December 27, 1983. M A Chidambaram Stadium, Chennai. 6th test between West Indies and India. Sunil Manohar Gavaskar, who had been opening throughout the series, dropped down to bat at No. 4. But his joy at not having to face the new ball was short-lived. Both Gaekwad the opener and Vengsarkar, the No. 3, got golden ducks. Sunny was facing the third ball of the innings and Viv Richards, the great legend who was standing in the slips quipped, “No. 1 or No. 4 doesn’t maatter maan! The score is still 0!”

All this appears to be aimed at cutting off the oxygen to 63 Moons in its fight to stay and fight their legal battles, the most significant being a merger judgment delivered by the Bombay High Court, which has long term ramifications for India as an investment destination.

Doesn’t matter whether it is BJP or Congress

As far as acting against the Financial Technologies of India Ltd. (FTIL) group of companies is concerned, it seems like it makes no difference as to which party is in power. The inexplicable, one-sided raids and actions continue from the investigating agencies without as much as a finger being laid on the counterparties. It is as if an “invisible hand” is directing operations, setting aside inconvenient facts and irrefutable details.

First, recent searches conducted by the Central Bureau of Investigation (CBI) on 63 Moons Technologies limited (formerly FTIL) in connection with the recognition of one of its former subsidiaries, the Multi Commodity Exchange of India (MCX), as a nationwide exchange, way back in 2003. The CBI lodged a First Information Report (FIR) against Mr Jignesh Shah, the then Managing Director of MCX and its then parent company, FTIL, 15 years after the government granted recognition to MCX, alleging that it had not met the conditions stipulated for a nationwide commodities exchange. The CBI has also booked four former chairmen of the Forward Markets Commission (FMC), the then regulator of commodities markets, in the case, who had taken the call to facilitate a market development for commodities exchanges. What is striking about this is that of the four entities, NCDEX, NMCE, N-BOT and MCX that were granted permission to set up nationwide commodities exchanges at the same time 15 years ago, the CBI has hand-picked only the founder company of MCX to build up a case.

Second, the Economic Offenses Wing (EOW) of Mumbai Police attached three operational accounts of 63 Moons[1], which essentially deprived the company the means to pay the salaries of the thousand-odd employees. If this was an attempt to recover the dues of NSEL, which it claims, then why did the EOW not do the same to the 24 defaulters? In fact, the money trails show that just 7 of these defaulters owe Rs.4400 crores! EOW claims that it has attached close to Rs.5000 crores of defaulters assets[2]. Why have they not liquidated them? Should Fadnavis not be looking at monetizing this so he can claim the mantle of having solved this crisis?

