Adani the newest Indian billionaire to own media to set the “right” narrative

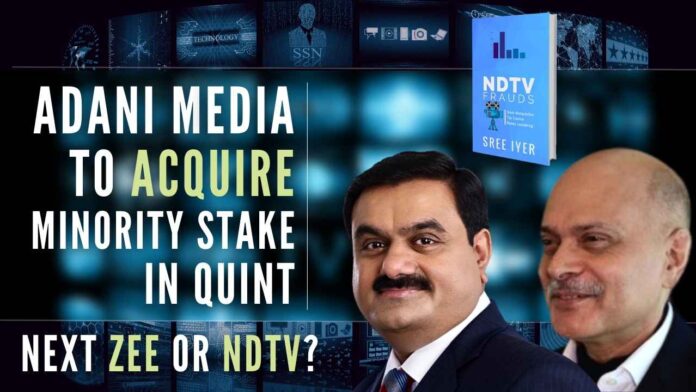

Billionaire Gautam Adani’s newly floated media venture Adani Media declared that it is buying an unspecified “minority” stake in Raghav Bahl-controlled digital business news platform Bloomberg-Quint of Quintillion Business Media Pvt Ltd for an undisclosed sum. Adani Group has entered into a binding term sheet with BSE-listed Quint Digital Media Ltd to acquire a minority stake in Quintillion Business Media Pvt Ltd (QBM), an indirect subsidiary of Quint Digital, the companies said in a statement.

QBM is a business and financial news company and operates a leading business news digital platform BloombergQuint. US-based Bloomberg Media quit the venture just as Adani entered. “The proposed transaction with the Adani Group is only for QBM which is a digital business news platform and not in relation to other digital media/ media tech properties owned by Quint Digital viz. The Quint, Quintype Technologies, The News Minute and Youth Ki Awaaz,” it said.

India’s second richest man Gautam Adani, who is considered very close to Prime Minister Narendra Modi has been eyeing an entry into the media space for some time now. In September last year, it hired veteran journalist Sanjay Pugalia to lead its media company, Adani Media Ventures. However, curiously both Adani Media or Bloomberg or Raghav Bahl’s Quint Group are keeping mum on the deal value.

Raghav Bahl is now embroiled in tax evasion and money laundering cases and reached a business deal with Gautam Adani. PGurus has reported in a series of articles on Raghava Bahl facing cases in tax evasion, money laundering, and stock exchange manipulations.[1]

Meanwhile many in the media industry feel Gautam Adani’s media venture is in talks with Subhash Chandra’s Zee Group. A few months ago Mukesh Ambani’s Reliance Group had called off an Rs.10,000 crore worth deal with Zee Group.[2]

Indian media players are also watching the possible deal with Prannoy Roy headed NDTV with Adani Group. Prannoy Roy is facing two serious Central Bureau of Investigation (CBI) probes. The first FIR (First Information Report) was filed in 2017 after raiding Roy’s home for ICICI bank loan siphoning off more than Rs.400 crore and diverting funds of more than Rs.40 crore to build a palatial home in South Africa. The second FIR was filed in 2019 for siphoning around Rs.1000 crore by floating 32 shell firms in more than 20 countries and routing money including tax havens like Bermuda. It is interesting to note that to date CBI has not yet filed a charge sheet against Prannoy Roy. Why such a delay?

It is a well-known secret that NDTV’s major shares are held by Mukesh Ambani’s Reliance Group’s closely linked man Mahendra Nahata’s firms from 2009. In 2019, Prannoy Roy and his wife Radhika Roy were deplaned from Mumbai Airport on their way to their palatial home in South Africa. But why are chargesheets not filed by CBI in the two FIRs filed in 2017 and 2019? Any deals or escape routes for scam-hit Prannoy Roy is on the anvil. Prannoy Roy and his wife Radhika Roy are fined by the Securities Exchange Board of India (SEBI) for stock exchange manipulations.[3]

The billion-dollar question here is – Prime Minister Narendra Modi’s known good friend industrialist Gautam Adani is trying to deal with a scam-hit/ under probe/ facing charges/ cases Media Barons and striking a patch up? We have already seen Adani’s deal with a scam-hit, tax-evading, money laundering case-facing Raghav Bahl.

PGurus Managing Editor Sree Iyer has written a detailed book – NDTV Frauds – on money laundering, stock exchange manipulations, and tax evasion in the garb of journalism. The book is available here.[4]

Reference:

[1] Delhi HC seeks ED’s stand on media baron Raghav Bahl’s plea against money laundering case – Dec 03, 2021, PGurus.com

[2] Mukesh Ambani’s Reliance says dropped Rs.10,000 crore merger or acquisition plans with Subhash Chandra led Zee Group. – Oct 13, 2021, PGurus.com

[3] SEBI fines NDTV Rs.5 crores after putting penalty of total Rs.43.97 crores on Prannoy Roy, wife and their shell firm for blatant Stock Exchange manipulations – Dec 30, 2020, PGurus.com

[4] NDTV Frauds: A classic example of breaking of Law by Indian Media Houses – Amazon.in

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.