweller Nirav Modi and his associates last month in the banking fraud case but by then they had escaped from India, CBI sources said on Thursday.

Our laws and laid down guidelines are truly democratic and humane, but laggard, while the corporate entities are calculated and cunning, forever on nimble feet

“According to the sources, a Look Out Circular was issued against Modi along with his wife Ami, brother Nishal Modi and Mehul Choksi in the Punjab National Bank fraud case on January 31.

“The circular was issued to all airports, ports and exit points to stop them from escaping.

“However, according to the sources, Modi and his associates fled the country before the notices were issued.

“While Nirav and his brother Nishal left India on January 1, his wife Ami, a US citizen, and Choksi left on January 6, all before the CBI received a complaint from the PNB on January 29.

“The source added that around 150 Letters of Understanding were issued to Nirav Modi’s firms by the PNB. In course of the probe, the CBI has finished imaging computers seized during searches at Modi’s properties on February 3, 4 and 21.” Unquote

The conclusion is clear. Our laws and laid down guidelines are truly democratic and humane, but laggard, while the corporate entities are calculated and cunning, forever on nimble feet.

Lookout Circular Rules

LookoutCircular 27042017 EXISTING NORMS by PGurus on Scribd

Passport Impounding Rules

Passport Revocation or Impounding of a Passport by PGurus on Scribd

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

- To Editors’ Guild; May we also have our say… please? - July 17, 2019

- Farooq Sahab is either down with dementia or he is a congenital liar? - July 8, 2019

- Shah Bano, Muslims in gutter &Zakaria’s secularism - June 30, 2019

Many countries have banking channels alerts for defaulters or fraudsters linked to airport immigration. IT is IT super power it has nothing of this sort… it remains only super powder i.e. talcum powder.

if a bank is giving me willingly more credit facilities after I have established a great track record with it – having met timely all my past obligations arising from use of such credit – I see no reason to question the bank as to its wisdom or its compliance to banking norms. Why must I do bank’s job for which I am not qualified nor obligated? The police seems to think otherwise as it has arrested Nirav Modi ‘s staff executives.

Well said. Arresting N Modis staff is unfair as they are not decision makers and at best they could be questioned. Trust and track record are key to the success of a banker and a borrower and a banker can push up an industry or destroy with the stroke of a signature. Just imagine what if bankers stop lending to industries? Chaos and destruction of economy. UAE is a country where trust banking exists. 3 years bank track record is checked and loan is given against personal gaurantee of promoters. No collaterals and no margin money and clean overdraft. Any cheque bouncing is a criminal case where courts do not interfere. Hence honest indians make millions in Dubai, though bad apples do exists.

In N Modis case, they paid commission for LOUs, which is in banks record and the dollar loans details with security are submitted to RBI by foreign lending bank.In fact RBI monitors details of inflow and outflow of dollars every minute.Why this big drama and crucifying N Modis business ?

Some one in RBI changed rules and shot an arrow which hit two people Nirav Modi and Narendra Modi and indias image abroad.

What the author has stated is true . Unless an FIR is filed, no Indian can be prevented from leaving the country. There is a big role by our judicial system giving freedom of speech and also travel freedom without giving importance to the version of Agencies. Perfect is the example of Green peace quoted. The lady member of theOrg was prevented from travel as she was going to give a lecture to a foreign entity abusing the country. End result, courts restored her right to travel. Green peace a notorious NGO is known for inciting villagers against building new projects in rural areas.

Regarding case of Gitanjali, bank has filed an FIR and the party got it quashed by court. It will be shocking how defaulters are manipulating indian system and getting away.

The TV debates are organised to defame Modi. This has precisely happened To Vajpayee before 2014 election.While banking in directly under FM, every channel and Cogi spokesman are blaming Modi no name of FM is whispered, though buck stops at him.Why isnt FM protecting the PMs name ?

Businessmen are not angels especially in India.But at the same time they create jobs. For a honest man doing business is impossible in a clean way.To arrange pay offs he is forced to siphon funds from bank or evade tax. The situation is pretty bad for Modi govnt. Nirav Modi case rendered 2200 people jobless. If banks act on other defaulters another one lac may be jobless. Govnt cant create jobs, and Modi becomes bigger villain.

Majority of gems & jewellery business is carried out by Gujarati businessmen. They open shell companies in countries where they don’t have to pay tax. They route the same stock multiple times expediently in and out of the country. On every transaction they also avail government benefits for export/import sector. They have perfected the art of gaming the system. In future, Government should scrutinize this business very closely.