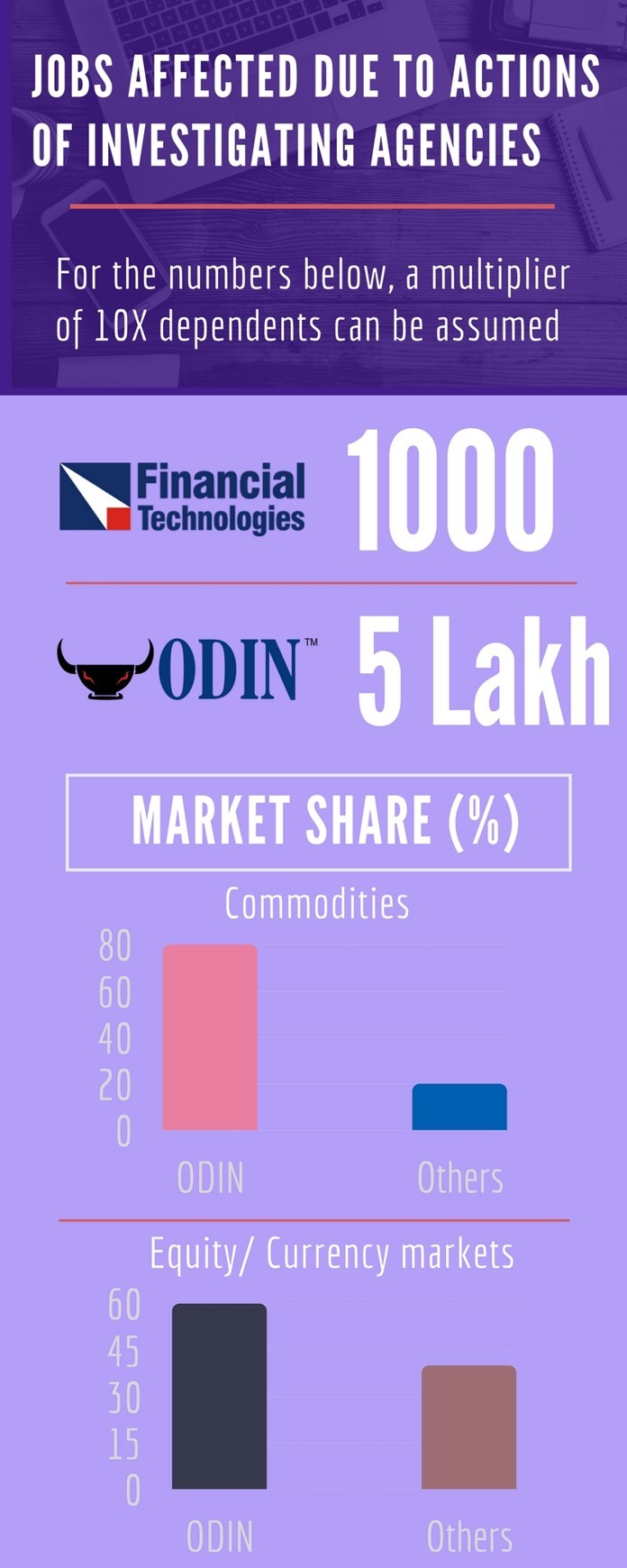

Third, now the EOW has attached the intellectual property rights (IPR) along with receivables to Open Data Interface Network (ODIN) software also. ODIN runs on 5,00,000 terminals across India and generates employment for many more (see Figure 1). All this appears to be aimed at cutting off the oxygen to 63 Moons in its fight to stay and fight their legal battles, the most significant being a merger judgment delivered by the Bombay High Court, which has long term ramifications for India as an investment destination.

Think about it. If 63 Moons is unable to fight the case in Supreme Court, this judgment will set a precedent for lifting the Corporate veil as and when it is needed. There will be a wave of forcible mergers of unprofitable subsidiaries with the richer parent bodies. No promoter or investor would ever dare to invest in India in such an investment climate.

The FIR filed against the FMC officials will serve as an eye-opener to all public servants who cannot express their candid views on official files freely. Henceforth, government officials will obviously hesitate to take any bold policy decisions that could make them a victim of a possible witch hunt, while in service or post-retirement, thus throwing our governance into policy paralysis.

Investigative agencies misguided?

Are the investigative agencies being misguided by certain vested interests that have a single point agenda to target Mr. Shah and his FTIL Group? What else could explain this one-sided action? The Enforcement Directorate also is supposed to have attached Rs.800 crores worth of assets of the defaulters. Why has that not been auctioned? What have the agencies to say for themselves? The long-suffering, taxpaying nation has a right to know how its money is being spent.

Back to the Sixth test in 1983…

Sunil Gavaskar played the innings of his lifetime, compiling a career best (and the highest test score by an Indian at that time) 236 not out to steer India to safety. Our Dharma says Satyameva Jayate (Truth will triumph). I hope that the governments at the Center and in Maharashtra see their way clear to ensure that justice is done, not just for Shah and his company but also to the genuine/ non-bogus traders.

References:

[1] EOW attaches 3 accounts of 63 Moons Technologies with Rs. 4.8 billion funds – Apr 5, 2018, Business Standard

[2] NSEL Crisis: Manufactured for whose benefit? Apr 6, 2018, PGurus.com

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023